Get a pulse on your

business’s financial health

Join the millions of small business owners using Nav to improve their business financial health to access the funding options they need to run their business.

Get Started

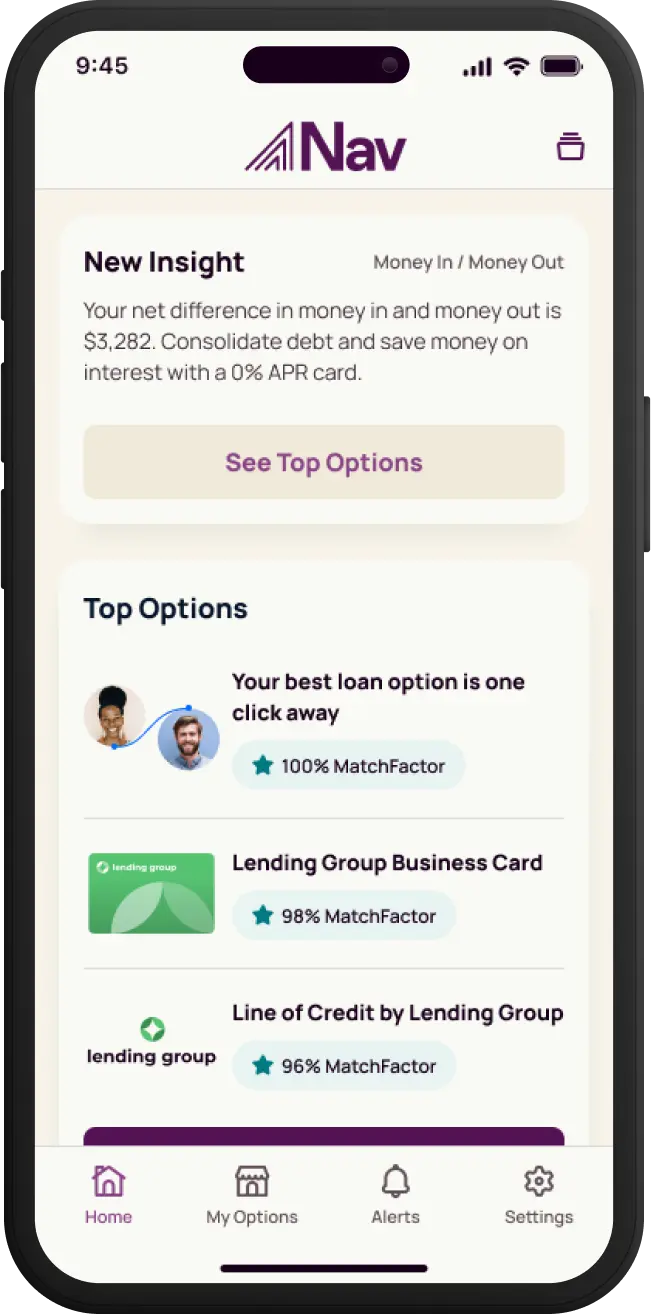

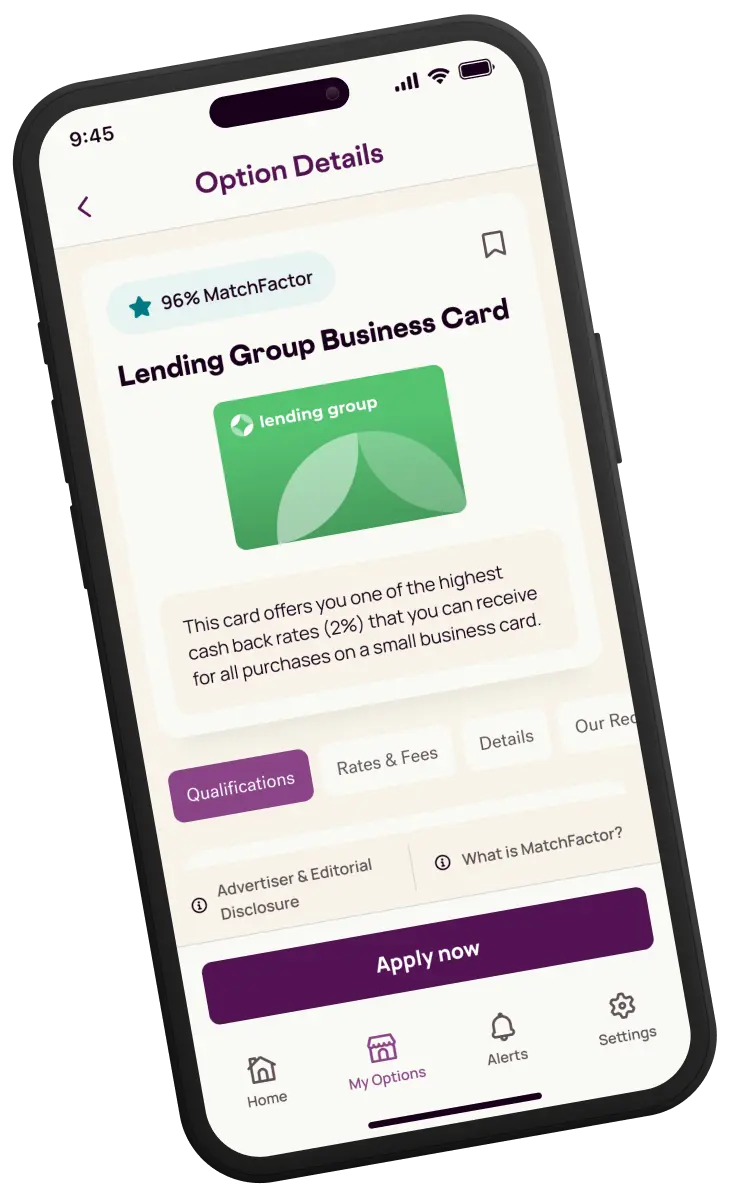

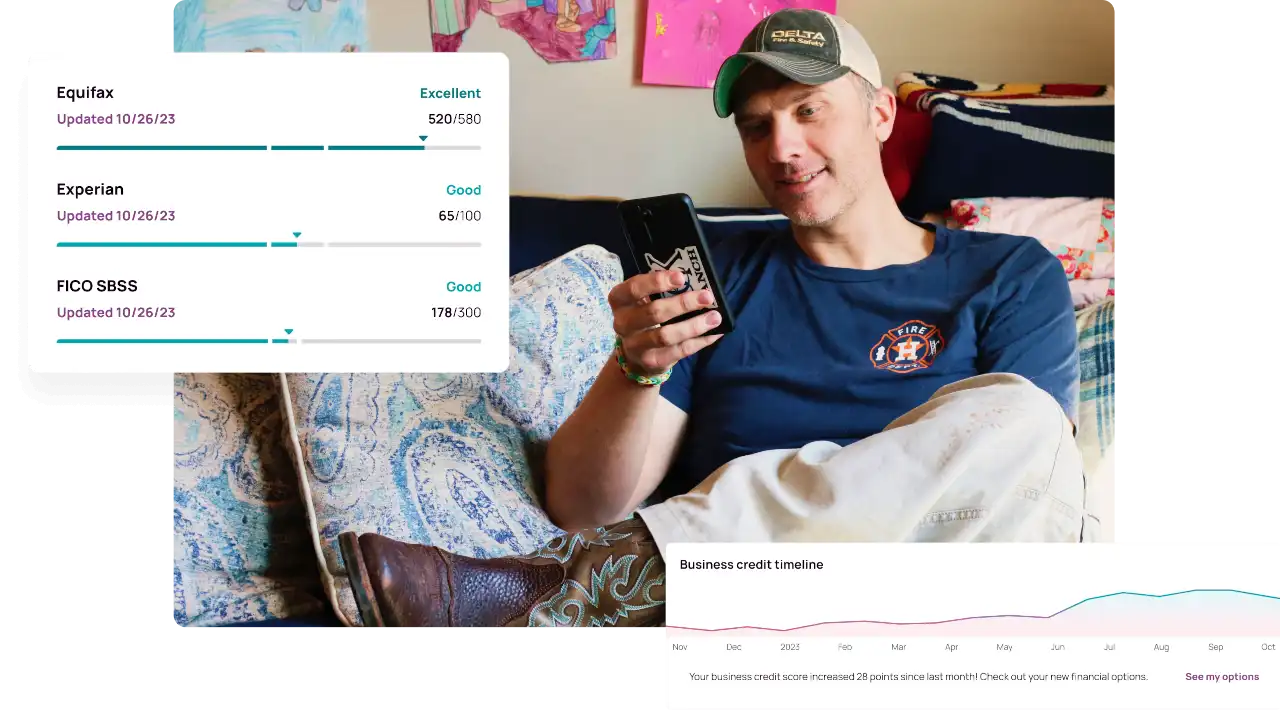

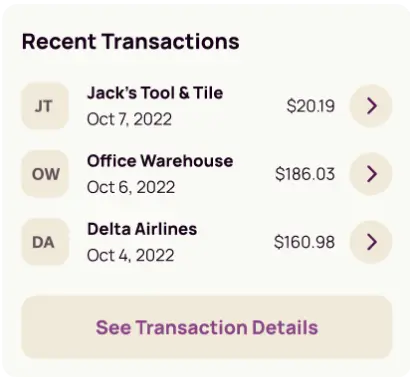

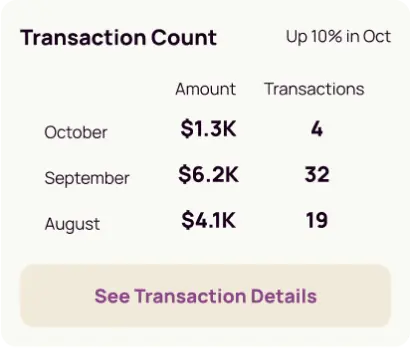

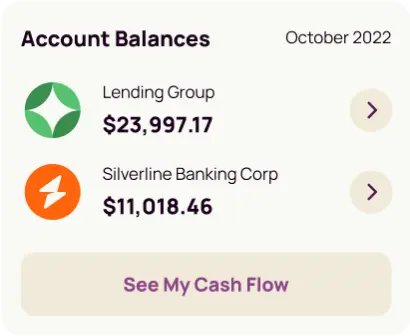

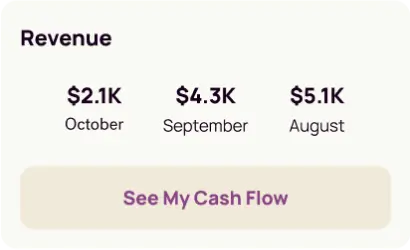

Financial health for your small business, in your pocket

By connecting to your financial health you can understand where your business stands today, what your options are, and how to move your business forward.

Let's Get Started

Drive your business’s performance with Nav insights

Get Insights

Prepare Your Business for a Loan Checklist

Read More

Five Simple and Inexpensive Asset Protection Strategies

Read More

Small Business Owners Guide to IRS Business Codes and NAICS Codes for Financing Success in 2024

Read More

Calculating Annual Business Revenue 101: Why Is It Important?

Read More

How to Start and Finance a Mobile IT Support Business in 2024

Read More

What the Visa Mastercard Settlement Means for Your Small Business

Read MoreFinancial health for your small business

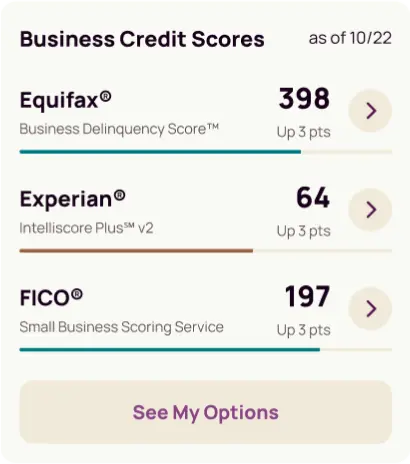

I'm Ready¹Based on aggregate data tracking Experian® Intelliscore Plus business credit scores after three months of having Nav tradeline reporting. Results will vary. Scores are calculated from many variables; some users may not see improved scores.