Business credit scores and reports

Take charge of your future by building your business credit history. Learn how it works.

How are business credit scores calculated?

Like personal credit scores, a few pieces make up the business credit score puzzle. Each part impacts a certain percentage of your business credit scores.

How can I improve my credit score?

Make on-time payments. Paying lenders and vendors that report to business credit bureaus (a.k.a. tradelines) by or before the due date is the best way to boost your business credit.

Manage debt levels. Only borrowing what you need is key. Make sure you can afford to pay back what you owe — plus any fees or interest.

Avoid delinquencies. If your business pays its bills late, your credit report may be flagged as “slow pay.” Any vendor or lender can pull your business credit report, and delinquencies might make them hesitant to work with you.

Manage your credit. Failing to keep an eye on your credit reports is like setting a savings goal and never adjusting it over time. There may be mistakes to fix or changes to make to build your credit faster.

4 reasons to check your business credit scores

*Based on aggregate data tracking Experian® Intelliscore Plus business credit scores after three months of having Nav tradeline reporting. Results will vary. Scores are calculated from many variables; some users may not see improved scores.

Business Credit Scores & Reports

October 13, 2023 Gerri Detweiler

Strong business credit scores can be key to getting your company approved for trade credit and financing. But they can be very different than personal credit scores. Understand how they work and how to build strong business credit.

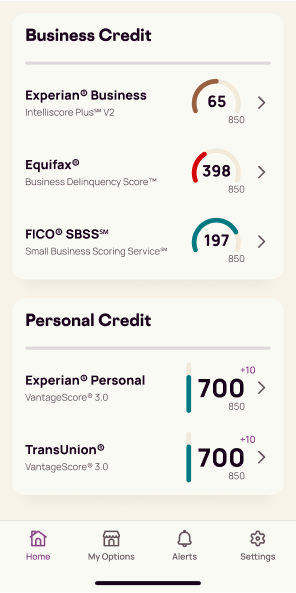

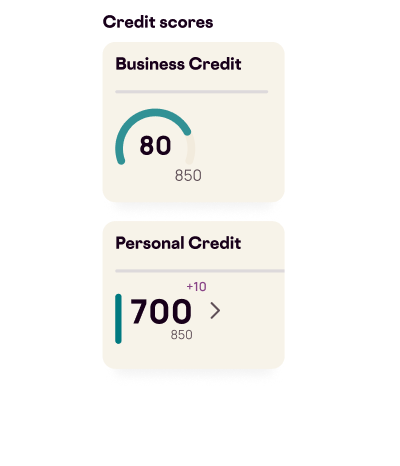

Free Personal and Business Credit Scores

See how lenders view your business data and apply for financing you’re likely to qualify for.

By clicking “Sign Up” below, you confirm that you accept the Terms and Conditions, acknowledge receipt of our Privacy Notice and agree to its terms.

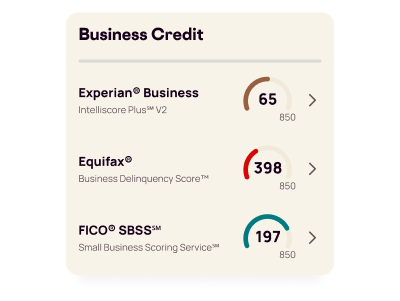

What is a Business Credit Score?

Personal credit scores rank creditworthiness of individuals, business credit scores do the same for businesses. Personal credit scores range from 300 to 850. Business credit scores range from 0 to 100. Major business credit reporting agencies Dun & Bradstreet, Experian, and Equifax produce business credit scores and reports. FICO scores for small businesses are known as “FICO SBSS.”

If you try to compare business credit to personal credit, you’re likely to get frustrated. That’s because business credit scores differ from consumer credit scores in some key ways:

Credit Score Ranges: Personal FICO scores range between 300 to 850; business credit scores typically range between zero to 100. Paying on time to lenders and/or creditors is the best thing you can do to establish a good business credit score.

Free scores: There are over 150 places where consumers can check and monitor their consumer credit scores for free. But free business credit scores are available from a very limited number of sources, such as Nav.

Access: Anyone can check a businesses’ credit scores, unlike consumer scores which are restricted to anyone with a “permissible purpose” under federal law.

Accuracy: A study published in the Wall Street Journal found as many as 25% of business credit reports may contain errors or are missing key information. If the credit report contains mistakes, the scores produced may not accurately reflect the risk of the business.

| Business credit score | Score range |

|---|---|

| Dun & Bradstreet PAYDEX | 0 – 100 |

| Intelliscore℠ Plus from Experian | 0 – 100 |

| FICO® LiquidCredit® Small Business Scoring Service℠ | 0 – 300 |

| Equifax Business Delinquency Risk Score | 224 – 580 |

These are some popular business credit scores. Just as there are many different versions of consumer credit scores, though, there are other business credit scores besides these. Just by checking these scores and making sure they are strong, you’ll be ahead of most business owners who never check or work on theirs.

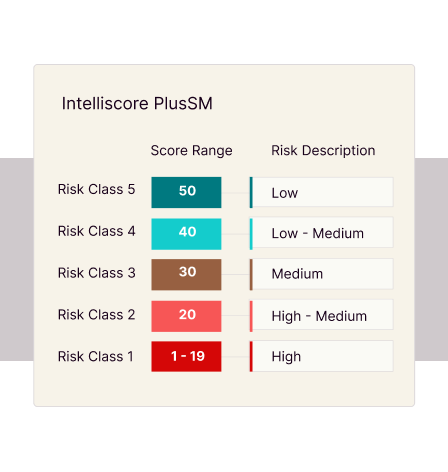

Intelliscore Plus℠ from Experian

With the Experian Intelliscore Plus℠ scores range from 1 to 100. A Higher scores indicate lower risk, so as a business owner, you want to aim for a higher score.

There are over 800 variables that can go into these scores, including tradeline and collection information, public filings, new account activity, key financial ratios and other performance indicators. But the bottom line is paying on time and managing debt well will help build a strong score.

Note: Experian offers a version of Intelliscore Plus that can evaluate data from the owner’s personal credit report as well as business credit.

Learn more about Experian Business Credit Reports here.

FICO® LiquidCredit® Small Business Scoring Service℠

FICO’s Small Business Scoring Service (SBSS) rank-orders applicants by their likelihood of making payments on time. The score ranges from 0 to 300. The higher the score, the better. The scoring can use both personal and business credit data and other financial information. A strong history of business credit with timely payments to vendors and suppliers may help boost your SBSS score. The FICO SBSS score will be used for term loans, lines of credit, and commercial loans up to $350,000 from the Small Business Administration (SBA). The minimum score to pass the SBA’s pre-screen process is currently 140.

How Business Credit Scores Are Used

Lenders and other creditors need a means of determining how well your business repays debts before they will approve you for financing. This is where business credit scores can come in. Higher scores indicate to creditors that your business is more likely to pay bills on time, thereby improving the odds that you can obtain financing. Lenders can check your company’s business credit reports to get more detailed information about your business’s financial history, and business credit scores serve as shorthand evaluations. Here are three other ways your business credit scores may be used:

How Can I Get Free Business Credit Scores?

As a consumer, you probably have a few different sources for your free credit reports and scores (we found 150+ places you can get your scores for free). But free business credit reports are another story. Many business credit reporting agencies require you to pay to review the information they have on your business.

Business owners can, however, access information about their Experian and Equifax business credit reports with a Nav account. Nav provides business credit grades for each score as well as summary reports, your personal credit score from Experian, and free tools that may help you build business credit. (No credit card required.)

How Can I Improve My Credit Score?

Building business credit may be a challenge. For example, not all the bills you pay show up on your credit reports, and accounts that don’t report won’t help you build credit. One possible way to build business credit is to open accounts that report to business credit, such as vendor accounts and the right business credit cards.

Nav can help you gain insight for the next steps in business credit. See how lenders view your business data with personal and business credit scores.

Business scoring models vary by bureau. Credit score improvement strategies do not guarantee results and will vary based on a business’ scoring factors.

Business Credit Reports

Just as you’d view your personal credit report to check your financial history, the same information can be reviewed for your business. That’s because the minute you start a business, credit bureaus begin to develop a business credit report on your company. They do this by scouring public records and other financial data.

Then, when you receive small business loans or a line of credit — sometimes called trade credit — information about your payment history is compiled by one or more business credit reporting agencies, including Experian, Equifax and FICO and turned into a business credit score.

The Basics of Business Credit Reports

Your business credit report only includes debts that are under your company’s federal tax identification number — also known as an employer identification number. Any personal lines of credit that you have are not listed on the report. This is true even for business credit cards that are still listed in your name.

Information that is present on your trade credit report is voluntarily sent to the reporting bureaus from the businesses that own the debt. This means some lines of credit may not be listed on the report.

How Business Credit Is Used

When you apply for future business credit, potential creditors and lenders will view the report to determine your company’s creditworthiness. They will use the information to evaluate how well your business repays its debts, and negative marks can cause you not to get approved, or lower the amount of credit they will extend, or limit the terms under which that credit will be given.

Besides lenders and creditors, several other parties may be interested in reviewing a business credit report. Business insurance companies, for example, assess a business’s report as part of the underwriting process. Customers and other businesses that are being considered for a joint venture or partnership may also review your company’s credit history before working with your business.

Why Separating Personal and Business Credit Matters

Trade credit reporting is beneficial for helping you separate your business and personal finances, which is particularly advantageous in regard to credit. A business credit report offers a clear view into the financial standing of your business, providing you with a clean report of the company’s credit inquiries, lines of credit and delinquencies. This streamlined information makes it easier for fraud monitoring and for lenders to accurately assess creditworthiness (see the importance of business credit monitoring).

Furthermore, separately listing business credit information protects your personal credit standing. Your company will typically have more annual inquiries and for larger lines of credit. With combined information, these inquiries could hurt your credit score, but a trade credit report gives your business its own history to list your business’ credit activity.

Get Your Free Business Credit Check

Doing the right things to build your business credit profile is one of the most important items you can take as a small business owner. Doing so opens up financing opportunities and business relationships that make it a hell of a lot easier for you to run and grow a business.

Ready to see your credit data and start building better business credit? Check your Personal and Business Credit for free (no credit card required).

Top FAQs on Business Credit Scores