Get clear on your credit

Nav has given 2.5 million business owners the credit details they need to build and grow, in words they understand.

HOW IT WORKS

Meet the Nav Prime Card

Build business credit history with every swipe — no interest or security deposit.

Spend

Spend up to your daily credit limit on whatever your business needs — with 0% APR.

Pay

Repay at the end of each day from your linked account. Set up autopay to make it easier.

Build

The more you use the card, the more business credit history you build with the major bureaus.

Repeat

Continue to spend responsibly and repay on time. Check progress in your Credit Health dashboard.

Nav Technologies, Inc is a financial technology company and is not an FDIC-insured bank. Banking services provided by Thread Bank, Member FDIC. The Nav Prime charge card is issued by Thread Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa cards are accepted. See Cardholder Terms for additional details. All other features of the Nav Prime membership are not associated with Thread Bank.

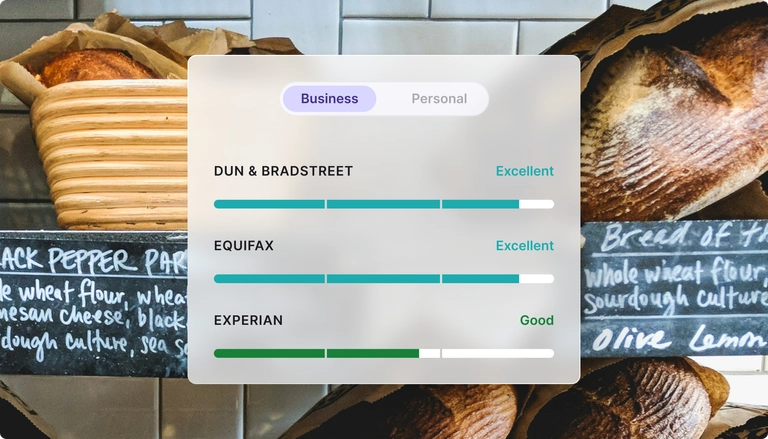

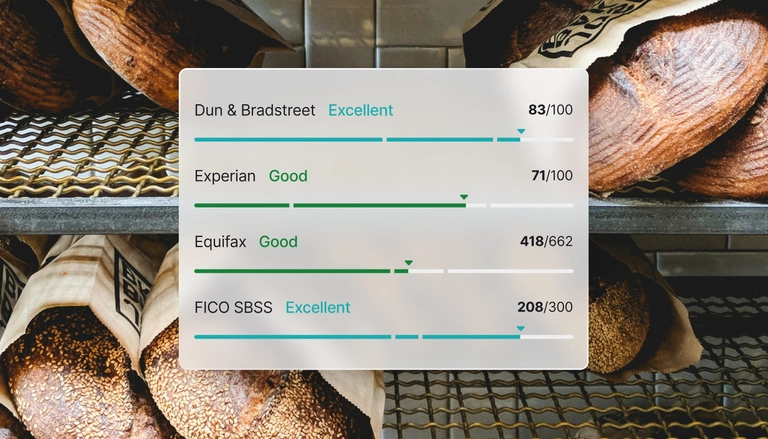

Personal and business credit

Up to 6 credit profiles. 1 login.

No need to jump around to see why your credit scores are changing. Get up to 6 personal and business reports in one place.

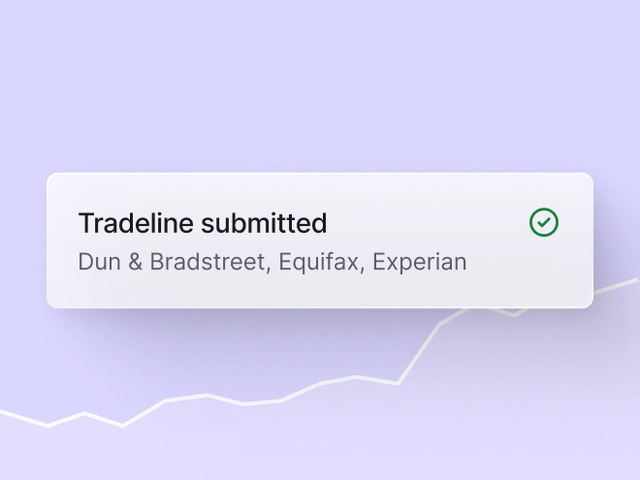

Real-time alerts

See credit changes instantly

Things happen. Get pinged when they do. Celebrate your wins, monitor for fraud, and learn how to fix errors if you need to.

CREDIT BUILDING

Simplify business credit growth

Get up to 2 tradelines submitted monthly to the major business credit bureaus. No hard credit checks.

Why Nav customers love Credit Health

Meet the small business owners who are redefining their business journey with Nav.

“I like to see where I started and where I can go in the future with Nav’s credit features. I’ve been able to work on both business and personal credit.”

Brynn K.

Kings Mobile Detail

“Nav is the best. The credit build products make business credit building a breeze.”

Stephen

Nav Prime member

YOUR MEMBERSHIP

Invest in your success

Getting credit reports elsewhere would cost you 4x more each month.1

Pay monthly

Pay quarterly

save 20%

Track

$39.99

/ mo

For new business owners looking to monitor credit, or established ones who want to protect it

Track with Prime5 credit scores, alerts, and reports from D&B, Experian, Equifax, and TransUnion

One tradeline to build business credit (membership payment)

Build

Popular$49.99

/ mo

For growing business owners looking to build business credit² with up to two tradelines

Build with Prime5 credit scores, alerts, and reports from D&B, Experian, Equifax, and TransUnion

One tradeline to build business credit (membership payment)

Second tradeline to build business credit history (Nav Prime Card)³

Bookkeeping tools to manage cash flow and simplify taxes

Expand

$74.99

/ mo

For business owners seeking one-on-one guidance from an expert to reach their next level

Expand with Prime5 credit scores, alerts, and reports from D&B, Experian, Equifax, and TransUnion

One tradeline to build business credit (membership payment)

Second tradeline to build business credit history (Nav Prime Card)³

Bookkeeping tools to manage cash flow and simplify taxes

Dedicated business credit coach

FICO SBSS score to track eligibility with 7,500+ lenders — and the SBA

Frequently asked questions

Unlock your credit scores

Just enter your basic business details and securely verify your identity.