I recently stumbled upon a new service that makes sending checks electronically a breeze. The service, Checkbook.io, still has some rough edges to work out, but is overall a very simple and elegant service for businesses and individuals who want to send out checks electronically.

The following is a quick walkthrough of Checkbook.io.

Get the credit your business deserves

Join 250,000+ small business owners who built business credit history with Nav Prime — without the big bank barriers.

The walkthrough

First, I selected the Create Account button to add my account.

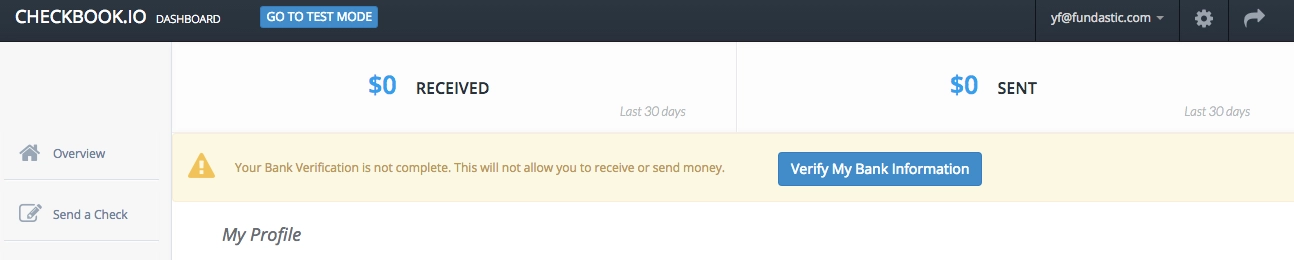

After creating the account, I was shown the dashboard. I clicked on Complete Profile to get to the next step.

I am setting up a business account so I entered the information about my business here.

After completing my business profile, I clicked on Verify My Bank Information.

There are two ways you can verify your account. You can log into your bank account from checkbook.io to verify instantly. Or you can verify it manually by entering your bank routing/account numbers. checkbook.io will make two micro deposits into your bank account. You will check your bank account, look up the exact amounts of the deposits, enter it back to checkbook.io to verify your bank account. I chose the Verify Instantly option, entered my bank user ID/password and clicked Submit.

Next, I picked on the bank account I want to connect to and clicked on Complete.

Now I'm ready to send checks.

I wanted to send $10 to John Smith through email. Note that I don’t need to enter John Smith’s address here. I clicked on Send.

I confirmed by clicking Yes.

Now, the check record showed up on my dashboard. That’s it.

On the recipient side, the recipient can print out the check directly. He or she can then use banks’ mobile app or go to the branch to deposit the check. The recipient can also deposit it electronically. The check typically will clear in 4-5 business days if deposited online. Note that the recipient needs not to sign up for checkbook.io to deposit a check. The first check I deposited takes about 5 business days to clear. The second one is still pending after 7 business days though. I asked their customer service. The rep told me they are growing rapidly and there’s a backlog of processing the payments right now. Hopefully, I will get the fund of my second check soon.

Selecting No, I’m sure I want to print it will open a new tab with an image of the check to print. Make sure to print or save before closing this tab — you will not have another chance to access your check.

Nav's verdict

Checkbook.io is a useful service. The user interface is very simple and elegant.

But it’s also a very new service so it seems like their back-end processing part is not totally in order. Currently, there is a $2,000 limit per day and a $15,000 limit per month.

I will probably start using checkbook.io to send out small checks for now and see how they evolve from here to decide if I want to use them exclusively for check sending.

Update: I received the funds of my second check a week later, so it works. It just took a bit longer than I expected.

Get the credit your business deserves

Join 250,000+ small business owners who built business credit history with Nav Prime — without the big bank barriers.

Build your foundation with Nav Prime

Options for new businesses are often limited. The first years focus on building your profile and progressing.

Lydia Roth

Lydia is a former Content Manager for Nav, which provides business owners with simple tools to build business credit and access to lending options based on their credit scores and needs.