There are numerous reasons why opening a small business credit card can be beneficial. From travel rewards and benefits to financial flexibility in the face of the unexpected, the right credit card can help you manage cash flow, grow your business, and potentially earn you a few perks along the way. In this article we’ll talk about instant approval business credit cards—or at least nearly-instant approval.

But what if you don’t already have a card on hand and you need to make a purchase or want to take advantage of a particularly appealing welcome offer? Do you have to wait a few days, or even weeks, before you find out if you’re approved?

Thanks to advancements in technology and the increasing speed and efficiency of the digital world, there are several business credit cards on the market with quick application and approval processes. Some of the best instant approval business credit cards are listed below.

Find the Right Credit Card for your Business

Get personalized business credit card options and access to your business credit report when you create your Nav account. Checking won’t hurt your credit scores.

What Does Instant Approval Really Mean?

Technology has made nearly-instant credit card approvals possible, but only in some cases. Most credit card issuers won’t even label their credit cards “instant approval” because some applicants may be approved with the click of a button, while others may require a manual review or an automated review that can take hours or days to complete.

There are a few things you can do to make the approval process as fast as possible for credit card issuers.

- First, be sure that none of your personal credit reports have a freeze or fraud alert on them. This can make for a longer application process as you may need to provide the issuer a code to allow them to review your credit history or you may need to lift the freeze entirely. If you’re unsure whether there is a freeze or fraud alert on your credit reports, you can call the major consumer credit bureaus to find out.

- Second, ensure your credit reports are in tip-top shape. Items like bankruptcies and judgments will throw a red flag up for the issuer, even if they’re from years past and could have a negligible impact on your scores today. And if there’s any inaccurate information on your credit reports, you should take the time to dispute it.

- Lastly, pre-approved or pre-qualified offers can help speed up the approval process, as the lender has already taken a peek at a sample of your data and deemed you potentially a good match. Still, you should never take a pre-approval or pre-qualification as a guarantee of approval.

Before you apply, keep in mind that “instant” also doesn’t mean guaranteed. In some cases, a credit card application may go into pending status while it’s reviewed or the credit card company requests additional information.

If a quick and easy approval process is just one factor that may drive your decision,

use Nav to help you filter and search through your top options based on your business’s details.

Perks of Business Credit Cards

There are a lot of reasons to use business credit cards, like:

- Higher credit limits than personal cards

- Rewards program, like points, miles, or cash back rewards for eligible business expenses you’re already paying for

- Welcome bonus potential a few months after account opening

- Free employee cards

- Integrations with business tools

- Potential to build business credit with on-time payments

Look for business credit cards with low or no annual fees, a 0% introductory APR, no foreign transaction fees (especially if you’re traveling with the card), and/or rewards on eligible purchases that you already buy.

You might not be able to find all of the perks your business needs in one card, which is why many small business owners use two or more. Do whatever makes the most sense for your business.

100+ business credit cards in one click

Business credit cards can help you when your business needs access to cash right away. Browse your top business credit card options and apply in minutes.

Instant Approval vs. Pre-Approval

Instant approval means that the process of reviewing your application is very quick. While not literally instant, these applications should result in a decision within a minute or so. On the other hand, a pre-approved credit card application is one that’s been sent to you based on your credit history and credit score meeting a pre-defined profile.

For example, a card issuer could be looking for new applicants in your state who are small business owners and who have a credit score of 700 or above. The card issuer will purchase a list of qualified people from one of the consumer credit bureaus, and send you a pre-approved offer.

Being pre-approved doesn’t mean that you’re guaranteed to be approved, it just means that what the card issuer knows about you is consistent with the profile of those they would like to acquire as new customers.

How to Prequalify for Business Credit Cards

Most pre-approval on credit cards happens with personal credit cards. With these cards, becoming pre-approved may come in the form of an offer in the mail that you can apply for. The check for pre-approval is a soft credit check, which means it won’t affect your credit score, but submitting a full application will require a hard credit check. Hard inquiries will reduce your credit score by a few points temporarily.

Your best option with business credit cards is to check with a credit card company. Visit a local branch or call the card’s customer service to talk to someone about getting prequalified. If you have a good credit — or even an excellent personal credit score — you’re more likely to have more pull than if you only have fair credit or poor credit.

Being prequalified for a business credit card doesn’t mean you’re definitely going to get it. Instead, it means that the information the credit card issuer has access to looks like you’re likely to qualify.

Personal Guarantees and Instant Approvals

Personal guarantees are an agreement between a cardholder and a credit card company that the business owner will pay off any debt the business fails to pay off with their personal assets. Most business credit cards require a personal guarantee (but there are a few that don’t).

Instant approvals, as mentioned above, are when your application for a business credit card goes through almost instantaneously. The easiest business credit cards to get will be the ones your qualifications line up with the best — use Nav to see what you’re most likely to qualify for before you apply.

Keep in mind that it’s often easier to qualify for secured business credit cards or charge cards (like the Nav Prime Card* included with the Nav Prime bundle).

Business Credit Cards with Fast Approval

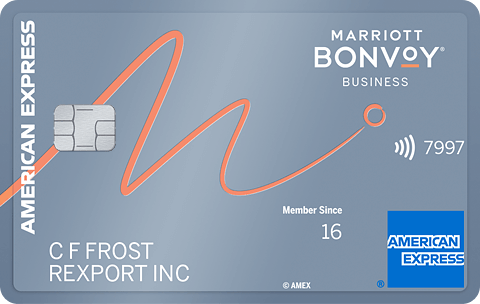

- Marriott Bonvoy Business® American Express® Card: Best for hotel stays

- Delta SkyMiles® Reserve Business American Express Card: Best airline miles welcome offer

Marriott Bonvoy Business® American Express® Card: Best for Hotel Stays

If you’re looking for a business credit card to cover some upcoming travel expenses, and you want to stay in the American Express family, the Marriott Bonvoy Business® American Express® Card may be a good fit. WELCOME OFFER: Earn 3 Free Night Awards after you use your new Card to make $6,000 in eligible purchases within the first 6 months of Card Membership.

With this card, you can earn 6x Marriott Bonvoy points on each dollar of eligible purchases at hotels participating in the Marriott Bonvoy® program. 4x points for purchases made at restaurants worldwide, at U.S. gas stations, on wireless telephone services purchased directly from U.S. service providers and on U.S. purchases for shipping. 2x points on all other eligible purchases.

The card does have a $125 annual fee, but with membership perks like a free night stay after your card anniversary and Marriott Bonvoy Gold Elite Status in the Marriott rewards program (enrollment required), it’s easy to merit the annual fee. The cardholders also access basic Amex benefits like extended warranties, purchase protection, and dispute resolution.

A good option for racking up hotel points. Comes with membership, travel, and airport perks.

Pros

- Earn valuable points with Marriott Bonvoy Hotels and other popular spending categories

- Free Night Awards each year.

Cons

- Marriott Bonvoy points are most valuable when you understand how to use them.

Intro APR

Purchase APR

Annual Fee

Welcome Offer

Delta SkyMiles® Reserve Business American Express Card: Best Airline Miles Welcome Offer

It’s not very often that you see credit card offers that feature six figures of bonus miles from a business credit card, but this card features a limited time offer. Limited Time Offer: Earn 110,000 Bonus Miles after spending $12,000 in purchases on your new Card in your first 6 months of Card Membership. Offer Ends 7/16/25.

Earn 3 miles per dollar on eligible Delta purchases. There’s a $650 annual fee for this card.

Delta SkyMiles® Reserve Business American Express Card

This is the top-of-the-line Delta SkyMiles card for frequent business travelers who get the most benefits when flying on Delta. Boost your elite status, get access to airport lounges, and enjoy the luxury travel perks.

Pros

- Amazing limited time offer! Attractive benefits for the frequent Delta flyer

- Offers a Delta SkyClub membership, a companion airfare certificate, and upgrade priority.

Cons

- High annual fee and limited ongoing rewards.

Intro APR

Purchase APR

Annual Fee

Welcome Offer

How to Get Instantly Approved for a Business Credit Card

Nearly all credit cards will offer online applications, which will offer approval to most qualified applicants in a matter of seconds or minutes after submission. However, there are several ways to help ensure that your application has the most chance of being approved.

First, make sure that you’re applying for a card account that you’re qualified to be approved for. For example, many business credit cards will require excellent credit, and you won’t likely be approved if your score isn’t that good. However, there are business credit cards for those with good, fair or even bad credit that you can apply for.

Regardless of your personal creditworthiness, there’s a business credit card that you can qualify for. For example, there are even secured credit cards for business that require the payment of a refundable security deposit before you can open an account.

Next, make sure that all of your information is correct. For example, if you apply for a business credit card using an address not associated with your business, then it’s unlikely that you’ll receive instant approval. For instance, if your business is registered to your office address, but you apply using your home address, it could be a problem. And if your business has recently moved to a different office, then your application could be rejected if you haven’t updated your business address with the state your business is incorporated in.

And if you fail to receive instant approval, you can quickly call the card issuer. Most major card issuers have a reconsideration line that you can call to discuss your application, and often receive approval over the phone.

How Long Does It Usually Take to Get Approved?

Many credit card issuers will offer nearly instant approval when you submit an application online. If you’re not approved instantly, then you’ll often receive a letter in the mail within 7-10 business days. That letter may offer you approval, or it may give you reasons why your application wasn’t approved. However, if your application wasn’t immediately approved, you don’t have to receive the letter. You can call the card issuer’s reconsideration line to speak with a representative who often has the ability to approve your application.

Can You Get Instant Approval with Bad Credit?

You can, but only if you apply for a secured card that offers approval to those with bad credit. Even then you must be able to document your identity, and have no pending bankruptcies or foreclosures.

100+ business credit cards in one click

Business credit cards can help you when your business needs access to cash right away. Browse your top business credit card options and apply in minutes.

Frequently asked questions

Can you get pre approved for a business card?

Most credit card companies don’t let you know ahead of time how likely you are to qualify for their products. However, there are credit cards that offer instant approval to speed up the process.

How do I use my business EIN number for credit?

You may be able to qualify for a business credit card without your Social Security number and instead using your employer identification number (EIN). These are harder to get, and you’ll likely need established business credit scores to qualify.

How does a pre-approved credit card work?

A pre-approved credit card is most often a personal credit card. Credit card issuers connect to individuals that are most likely to qualify for their products. However, there’s no guarantee that they will be approved.

Do business credit cards get approved instantly?

Some business credit cards offer instant approval. This means that an applicant can receive a decision on whether or not they’re approved within a few seconds or a few minutes. Not all business credit cards offer this, however.

*DISCLAIMER: Nav Technologies, Inc. is a financial technology company and not a bank. Banking services provided by Thread Bank, Member FDIC. The Nav Visa® Business Debit Card and the Nav Prime Charge Card are issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa cards are accepted. See Cardholder Terms for additional details. FDIC insurance is available for funds on deposit through Thread Bank, Member FDIC. All other features of the Nav Prime membership are not associated with Thread Bank.

Build your foundation with Nav Prime

Options for new businesses are often limited. The first years focus on building your profile and progressing.

Susan Guillory

Susan Guillory is an intuitive business coach and content magic maker. She’s written several business books and has been published on sites including Forbes, AllBusiness, and SoFi. She writes about business and personal credit, financial strategies, loans, and credit cards.