Monitor your business credit with Nav

Business credit monitoring helps you understand how lenders, suppliers and business partners view your business’s financial responsibility. With Nav, you can track the data that matters in real time so you can focus on maintaining good business credit habits.

What is business credit monitoring?

If you’re a small business owner, you can use business credit monitoring to get regular updates on your business credit file and business credit scores. You may also get alerts to important changes in your credit profile, such as credit inquiries and new credit accounts, or changes in your credit scores.

Why you should monitor business credit

Business credit is a key indicator of your business’s financial health. Whether your business is new or well-established, here’s why monitoring your business credit matters:

1. Strong business credit

Business credit monitoring helps you understand if your business credit scores are moving in the right direction. Managing your business credit helps you correct mistakes — which happen more often that you might think — that could potentially impact your scores.

2. See what lenders (and others) see

Lenders may use your business credit reports whento decidinge whether to offer your business a small business loan or financing. Vendors use it to determine if your business qualifies for trade credit and on what terms (like net-30). Business insurance companies may also check it.

3. Protect against business identity theft

Business identity theft can be worse than personal identity theft because many business owners don’t learn about it for months or years. While you can’t prevent it completely, monitoring your business credit can help you catch it sooner to minimize the damage.

How to monitor your business credit

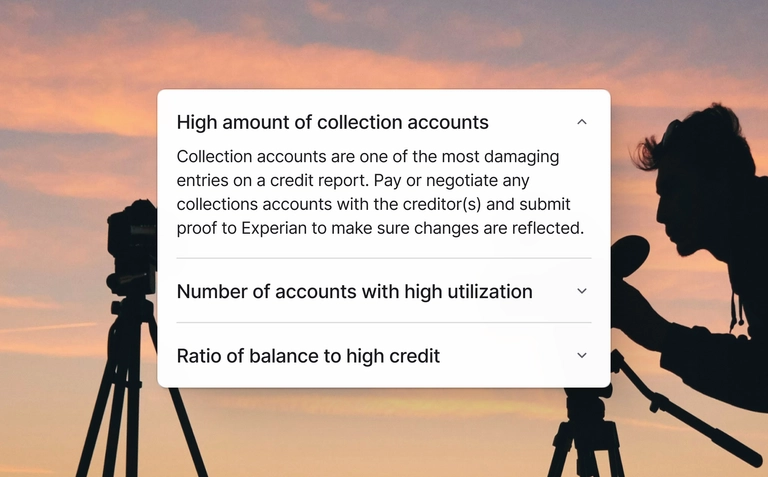

Nav offers the most comprehensive business credit monitoring solution. We pull information from the major business credit bureaus and help you make sense of it, with key factors and focus areas to help you take the right next steps.

With Nav Prime, you can monitor your business credit scores and detailed report data from Dun & Bradstreet, Experian, and Equifax. Nav Prime is also the only place you can unlock your FICO SBSS score to track your eligibility with 7,500+ lenders — and the SBA.

How to improve and maintain business credit

In general, the key to building and maintaining business credit is to do business with companies that report payment history — then pay on time and keep debt levels manageable.

- Seek out tradelines (business accounts) with vendors that report to the business credit bureaus

- Consistently repay on time or early to build positive payment history.

- Keep credit utilization low, and make sure information about UCC filings is correct and up to date

As you develop and build upon good business credit habits, Nav can help you track progress and take action to keep improving.

Unlock your Nav tradelines

You’re one short application away.