Clearing up Cash Flow and Bookkeeping

Cash flow and bookkeeping basics

Cash flow management is something that can seem too advanced for smaller operations, and may bring to mind Wall Street-style multi-monitor spreadsheets. But if you’re checking your bank balance, you’re managing cash flow.

Cash is the lifeblood of your small business. It’s important to understand how money moves in and out of your business so that you can avoid shortages, make informed decisions about your current plans, and invest wisely in future goals.

Bookkeeping is not the same as cash flow, but it’s a key part of understanding your finances. And it’s not just about taxes either. Bookkeeping helps you track cash flow, demonstrate financial stability when you apply for funding, and make smarter financial decisions.

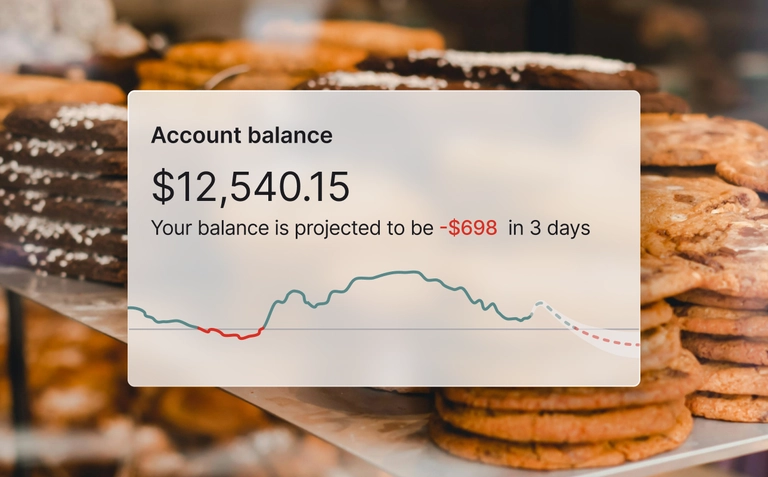

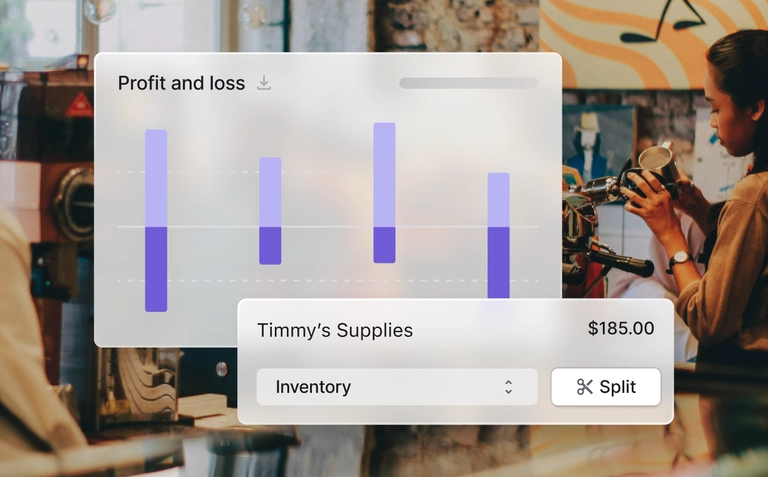

Nav’s Cash Flow Health gives you a clear picture of your cash on hand across unlimited accounts. You can also unlock bookkeeping tools to help simplify tax prep, automatically categorize expenses, and get detailed financial statements with select Nav Prime plans.

What are cash flow and bookkeeping?

Cash flow is essentially the cycle of funds going in and out of your business bank account from operations, investing, and financing. It’s the amount of cash that you have at your disposal at any given time. Your business can either be cash flow positive or cash flow negative.

Positive cash flow means there is more cash coming into your account than you’re spending. Negative cash flow means you’re pending more than you’re bringing in.

At its core, bookkeeping is the process of tracking and organizing all of your business transactions. When done right, you can see how money flows through your business and where you stand financially at any given moment.

Why cash flow and bookkeeping matter for small businesses

Cash flow management is one of the most important financial tasks for any business owner. Run out of cash too often, and your business might not be able to keep the lights on. Sit on too much cash and you may miss out on opportunities for business growth.

When it comes to bookkeeping, it’s not unusual for business owners to find themselves struggling. Weeks can turn into months, and before you know it, it’s time to file taxes but all you have is a box of unorganized receipts.

Bookkeeping helps you produce accurate financial statements, whether for tax-prep or for lenders who may request them when you apply for small business financing. It helps you get a clear picture of where you stand now, make cash flow forecasts, and plan next steps that make sense for your business.

Explore our guide

Chapter 1

Understanding cash flow

Unlock powerful bookkeeping tools with Nav Prime

Frequently asked questions

Cash flow and bookkeeping glossary

Start tracking your cash today

Monitor all your money in one spot. Secured using bank-level encryption.