CUSTOMER SPOTLIGHT

Meet Ryan, owner of BCK Ranch

See how Ryan is using Nav Prime to power an at-home microgreens farm

Their story

It’s all about family

Ryan Lockwood had planned to complete his career as a firefighter, but found himself wanting more time with his family. After his wife Taryn discovered an allergy, they found their purpose — and their business idea.

Ryan and Taryn launched Houston-based BCK Ranch in 2022 to help people with heavy metal allergies enjoy greens again. Soon enough, local chefs and grocers were placing orders. As they’ve expanded, Ryan has used Nav Prime to build business credit and finance BCK Ranch’s operations.

“Big banks don’t want to fund a new business. They don’t see you as anything in your first two years. Nav has taken that zero to two year mark and said, hey, we trust you. We want to build a relationship with you.”

— Ryan Lockwood

Nav Prime

Ryan uses Nav Prime to build his foundation

Options for new businesses are often limited. The first couple years are about establishing your business profile and working your way up to where you want to be.

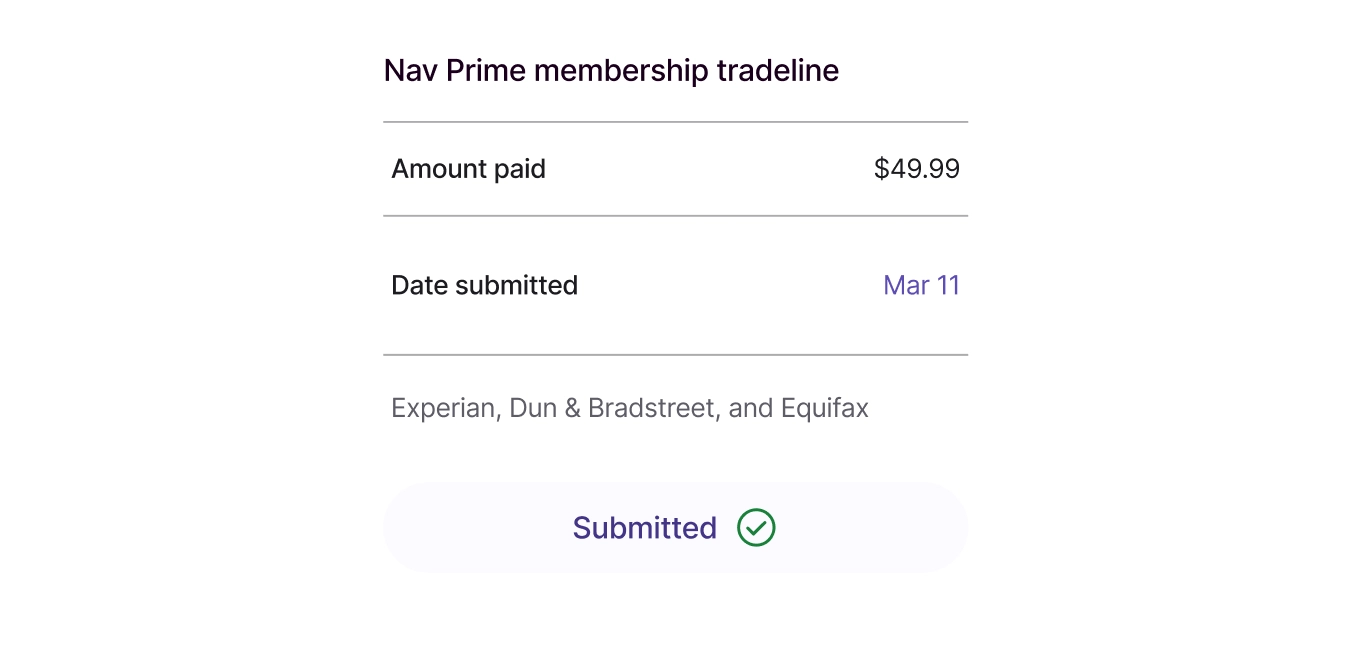

tradeline reporting

Ryan works on his business credit with Nav Prime

Ryan’s membership tradeline helped him get a jump start on building business credit early in his business journey.

Credit Health

Then, he tracks his credit

Nav Prime unlocks Ryan’s most powerful business credit insights as he builds, so he’s never left wondering where he stands or what he needs to do to improve.

You didn’t start your business because you love business credit

But that’s why we started ours. Nav isn’t just a powerful suite of financial tools — we’re part of your team.