Financial Foundations Handbook

Financial foundation basics

The financial health of your business is a direct reflection of the strength of your operation. Banks, lenders, and potential partners look for signs of consistent cash flow and responsible credit use to help determine whether your business is reliable and can manage debt.

At its core, a business’s financial health shows how well it’s positioned to handle challenges and pursue opportunities. It’s not about one single number — but the overall condition of your finances. Strong financial health may help you secure funding and negotiate better terms with suppliers, which can make it easier to grow.

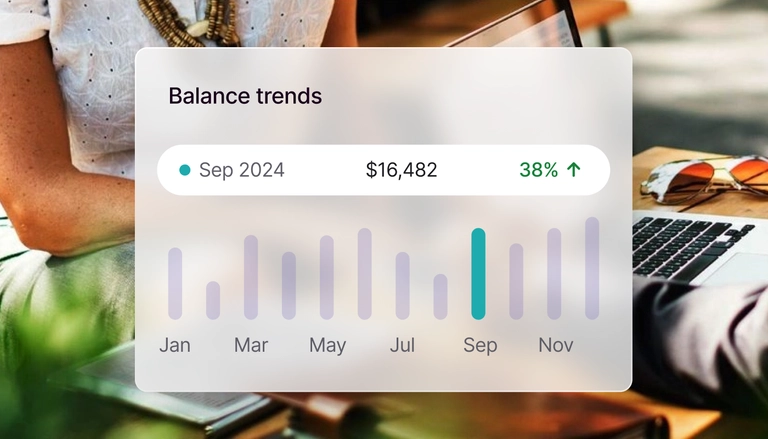

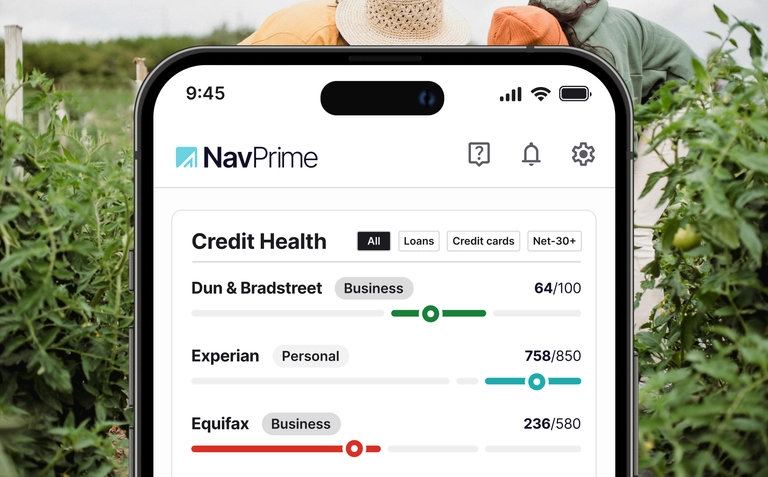

Achieving a strong financial standing requires consistent effort: tracking your numbers, planning ahead, and making strategic decisions. Over time, this steady approach can help your business thrive. For tools that can help you build a financial foundation, get started with Nav Prime.

What is financial health in business?

In simple terms, business financial health is a snapshot of how well your business is managing money and sustaining operations. It can be improved with factors like:

- Steady cash flow

- Manageable debt

- Healthy profit margins

- Proper growth planning

Strong financial health doesn’t just give you peace of mind — it can make a real difference in how others view your business. Lenders may be more willing to provide funding and supplie rs may extend better terms. Plus, opportunities like partnerships or contracts may become easier to secure when your business is on solid financial footing.

Why financial health matters

A financially healthy business may have more flexibility and opportunities. Lenders, vendors, and even potential clients may review a business’s financial condition to decide whether it’s stable, reliable, and able to deliver on commitments. Strong financial health signals that your business can handle obligations, weather challenges, and grow with confidence.

Here are a few ways solid financial health can benefit you:

- Lower borrowing costs: When your finances are in good shape — steady revenue, manageable debt, and healthy reserves — it can help demonstrate stability, which is one of the factors lenders typically review when determining financing terms

- Improved cash flow options: Strong financial management may help you negotiate more favorable terms with vendors and suppliers, helping give you extra breathing room to balance income and expenses

- Room to grow: A stable financial foundation may make it easier to unlock new opportunities, whether thats applying for financing, taking on a big contract, or expanding into new markets

Explore our guide

Chapter 1

Understanding business financial health

Simplify bookkeeping with Nav Prime

Frequently asked questions

Financial foundations glossary