Coming Soon

A credit builder card that rewards your growth

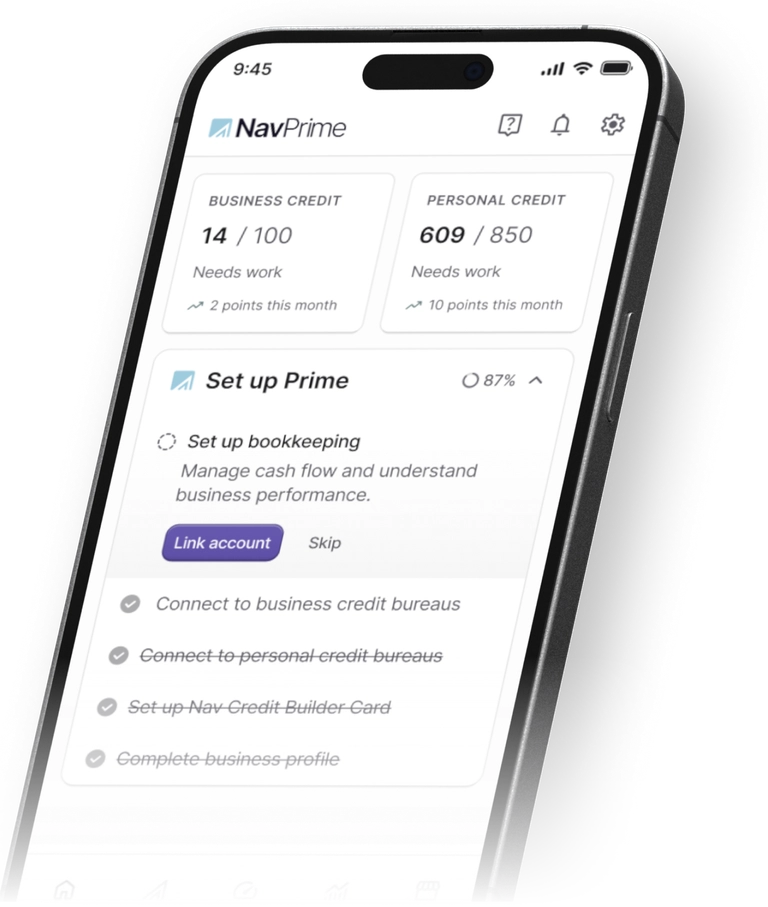

Meet the all-new Nav Credit Builder Card. More flexibility in every swipe, with no personal or business credit check.

- A credit limit that grows with your sales

- Cash back on every purchase

- Flexible repayment terms

- No compound interest

Join the waitlist now.