Nav Prime

The simpler way to build business credit and grow your business

Join over 300,000 small business owners who have built business credit history and managed credit with Nav Prime. Up to 2 tradelines reporting to major business bureaus is just the start.

tradeline reporting

Nav Prime membership tradeline

Your Nav Prime membership payment is reported monthly as a tradeline on your credit reports. Track your credit-building progress as you go.

- Establishes profiles with major business credit bureaus

- Automatically reports payments monthly to D&B, Experian, and Equifax

- Only reports positive credit history

Use your Nav Prime Card. Get business credit.

Spend up to your daily limit on anything — from team tacos to Instagram ads — and build business credit.1

- No credit check, security deposit, or personal guarantee

- Build business and personal credit together: 1 card, 2 tradelines.2

- Charge card with no risk of carrying a balance

Nav Technologies, Inc is a financial technology company and is not an FDIC-insured bank. Banking services provided by Thread Bank, Member FDIC. The Nav Prime charge card is issued by Thread Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa cards are accepted. See Cardholder Terms for additional details. All other features of the Nav Prime membership are not associated with Thread Bank.

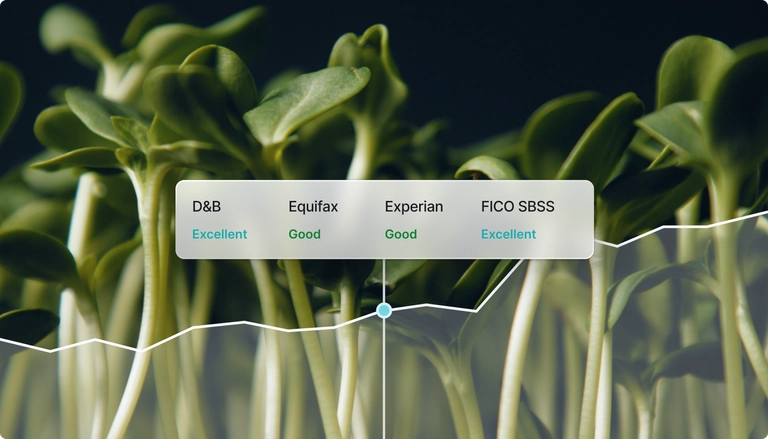

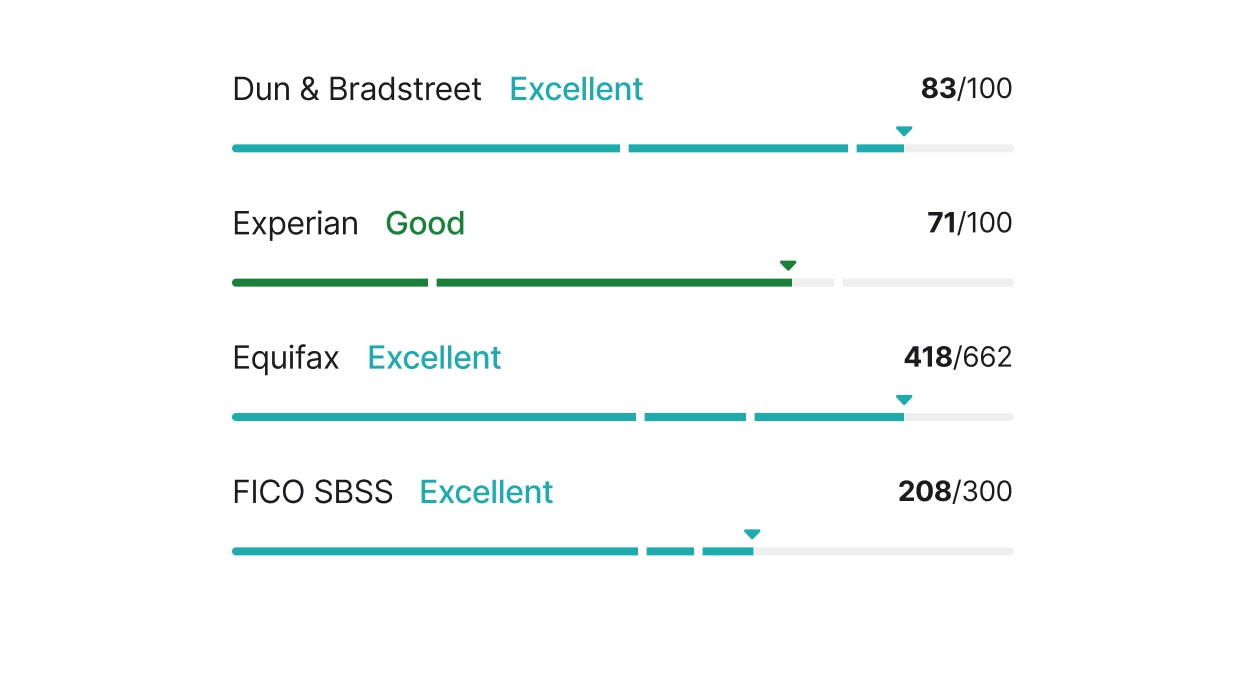

Monitor business and personal credit with 1 login

No need to jump around to see why your credit scores are changing. Get up to 6 personal and business reports in one place. Get real-time credit alerts to celebrate your wins, monitor for fraud, and fix errors if you need to.

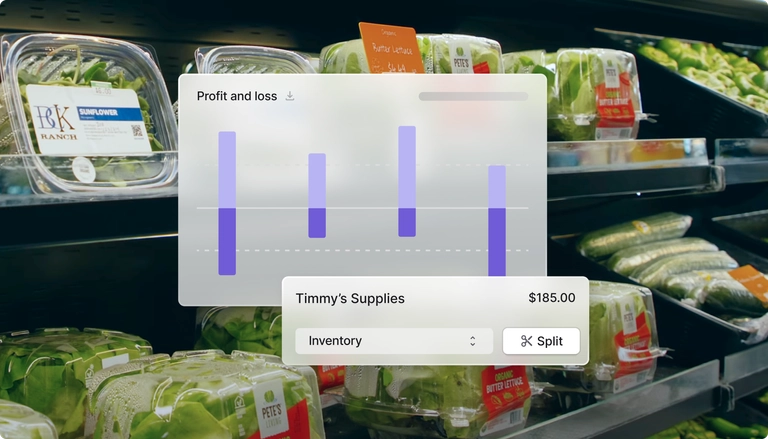

Credit building and business checking

Nav Business Checking is your starter bank account. Keep your books and transactions tidy while you build credit. Plus, get cash flow trends and credit insights to guide your journey. All with Nav Prime.

The credit platform small business owners call home

Custom-made for small business owners who want to build business credit and manage their money without second-guessing.

Pay monthly

Pay quarterly

save 20%

Track

$39.99

/ mo

For new business owners looking to monitor credit, or established ones who want to protect it

Track with Prime5 credit scores, alerts, and reports from D&B, Experian, Equifax, and TransUnion

One tradeline to build business credit (membership payment)

Build

Popular$49.99

/ mo

For growing business owners looking to build business credit³ with up to two tradelines

Build with Prime5 credit scores, alerts, and reports from D&B, Experian, Equifax, and TransUnion

One tradeline to build business credit (membership payment)

Second tradeline to build business credit history (Nav Prime Card)⁴

Bookkeeping tools to manage cash flow and simplify taxes

Expand

$74.99

/ mo

For business owners seeking one-on-one guidance from an expert to reach their next level

Expand with Prime5 credit scores, alerts, and reports from D&B, Experian, Equifax, and TransUnion

One tradeline to build business credit (membership payment)

Second tradeline to build business credit history (Nav Prime Card)⁴

Bookkeeping tools to manage cash flow and simplify taxes

Dedicated business credit coach

FICO SBSS score to track eligibility with 7,500+ lenders — and the SBA

Why our customers love Nav

Meet the small business owners who are redefining their business journey with Nav.

“When Nav started Nav Prime, I was sold. I get two tradelines for building business credit! I’m never leaving Nav.”

Brynn K.

Kings Mobile Detail

“Their credit reports are extremely helpful, very clear, and informative, and they are all offered at a fraction of the cost that it would be if a business purchased individual business memberships from each credit bureau. And on top of it, they consistently report a credit line to the business credit bureaus once a month.”

Sergio C.

Energy Company

Nav is a recommended solution for building business credit

Enhance the tools you need to reach your business credit goals with confidence.

Detailed credit reports

Access your full credit details

Get the inside scoop to see what lenders, clients, and partners see.

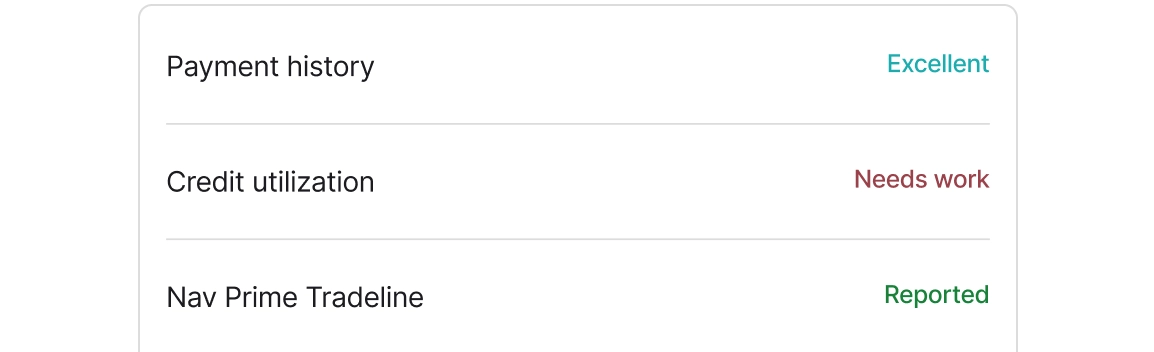

Key factors

Make the right moves

Explore the key factors impacting your credit scores like payment history and outstanding balance.

Credit trends

See your credit progress over time

Know where you stand and celebrate the milestones that help your business grow.

FAQs

Unlock your credit scores

Get free summary reports or access detailed credit reports and more with Nav Prime. Just enter your basic business details to get started.