Nav Prime

Build business credit to help you unlock growth

Join over 340,000 small businesses who have worked with Nav to build business credit history with Nav Prime.

Know where your business stands with

Join Nav Prime

Invest in your success

Start for free with basic tools, or get a Nav Prime membership to go further. Getting credit reports elsewhere would cost you 4x more each month.1

Pay monthly

Pay quarterly

save 20%

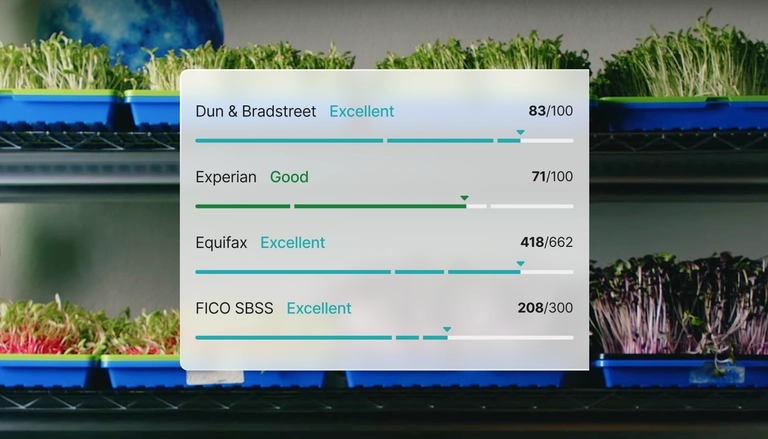

5 credit scores, alerts, and reports from D&B, Experian, Equifax, and TransUnion

Exclusive discounts on fees from Nav’s trusted lending partner2

Build

Popular$49.99

/ mo

For growing businesses looking to build business credit with up to 2 tradelines³

Build with Prime5 credit scores, alerts, and reports from D&B, Experian, Equifax, and TransUnion

Exclusive discounts on fees from Nav’s trusted lending partner2

One tradeline to build business credit (membership payment)

Bookkeeping tools to manage cash flow and simplify tax prep

Coming soon: Nav Credit Builder Card with a second tradeline opportunity (not included at signup)

5 credit scores, alerts, and reports from D&B, Experian, Equifax, and TransUnion

Exclusive discounts on fees from Nav’s trusted lending partner2

One tradeline to build business credit (membership payment)

Bookkeeping tools to manage cash flow and simplify tax prep

Coming soon: Nav Credit Builder Card with a second tradeline opportunity (not included at signup)

Business Credit Coaching

FICO SBSS score to track eligibility with 7,500+ lenders — and the SBA

The Nav Prime bundle

Big tools for small business

Custom-made for small business owners who want a way to build business credit and manage their money without second guessing.

Credit Building

Maximize credit building

Get up to 2 credit-building accounts (tradelines)3 submitted monthly to the major bureaus to build business credit.

Credit Health

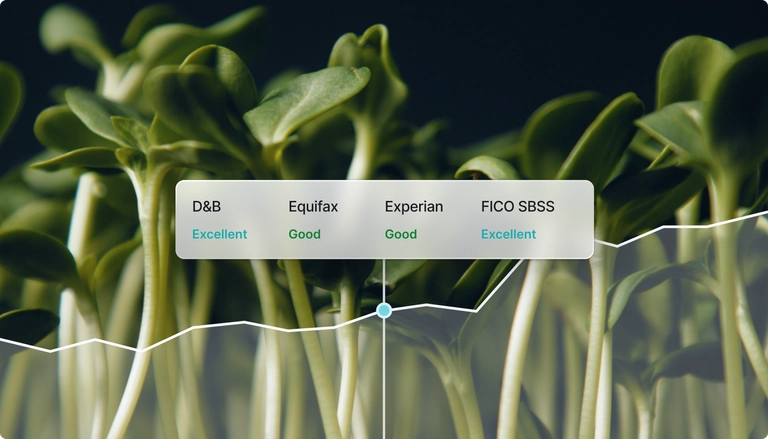

Deeply understand your credit

Skip the credit bureau jargon and learn what actually matters for building credit. Unlock up to 6 business and personal scores to track your total progress in one place.

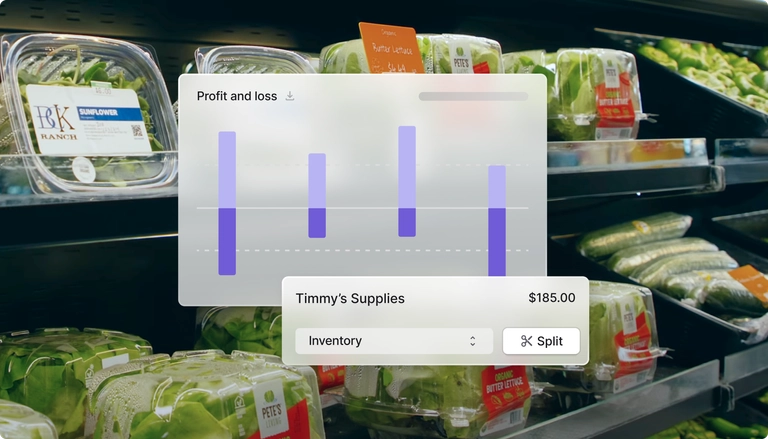

Cash flow health

Manage dollars with sense

Take back your time (and sanity) with simplified bookkeeping tools. Categorize your transactions automatically and get profit and loss statements with one click.

Business Credit Coaching

A business credit coach who gets small business

Nav Prime puts powerful tools and insights at your fingertips. Your dedicated business credit coach can show you how to leverage them to maximize your progress.

Why our customers love Nav Prime

“I log into Nav everyday. Once I got into building business credit, I became obsessed with checking it on Nav.”

Brynn K.

Kings Mobile Detail

“Nav has taken that zero-to-two year mark and said, ‘We want to build a relationship with you and see that business credit grow through Prime.’”

Ryan L.

BCK Ranch

“Here’s the advice I give to any new business owners — get your LLC setup, and get Nav. I started building business credit with Nav before I even started accepting clients, which made getting started working with vendors a whole lot easier.”

Dasia G.

Holu Cleaners

Frequently asked questions

Looking for basic tools to start?

You can monitor cash flow and your basic credit standing for free.

Get your business roadmap

Nav Prime helps you build, manage, and leverage your small business’s credit in one place.