Get your business credit scores

Nav is the only place you can immediately check your business credit across all 3 major bureaus: Experian, Equifax, and Dun & Bradstreet. To help you plan for tomorrow, check out where you stand today.

What good business credit scores can do for you

A strong business credit score can give your business more options. Lenders and other creditors use business credit scores to determine how likely your business is to pay bills on time — and decide whether to offer financing. Your scores can also help you:

1. Increase your borrowing power: A strong business credit score can help you qualify for higher funding amounts.

2. Lower your rates on business insurance: Higher business credit scores may win you lower deductibles. Some commercial insurance providers evaluate a business owner’s personal credit and business credit to set rates.

3. Get more time to pay: Vendors and suppliers can use business credit to decide what trade credit terms to give your business (net-30, net-60, etc.). More flexible terms can help you manage cash flow.

How to check your business credit scores

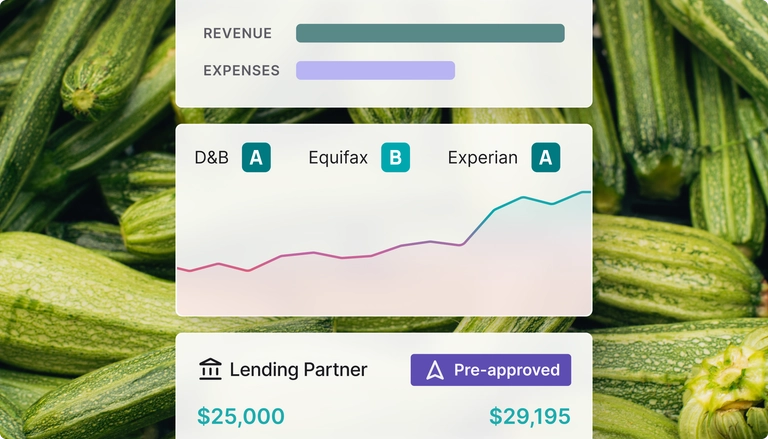

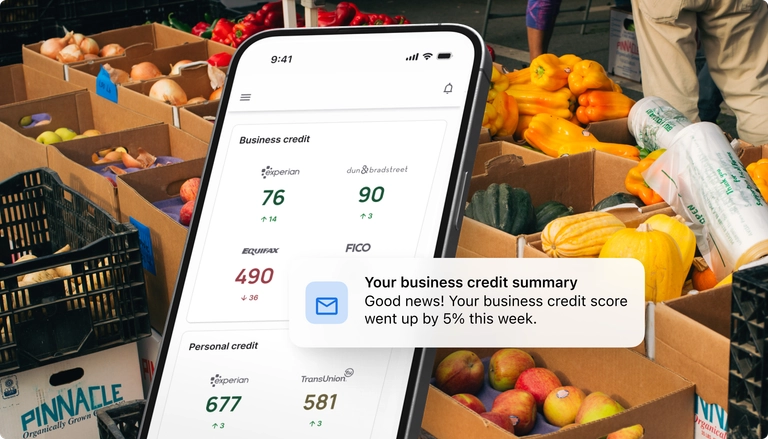

You can check your business credit scores with each individual bureau — or, you can check them all in one place with Nav. Get a clear look at your business credit and personal credit side-by-side in your Credit Health dashboard.

To check your business credit, log in to your account and select Credit Health in the sidebar.

If you don’t have data from a specific bureau, you can search for your business to get set up.

What is a business credit score?

Your business credit score measures how well your business pays bills, which helps vendors and lenders determine whether you qualify for trade credit or loans, and on what terms.

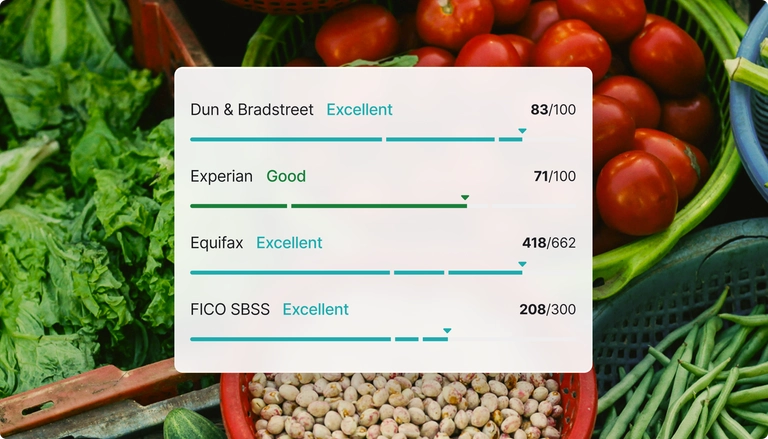

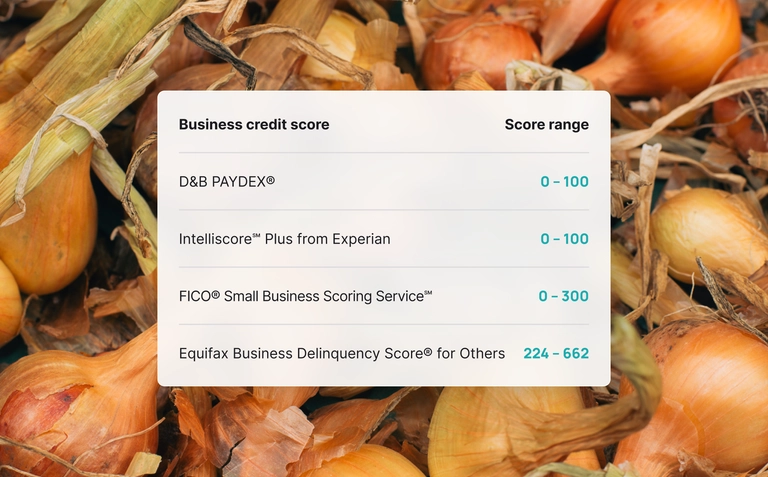

Major business credit bureaus Dun & Bradstreet, Experian, and Equifax produce business credit scores. FICO also provides the FICO SBSS score, a blended business and personal score used by 7,500+ SBA lenders nationwide to pre-screen for loans.

Factors that determine business credit scores

One of the most important factors for business credit scores is payment history. Paying bills on time (or early) is critical for building your score. Other factors that can contribute to your score include:

- Age of credit history

- Debt and debt usage

- Industry risk

- Company size

Business credit scores also use different score ranges from personal credit scores.

Intelliscore Plus℠ from Experian

The Experian Intelliscore Plus℠ score ranges from 1 to 100. A higher score indicates lower risk, so as a business owner, you want to aim for a higher score.

Over 800 variables can affect these scores, including:

- Tradelines and collections

- Public filings

- New account activity

- Key financial ratios

Paying on time and managing debt well is the key to help build a strong score.

FICO® Small Business Scoring Service℠

FICO’s Small Business Scoring Service (SBSS) score is a blended business and personal score used by 7,500+ lenders nationwide to pre-screen for loans up to $350,000 from the Small Business Administration (SBA). This score blends business and personal credit data.

The score ranges from 0 to 300. The minimum score to pass the SBA’s pre-screen process is currently 140.

A strong history of business credit with timely payments to vendors and suppliers may help boost your SBSS score.

D&B PAYDEX® score from Dun & Bradstreet

The D&B PAYDEX® score is a business credit score from Dun & Bradstreet (D&B). Suppliers and vendors often use it to determine what terms to extend on trade credit (net-30, net-60, etc.), which can help you manage cash flow.

The score ranges from 1 to 100, based on your payment history with vendors and supplies that report to D&B.

Aim for at least three open tradelines to get a PAYDEX® score. Also, paying on time will only earn your business a score of 80. For a perfect PAYDEX® score of 100, you need to pay early.

How can I get free business credit scores?

With Nav, you can get business credit summaries from Experian, Equifax, and Dun & Bradstreet. These include a grade and a score range to give you an overview of where you stand.

How can I improve my business credit scores?

Building business credit takes time. To set yourself for success, focus on the following:

• Add accounts you already pay to your business credit reports.

• Pay accounts that report on time or early.

• Keep debt under control. If possible, avoid maxing out credit lines.

Nav can help you monitor your business credit and track your scores.

Get your free business credit check

Building a strong business credit score can open up financing opportunities and partnerships that make it easier for you to run and grow your business.

With Nav, you can view your business credit and cash flow all in one place, and get next steps on how to make progress. Sign up today to check your business credit and take control of your financial health.