Summary

- A line of credit gives you flexible, ongoing access to funding with potentially low rates, while a credit card combines access to credit with perks like rewards.

- Business credit cards are easier to qualify for, especially for newer businesses, but often come with higher interest rates.

- Lines of credit may offer larger limits and are better suited for managing cash flow or covering larger short-term expenses.

- Understanding how each works helps you choose the best tool for your spending habits and financing needs.

Editorial note: Our top priority is to give you the best financial information for your business. Nav may receive compensation from our partners, but that doesn’t affect our editors’ opinions or recommendations. Our partners cannot pay for favorable reviews. All content is accurate to the best of our knowledge when posted.

When you’re a small business owner, there are going to be times when you need money. And when you do, you’ll often need it quickly.

That’s one reason lines of credit and credit cards are among the most popular types of financing for business owners. Once you’re approved for either type of business financing you can use it when you need it.

Unless you’ve used these financing options often, though, you may not be sure exactly how they work or fully understand the difference between a line of credit vs credit card. Most importantly, you may wonder which one is better.

Here we’ll explain how lines of credit and credit cards work, and when each may be the best choice for your business.

Line of credit vs. credit card: Key differences

Both financing options give you flexible access to funds, but they work differently in practice. Lines of credit typically offer larger borrowing amounts with structured repayment periods, while credit cards provide more flexibility and potential rewards for everyday spending.

Comparison of a line of credit vs. business credit card

Feature | Business line of credit | Business credit card |

Typical credit limit | $50,000–$500,000+ | $2,000–$20,000+ |

Interest rates | Prime + 1.75% to 35%+* | 18% to 30% (0% intro APRs available)* |

Repayment structure | Draw period + payback period | Monthly statement cycles |

Time in business required | 6–24 months typical | Available to new businesses |

Revenue requirements | Minimum thresholds vary by lender | Personal and business income often considered |

Rewards | Not common | Cash back, travel points, perks |

Best for | Cash flow, short–term borrowing | Cash flow, short–term borrowing, rewards |

*Ranges are general industry estimates and vary widely by lender/issuer, applicant qualifications, and market conditions

Curated funding options, smarter decisions

Your small business financing search stops here. Compare your top small business financing options, from over 160 financial products – with Nav.

Credit limits

A line of credit will often offer a higher credit limit than a small business credit card. Depending on the lender and your creditworthiness, you may be able to access up to $50,000–$500,000 or more from a line of credit.

A high-limit credit card will often offer closer to $10,000 to $25,000 as the starting credit limit, depending on the issuer and the applicant's qualifications.

Interest rates and fees

You'll pay interest on both credit cards and lines of credit, but rates vary significantly based on your qualifications and the lender.

Lines of credit may charge interest rates as low as the prime rate + 1.75% to as much as 35% or more, while credit cards typically charge between 18% to 30% or even higher. Some credit cards offer intro APRs of as little as 0% for a year or more.

Lines of credit may charge a draw fee each time you borrow money, and an origination fee when you open the credit line. Both credit cards and lines of credit may charge late fees and annual fees. Credit cards may also charge cash advance fees and balance transfer fees.

Repayment terms and flexibility

The repayment structure for lines of credit and credit cards share some similarities but may also have key differences.

A business line of credit typically has a predefined draw period and a payback period. During the draw period — which can last a few months or even a few years — you're allowed to borrow up to your credit limit. You may only need to make interest–only payments during this time, meaning you're not paying down the principal balance.

Once the payback period begins, your payments increase because you must repay the full amount borrowed within a specific timeframe. This shift can significantly impact your monthly cash flow.

Credit cards typically work on monthly statement cycles. You can pay your statement balance in full to avoid interest charges entirely. Or you can make minimum payments and carry a balance, though minimum payments can stretch out your debt for years and may cost significant interest charges.

Qualification requirements

Depending on where you get the line of credit — through a bank or online lender — qualification requirements can vary significantly. Generally lenders consider:

- Time in business (at least six to 24 months in business).

- Minimum annual revenue ($50,000 to $1 million or more).

- Good personal credit scores (650 to 680+ or higher).

- Business credit history may be reviewed.

Business credit cards may be easier to get for new businesses. Typically, issuers require:

- Acceptable personal credit scores (650 to 680+ or higher).

- Sufficient income from personal and/or business sources.

With many small business credit cards, as long as the owner meets personal credit requirements and has sufficient income from all sources — not just the business — they may qualify. Most business credit cards require good to excellent personal credit.

Impact on business credit

Both options can help you build business credit, but only if the lender reports to business credit bureaus. Some lenders and issuers report to one or more business credit bureaus such as Dun & Bradstreet (D&B), Equifax, or Experian, or to the Small Business Financial Exchange (SBFE) but reporting varies by product and provider. Confirm reporting before applying. On-time payments may help strengthen your business credit profile.

In some cases, business lines of credit and credit cards do not report to the owner's personal credit during normal use which can help you separate business and personal credit. However, some card issuers reserve the right to report to personal credit if the owner defaults. Personal credit reporting varies by issuer and product. Many business cards require a personal guarantee and may involve personal credit checks; some issuers may report certain activity to personal bureaus.

Late payments work in reverse: They can trigger a lender or issuer to reduce your credit limit or even close your account.

What is a business line of credit?

A business line of credit, also called a revolving line of credit, offers you funds you can access when you need them. It's typically used for short-term financing that can help with the ups and downs of cash flow that are common in small businesses.

If you're approved, you'll be given a credit limit and you can borrow up to that amount. You’ll typically only pay interest on the amount you borrow, not on your entire available credit limit. Your credit limit and interest rate are often based on your creditworthiness, which is determined in large part by your credit scores.

How a line of credit works

Once approved, here's what you can expect:

- During the draw period: This is the timeframe when you can borrow money up to your credit limit. It can be as short as several weeks to as long as a few years for larger lines of credit. You may only need to make interest–only payments during this phase, which can keep your monthly costs lower. As you pay down what you've borrowed, that credit often becomes available again. Use borrowing for specific, planned needs with a clear repayment path.

- During the payback period: Once the draw period ends, you enter the repayment phase. You'll need to make payments large enough to repay the full loan amount within a specific period of time. Your payments during this phase will be significantly larger than during the draw period since you're paying down principal plus interest.

- Interest rates: Your rate can be either variable, which means it changes when interest rates in the economy change, or fixed, which means it stays the same over the life of the loan.

- Credit requirements: Many lenders that offer business lines of credit check personal credit scores, and they may check business credit scores as well.

Types of business lines of credit

Secured vs. unsecured: A secured line of credit requires collateral — typically business assets, equipment, or real estate — which can help you qualify for larger amounts or lower rates. An unsecured line doesn't require collateral but typically demands stronger credit and may offer lower limits.

Traditional vs. online lenders: Lines of credit are available through traditional financial institutions such as banks and credit unions, as well as through online lenders. Banks may offer lower rates but often have stricter qualification requirements and it can take longer to get approved. Online lenders may approve applications faster and lend to newer businesses, though rates may be higher.

SBA lines of credit: The Small Business Administration offers programs like SBA CAPLines, and the Working Capital Pilot Program that provide government-backed lines of credit, which can mean better terms for qualifying businesses.

What is a business credit card?

Business credit cards are both a payment method and a line of credit. You can use a credit card to make purchases anywhere that card is accepted, and then either pay your balance in full to avoid interest or make smaller payments to pay back the amount you charged over time.

Most business credit cards are unsecured, meaning you don't need to put up collateral. However, secured business credit cards are available if you have bad credit or limited credit history. With a secured card, you provide a cash deposit (usually in a savings account) that serves as your credit limit. If you pay on time and build credit, you may eventually qualify for an unsecured card.

Just like personal credit cards, most small business credit cards require a personal credit check, and most cards require good to excellent credit. Higher credit scores can help you qualify for lower interest rates and larger credit limits.

How business credit cards work

Once approved for a business credit card, here's what you can expect:

- Monthly statement cycles: Unlike lines of credit with separate draw and payback periods, credit cards usually require payments each month. You'll receive a statement showing your balance and minimum payment due.

- Payment flexibility: Most cards offer a grace period so you can pay your statement balance in full each month to avoid interest charges entirely. This is the most cost-effective approach. Alternatively, you can make minimum payments — typically 1% to 3% of your balance — though this means you'll pay interest on the remaining balance and it could take years to pay off your debt.

- Revolving credit: As you pay down your balance, that credit becomes available again. You can continue using the card up to your credit limit indefinitely, as long as you keep the account in good standing.

- Interest charges: Interest only applies to balances you carry from month to month. If you pay in full by the due date, you typically won't pay any interest.

Business credit card rewards and perks

One of the biggest advantages of business credit cards over lines of credit is the rewards and benefits they offer. These perks can provide a lot of value.

- Cash-back rewards: Many cards offer 1% to 5% cash back on purchases, with higher rates in specific categories like office supplies, gas, or dining. Some cards offer flat–rate cash back on everything, while others have rotating or tiered bonus categories.

- Travel rewards: If your business involves travel, you can earn points or miles redeemable for flights, hotels, and other travel expenses. Premium travel cards may also include airport lounge access and travel credits.

- Purchase protection: Business credit cards may provide extended warranties on purchases, purchase protection against damage or theft, or cell phone insurance if you pay your bill with the card.

- Other perks: Depending on the card, you might get fraud protection, expense management tools, employee cards at no extra cost, and year-end spending summaries that simplify bookkeeping and tax preparation.

When to use a business credit card vs. line of credit

Choosing between these financing options depends on what you need the money for and how quickly you can pay it back. Here's a practical breakdown:

Use case | Best choice | Why |

Office supplies, software subscriptions | Credit card | Earn rewards, pay in full monthly |

Equipment purchases under $10,000 | Credit card | Purchase protection, potential 0% intro APR, rewards |

Covering payroll during slow season | Line of credit | Lower interest rates, larger amounts |

Building seasonal inventory | Line of credit | Access to higher limits, structured repayment |

Business expansion or renovation | Line of credit | Larger borrowing capacity for bigger projects |

Travel expenses | Credit card | Travel rewards, trip protections |

Emergency cash flow gaps | Either | Depends on amount needed and approval status |

Best for everyday business expenses

Credit cards excel for routine business spending where you can pay your balance in full each month. These expenses can include:

- Office supplies and recurring costs: Use your business credit card for items like printer paper, cleaning supplies, and monthly software subscriptions. You'll earn rewards on purchases you're making anyway, and paying in full means no interest charges.

- Equipment purchases: For smaller equipment needs such as computers, printers, or furniture, a credit card with a 0% intro APR can give you 12 to 18 months to pay without interest. Many cards also extend manufacturer warranties by an extra year.

- Vendor payments: If vendors accept credit cards without adding processing fees, you can earn rewards while maintaining your cash flow. Just make sure the rewards value exceeds any convenience fees charged. (Some vendors offer payment terms such as net-30 with no interest charged. These may be a low-cost alternative.)

Best for earning rewards

If maximizing rewards is important to your business, credit cards are your only option — lines of credit rarely offer rewards programs. Here’s when credit cards can be a better choice:

- Match spending to card categories: Use cards with bonus categories strategically. If you spend heavily on advertising, choose a card offering 2% to 5% cash back on digital ads for example. If you travel frequently, a card earning 3x points on travel can pay off quickly.

- Time large purchases strategically: Making a big purchase right after opening a new card can help you meet sign–up bonus requirements, which often offer $500–$1,000 in value after spending a certain amount in the first few months.

- Pay in full to maximize value: Rewards only make sense if you avoid interest. Carrying a balance at an interest rate of 20% will quickly erase any rewards earned.

Best for cash flow management

Lines of credit typically work better for managing larger cash flow gaps because of their lower interest rates and higher credit limits.

- Covering payroll during slow periods: If your business has seasonal fluctuations, a line of credit can help you cover payroll when revenue dips. Payroll usually can’t be paid directly by card, and third-party services that enable it often charge fees — so a line of credit is commonly a lower-cost tool for payroll timing gaps

- Building seasonal inventory: Retailers and businesses with seasonal demand can use a line of credit to stock inventory before peak season, then pay it back as sales come in. The higher credit limits available with lines of credit often make this more practical than maxing out credit cards.

- Bridging payment timing gaps: When you have outstanding invoices but need to pay suppliers now, a line of credit provides working capital until customers pay you.

Best for larger short-term expenses

For bigger projects that exceed typical credit card limits, a line of credit usually makes more sense. Common scenarios might include:

- Business expansion: Opening a new location, renovating your space, or adding significant square footage may require significant expenses. While construction and term loans often cover the major expenses, a line of credit can be helpful for buildouts and other expenses.

- Hiring for major projects: If you land a big contract that requires bringing on temporary staff or contractors, a line of credit may help you cover the upfront labor costs while you wait for project milestones and payments.

- Equipment or vehicle purchases: While smaller equipment can be charged on a credit card, a line of credit may be helpful if you find a piece of equipment at low price and need to act quickly.

Can you use both a line of credit and credit card?

You absolutely may use both credit cards and lines of credit. Many successful business owners do exactly that. Using both can be a smart strategy that gives you the right tool for different financial situations.

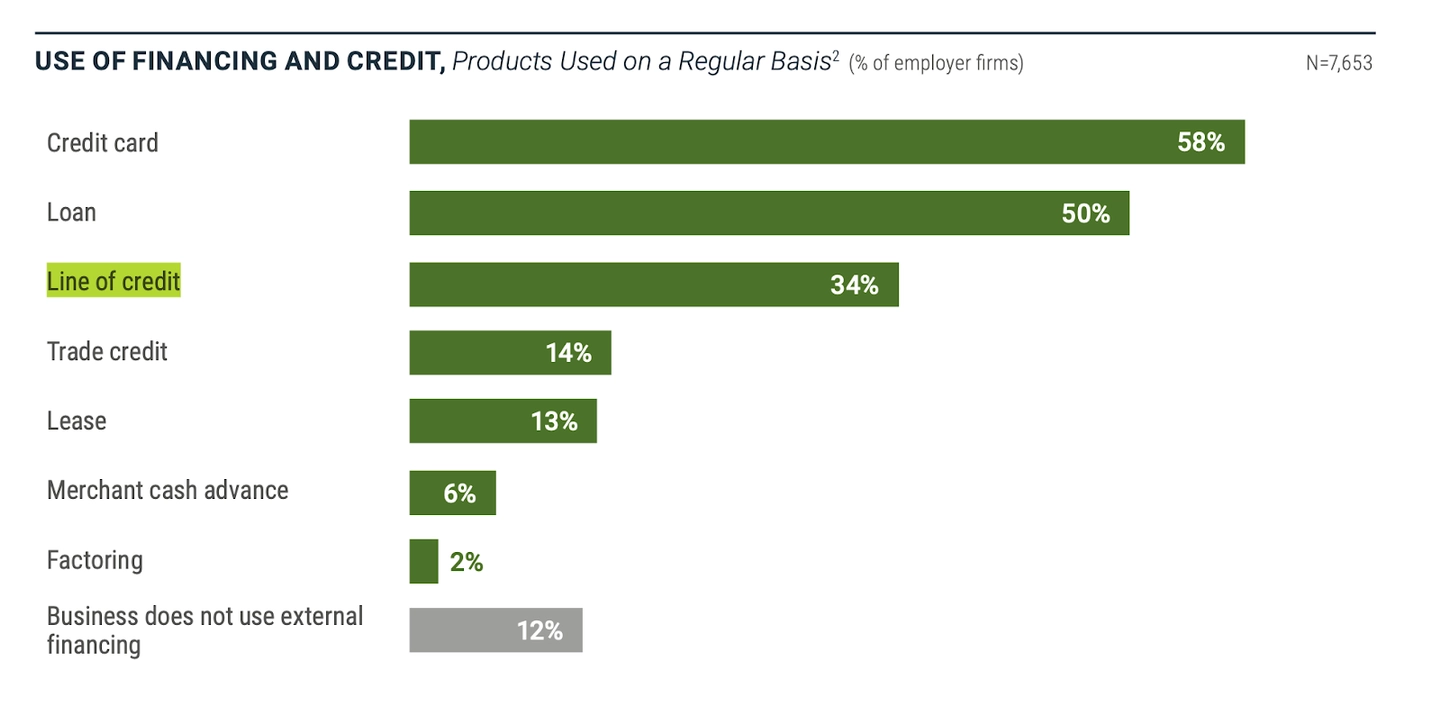

According to the Federal Reserve’s Small Business Credit Survey 2025 Report on Employer Firms, 58% of employers use a business credit card, while 34% report using a line of credit.

Source: Federal Reserve Small Business Credit Survey 2025 Report on Employer Firms

Each financing option has strengths that can complement the other.

Credit cards work best for everyday purchases where you can earn rewards and pay quickly. Lines of credit handle larger needs where you need more time to repay or require amounts beyond credit card limits.

Use your business credit card as your primary payment method for routine expenses that you can pay off quickly. Earn rewards on office supplies, gas, client meals, and recurring subscriptions. Maintain a line of credit in reserve for genuine cash flow emergencies or opportunities that require larger amounts.

Real-world example: A marketing agency might put all monthly expenses on a rewards card, earning 2% cash back while paying the balance in full each month. But when they hire three contractors for a major client project, they tap their $75,000 line of credit to cover wages until the client pays the invoice 60 days later.

The key is having both available without carrying unnecessary debt on either. Just because you can access $100,000 across both doesn't mean you should. Treat the line of credit as working capital for specific needs, not as a permanent source of funding.

If you manage both types of credit well — paying your credit card in full monthly and only tapping your line of credit when you can use those funds to increase profits — you can build stronger business credit while keeping your financing costs low.

Which offers higher credit limits?

When you can get a high-limit credit card or line of credit depends on where your business is in its lifecycle and your qualifications.

For established businesses: A line of credit typically offers much larger credit limits. Well-established companies with strong revenue and credit histories can access $100,000, $250,000, or $1 million dollar lines of credit.

Getting a business credit card with those kinds of limits usually requires qualifying for a corporate card program, which may only be available to businesses with at least $2 to $5 million in annual revenue.

For newer businesses: Credit cards often provide the only option for startups. An entrepreneur with a brand‒new business will struggle to qualify for most business lines of credit due to limited operating history and revenue. However, that same entrepreneur may qualify for a business credit card with a $10,000 to $25,000 starting limit based on strong personal credit scores and sufficient income from all sources (not just the business).

The middle ground: If your business has been operating for 6 to 12 months with consistent revenue, you might qualify for both options. In this case, a smaller line of credit ($20,000–$50,000) could still exceed a credit card limit.

The size of the credit limit your business can access — whether from a line of credit or credit card — ultimately depends on your qualifications and lender requirements.

Which builds business credit faster?

Neither option builds credit faster as both can build your business credit at the same rate if you pay on time and the lender reports to business credit bureaus.

Business credit reporting: Most business lines of credit and small business credit cards report payment activity to major business credit bureaus like Dun & Bradstreet, Experian, or Equifax, or to the Small Business Financial Exchange (SBFE). Before you apply, confirm the lender reports to at least one business credit bureau. No reporting means no credit building, regardless of which product you choose.

Read Nav’s guide, Which business credit cards report to business credit?

Payment timing: Paying on time strengthens your business credit profile with both options. Each on-time payment adds positive data to your credit file. Late payments damage your credit equally, whether on a credit card or line of credit.

Credit utilization: With credit cards, keeping your balance below 20% to 25% of your credit limit can help your scores. Lines of credit are evaluated differently, but keeping balances manageable still signals good financial management.

Length of credit history: Both options may help build your credit history if you pay on time, and keep balances low.

Account diversity: Having both a line of credit and a credit card may help strengthen your credit profile by showing you can manage different types of credit responsibly.

The point is that you shouldn’t choose based on which builds credit faster. Choose based on what fits your business needs, then focus on making payments on time to build credit.

Best options for bad credit

If you have bad credit, qualifying for traditional business lines of credit and unsecured business credit cards will be challenging. Most require good to excellent credit. But that doesn’t mean there may not be other options.

Secured business credit cards

A secured business credit card is an option for rebuilding credit.

With a secured card you provide a cash deposit — typically $500 to $10,000 — which becomes your credit limit. This deposit stays in a savings account as collateral, protecting the card issuer if you don't pay back what you’ve charged. You use the card like any other credit card, making purchases and monthly payments.

One of the main benefits is that secured cards report to business credit bureaus just like unsecured cards. Pay on time for 6 to 12 months to help build a positive payment history.

Secured cards often accept applicants with lower credit scores. Since the deposit helps reduce the issuer's risk, approval is much easier than with unsecured cards or lines of credit.

Your cash deposit is tied up as collateral, which may strain your working capital. But if building credit is your priority, it can be worth it.

Alternative financing for bad credit

When neither a line of credit nor a credit card is available, you may want to consider these options:

Merchant cash advances: You receive a lump sum of funding in exchange for a percentage of future credit card sales. Approval is based on sales volume, not credit scores. However, the cost can be high — effective APRs often exceed 50% -to 100% — making this an expensive option that should only be used short-term.

Invoice factoring: If you have outstanding invoices from creditworthy customers, a factoring company will advance you 70% to 90% of the invoice value immediately. The factoring company collects payment directly from your customer and takes its fee. Credit requirements focus on your customers' creditworthiness, not yours.

These alternatives cost more than traditional financing. Focus on building strong business and personal credit so you can access better options in the future.

How to choose between a line of credit and a credit card

The right choice depends on three main factors:

- How much money you need to borrow

- Why you need the funds

- Cost

- What your business qualifies for

If your business is less than six months old: Start with a business credit card. You're unlikely to qualify for a line of credit yet, but a credit card based on your personal credit scores can help you cover expenses and start building business credit.

If your business is six to 24 months old: As you establish your business, you may qualify for both. You may need to start with a credit card if your business revenues aren’t strong. You will likely need good personal credit and business credit may be checked as well.

If your business is established (24+ months): You likely qualify for both options. If you do, choose based on what you need the money for and how quickly you can repay it.

Choose a credit card if you:

- Need smaller loan amounts.

- Can pay the balance in full monthly.

- Want to earn rewards on purchases.

- Need to make everyday business purchases.

- Want flexibility with no draw or payback periods.

- Value purchase protection and extended warranties.

- Can qualify based on good personal credit scores.

Choose a line of credit if you:

- Need larger amounts of credit.

- Need several months or more to repay.

- Face predictable cash flow gaps.

- Can get lower interest rates than credit cards.

- Need short-term working capital for specific projects.

- Can qualify based on business revenue and credit history.

The bottom line: Line of credit vs. credit card

Both business credit cards and lines of credit can give your business the flexibility to cover expenses and seize opportunities. The key is understanding costs and using each tool for what it does best.

Credit cards can be ideal for everyday purchases you can pay off quickly, and rewards can add significant value.

Lines of credit can be helpful for larger loan amounts and longer repayment timelines, and may offer lower interest rates.

Many successful business owners use both in complementary ways; credit cards for routine spending, lines of credit for working capital needs.

Whichever option you choose, treat borrowed money as a tool, not a crutch. Pay back debt as quickly as possible to minimize interest costs and keep your business credit strong.

Take time to compare options, understand the terms, and choose what fits your specific situation.

Frequently asked questions

Build your foundation with Nav Prime

Options for new businesses are often limited. The first years focus on building your profile and progressing.

Get the Main Street Makers newsletter

Rate this article

This article currently has 66 ratings with an average of 5 stars.

Gerri Detweiler

Education Consultant, Nav

Gerri Detweiler has spent more than 30 years helping people make sense of credit and financing, with a special focus on helping small business owners. As an Education Consultant for Nav, she guides entrepreneurs in building strong business credit and understanding how it can open doors for growth.

Gerri has answered thousands of credit questions online, written or coauthored six books — including Finance Your Own Business: Get on the Financing Fast Track — and has been interviewed in thousands of media stories as a trusted credit expert. Through her widely syndicated articles, webinars for organizations like SCORE and Small Business Development Centers, as well as educational videos, she makes complex financial topics clear and practical, empowering business owners to take control of their credit and grow healthier companies.

Robin Saks Frankel

Senior Content Editor

Robin has worked as a personal finance writer, editor, and spokesperson for over a decade. Her work has appeared in national publications including Forbes Advisor, USA TODAY, NerdWallet, Bankrate, the Associated Press, and more. She has appeared on or contributed to The New York Times, Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC, and CBS TV affiliates nationwide.

Robin holds an M.S. in Business and Economic Journalism from Boston University and dual B.A. degrees in Economics and International Relations from Boston University. In addition, she is an accredited CEPF® and holds an ACES certificate in Editing from the Poynter Institute.