How to freeze your personal credit: a complete guide for business owners

Gerri Detweiler

Education Consultant, Nav

Summary

- You can freeze your personal credit for free with each of the three major credit bureaus.

- A credit freeze stops most new credit accounts from being opened in your name, but it doesn’t block existing creditors from checking your credit, and may not stop all types of fraud.

- While you can’t freeze business credit reports, regularly monitoring your business credit reports can help you catch suspicious activity early.

Editorial note: Our top priority is to give you the best financial information for your business. Nav may receive compensation from our partners, but that doesn’t affect our editors’ opinions or recommendations. Our partners cannot pay for favorable reviews. All content is accurate to the best of our knowledge when posted.

This might surprise you: There were over 3,300 data compromise incidents in 2025, according to the Identity Theft Resource Center. In other words, there’s an average of around 9 data breaches per day. And that is based only on the publicly disclosed data.

When you hear about another breach, you may wonder, “Should I freeze my credit?”

"I don't use my windshield wipers as a money clip, and my credit is never unfrozen,” says Beau Friedlander, host of DeleteMe's podcast What the Hack?

Learn how credit freezes work, and how to decide if you want to take the extra step of freezing your credit.

Track your business and personal credit for free

Get a clear view of your business and personal credit standings with a free Nav account. See your credit grades across major business bureaus to know where you stand today.

Should you freeze your credit?

Placing a freeze on your credit report will prevent new companies from accessing your personal credit reports or scores for new applications for credit.

What a credit freeze does

- Current creditors may still monitor your credit.

- Employment, insurance, phone or utility providers may still be able to check your credit if you open a new account.

- Preapproved or prescreened offers will continue despite a credit freeze.

- Debt collectors will be able to access your credit reports.

- Government agencies with a permissible purpose such as a court order will be able to get your reports.

What a credit freeze doesn't do

It won’t stop all access to your credit reports and scores, though, and it won’t stop other types of fraud such as:

- Tax refund fraud where someone claims a tax refund under your name.

- Credit card or debit card fraud where they steal your card information to make purchases.

- Phishing schemes where crooks trick you into sharing sensitive financial information.

In other words, you still need to be vigilant and monitor your financial information closely. A credit freeze is not a golden ticket to protecting yourself against all types of fraud.

Expert advice on credit freezes

“You should freeze your credit immediately if you haven’t already,” advises privacy expert and founder of CyberScout Adam Levin.

“The most important question to ask yourself is, ‘Do I want convenience or security?’

“Initiating a credit freeze takes a few minutes. Some find it burdensome. Thawing a credit freeze takes less time. Some still find that burdensome. Now compare that to the time it takes to recover from an identity theft. I rest my case.”

Although it took me a while, I’ve come around to Levin’s point of view about credit freezes.

Personal experience with identity theft and credit freezes

When I was a victim of both personal and business identity theft a few years ago, I chose not to place a credit freeze on my credit reports. Instead, I placed fraud alerts and monitored my credit reports closely.

However, after discovering that my information (including my Social Security numbers) were part of the 2024 National Public Data breach, I decided to freeze my credit reports.

What changed? Mainly, I realized I’d rather deal with the minor hassle of removing the freeze if I want to get new credit, than the major hassle of dealing with identity theft if my information was stolen and used again to open new accounts.

Keep in mind this is my personal experience, and I don’t mean to imply in any way that my approach is the right one for you or your business. But I’m not alone in my caution.

“A credit freeze is not a silver bullet,” Levin warns, “but it gives you another layer of protection and helps reduce your attackable surface. In a world where breaches have become the third certainty in life behind death and taxes, why wouldn’t you want every possible arrow you can have in your quiver of protections?”

Make monitoring your credit easier

Know the ins and outs of what’s going on with your personal and business credit, all in one place. Unlock your detailed credit reports and scores from the major business bureaus with Nav Prime.

How to freeze your credit with each credit bureau

You must contact each of the three major credit bureaus—Experian, Equifax, and TransUnion—individually to place a freeze. Each offers free online, phone, or mail options.

How to place a credit freeze with Experian

- Visit Experian’s Freeze Center and follow the instructions to create or log into your account

- Select “Add a Security Freeze”

- Confirm your identity with security questions or document uploads

- Save your PIN or password securely for future unfreezing

Here’s a little closer look at this process.

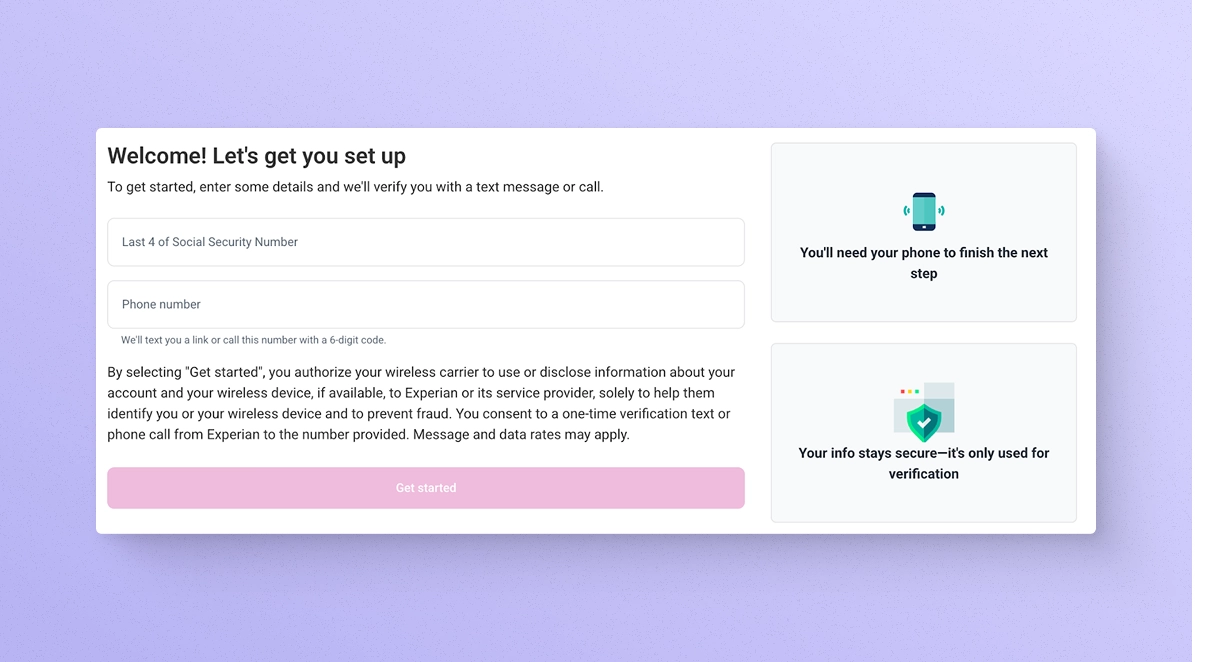

To initiate a credit freeze, you’ll need to start by providing the last four digits of your Social Security number and a phone number for a text or phone call verification.

The initial sign up page looks like this:

Once you verify the message received, Experian will automatically populate your name, address, phone number, date of birth, and last four digits of your Social Security number.

Confirm that and you’ll be invited to sign up for a free Experian CreditWorkssm Basic account that includes, among other benefits, a Free Experian Credit Report and FICO® Score, Experian credit monitoring and alerts, and access to Experian’s Security Freeze center.

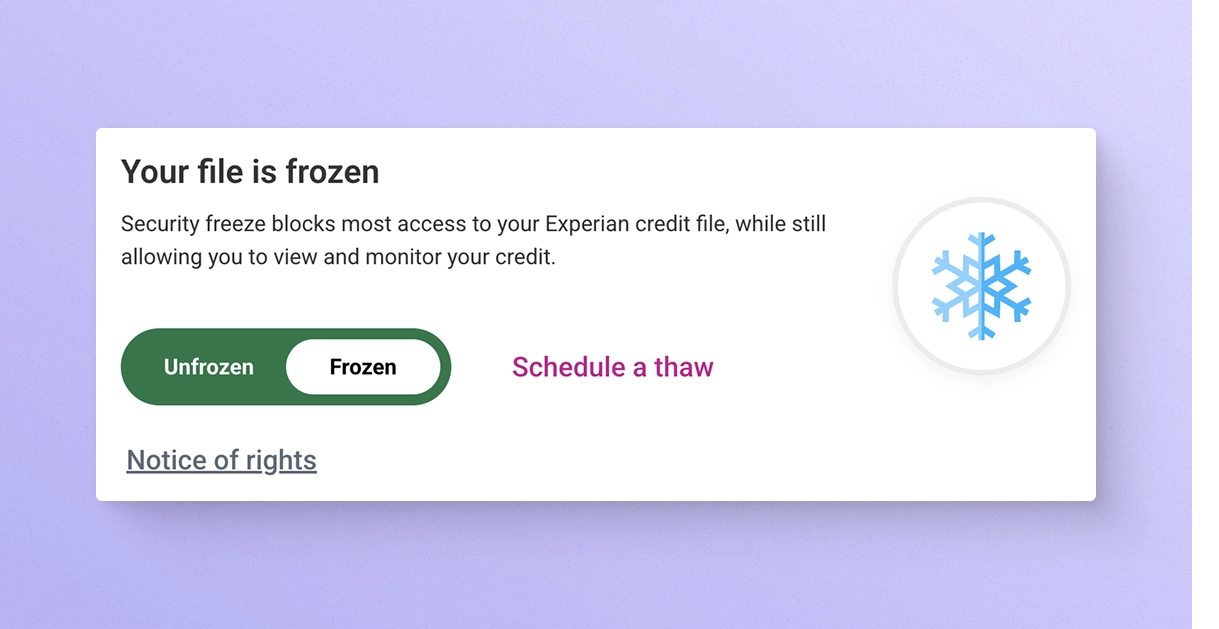

Once your account is set up, it’s simple to place a freeze, or remove it. Just toggle the button from unfrozen to frozen, or vice versa:

Screenshots from Experian™ website showing security freeze steps as of October 26, 2025

If you do not have access to a computer, call Experian’s customer service line at 1-888-397-3742 (1-888-EXPERIAN) to request your credit freeze.

How to place a credit freeze with Equifax

- Go to Equifax’s Freeze Center

- Create an account or sign in

- Choose to place or manage a credit freeze

- Record your confirmation details in a safe location

Again, here’s the process in more detail:

To place a credit freeze with Equifax, you’ll provide your name and address, date of birth, Social Security number (or ITIN if you don’t have an SSN), mobile phone number, and current address.

Once you’ve authenticated your identity you’ll be able to place a security freeze, fraud alert, or active duty alert.

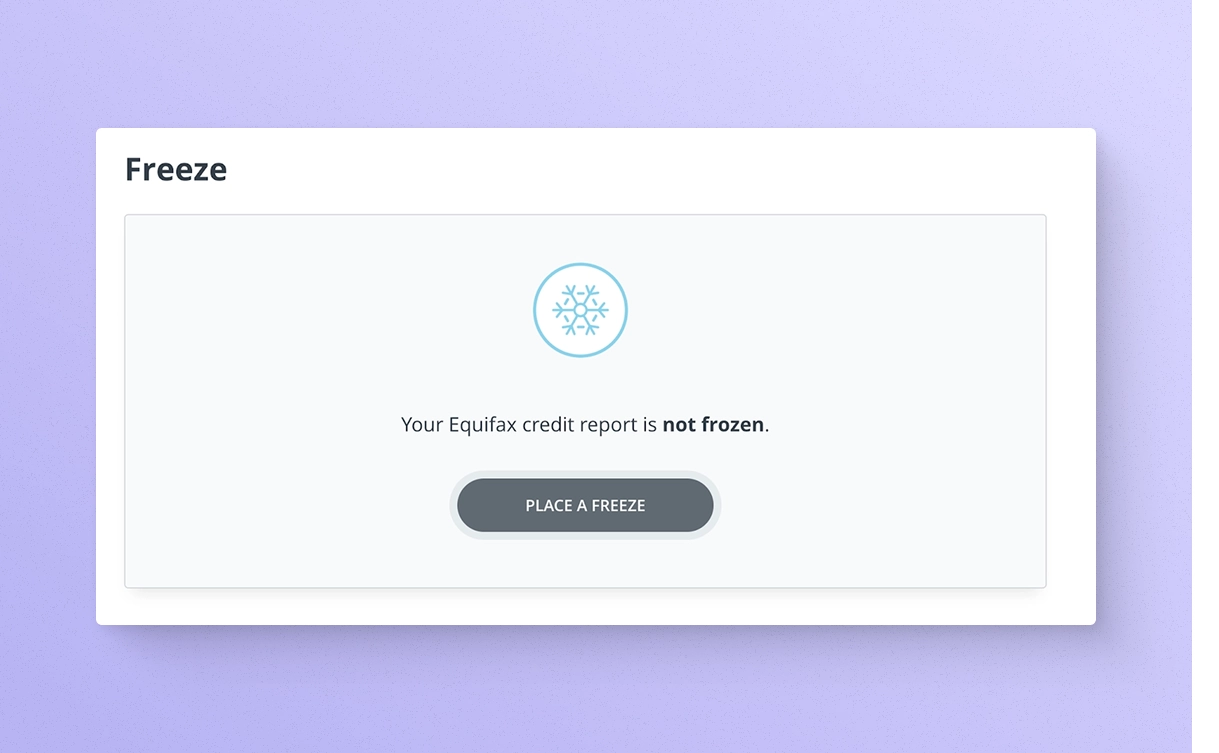

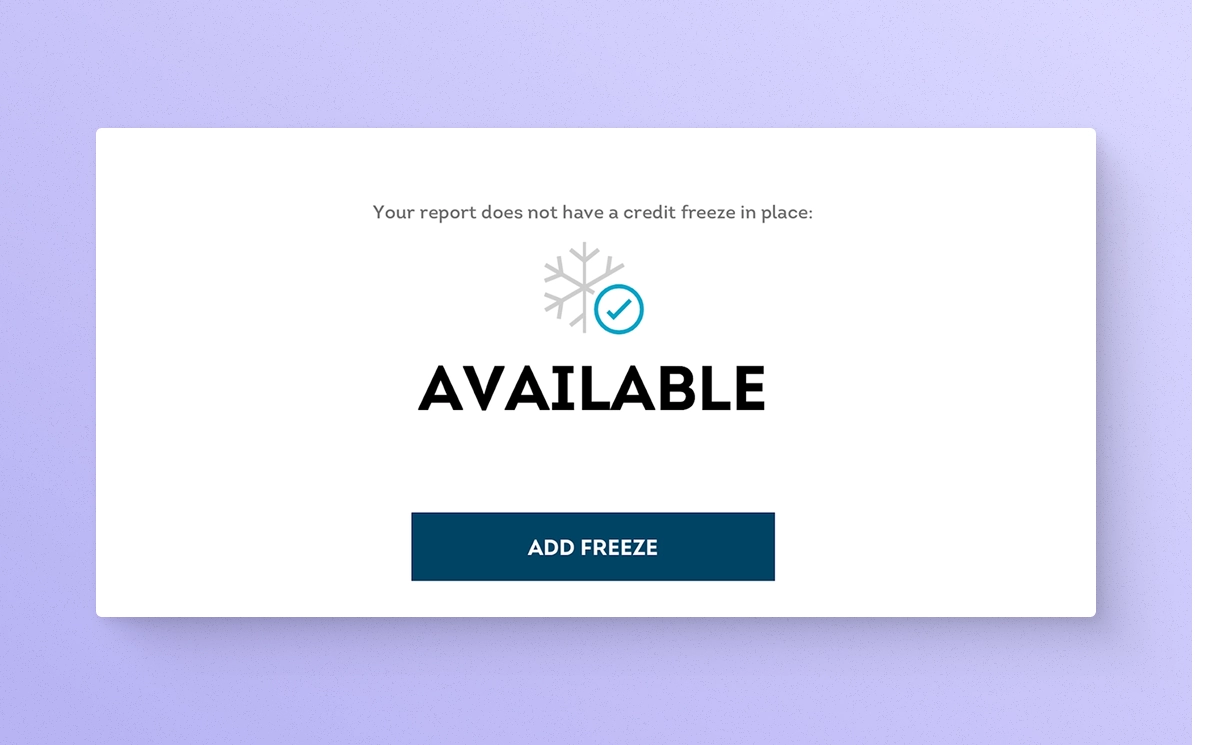

If you choose to place a freeze, it’s simple and straightforward. You will be taken to a screen showing your current status with the option to place a freeze:

Once you press the "Place a freeze" button, and your freeze will be activated.

Screenshots from Equifax® website showing security freeze process as of October 26, 2025.

If you do not have access to a computer, call Equifax at (888) 298-0045 to request your credit freeze.

How to place a credit freeze with TransUnion

- Visit TransUnion’s Credit Freeze page.

- Log in or create an account.

- Follow prompts to freeze your credit.

- Retain your login information for future use.

Here are some more details.

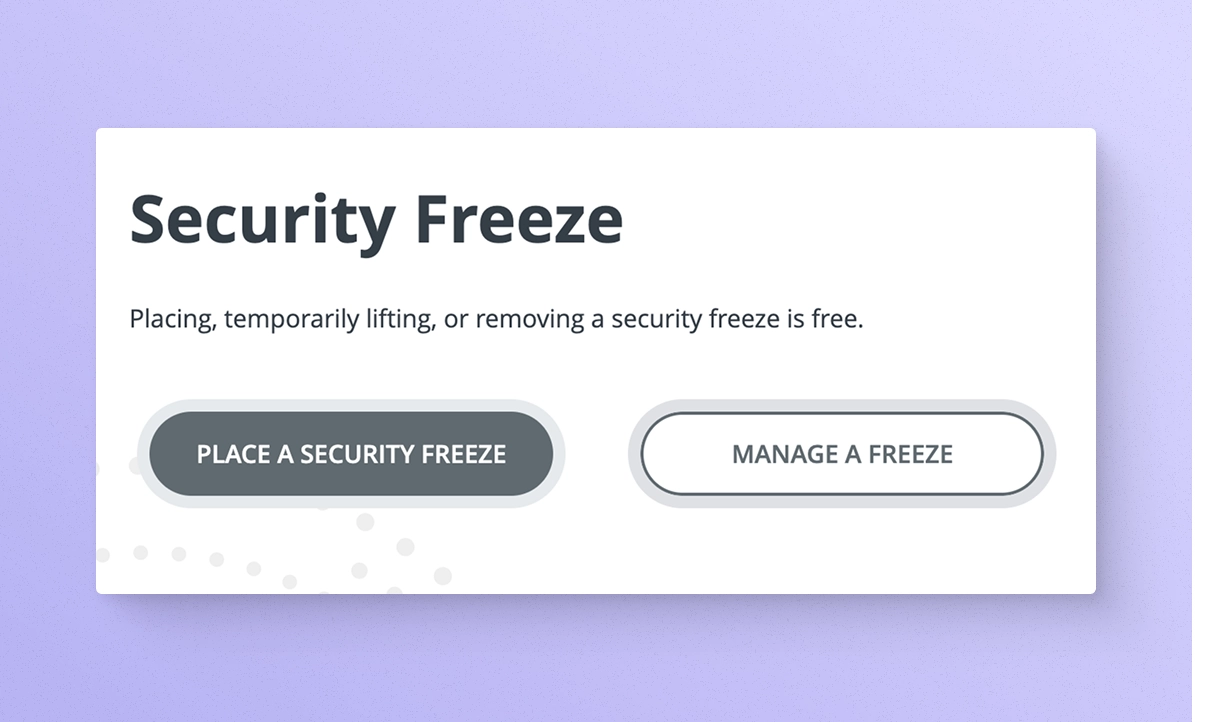

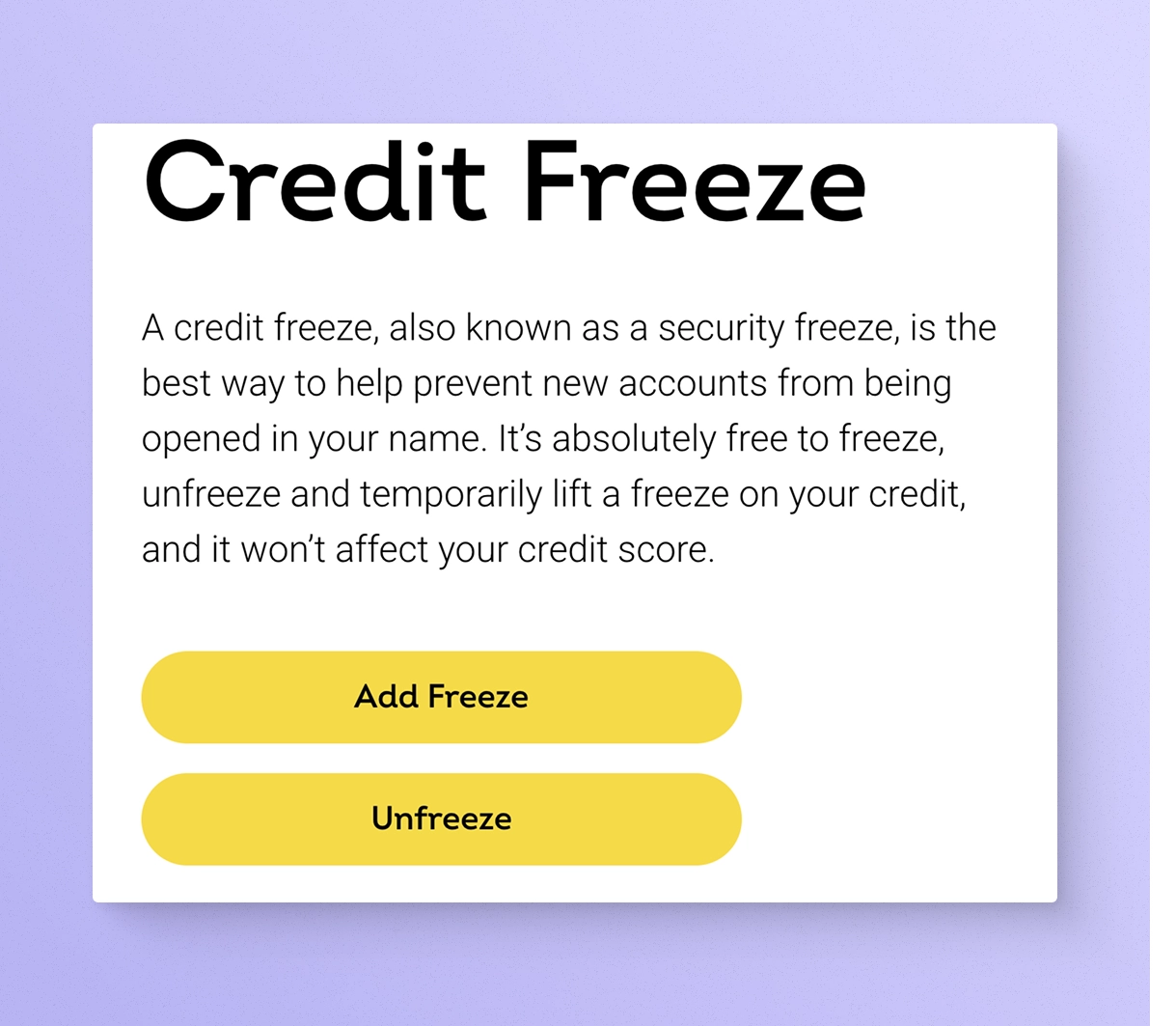

First, you’ll see the page with simple buttons to take you to the place to freeze or unfreeze your credit:

Choose "Add Freeze." You’ll then be guided to create a free TransUnion® Service Center account, by providing details including your name, address, mobile phone number, email address, date of birth and last four digits of your Social Security number.

Once your account is validated, you can request a credit freeze. The screen to do so currently looks like this:

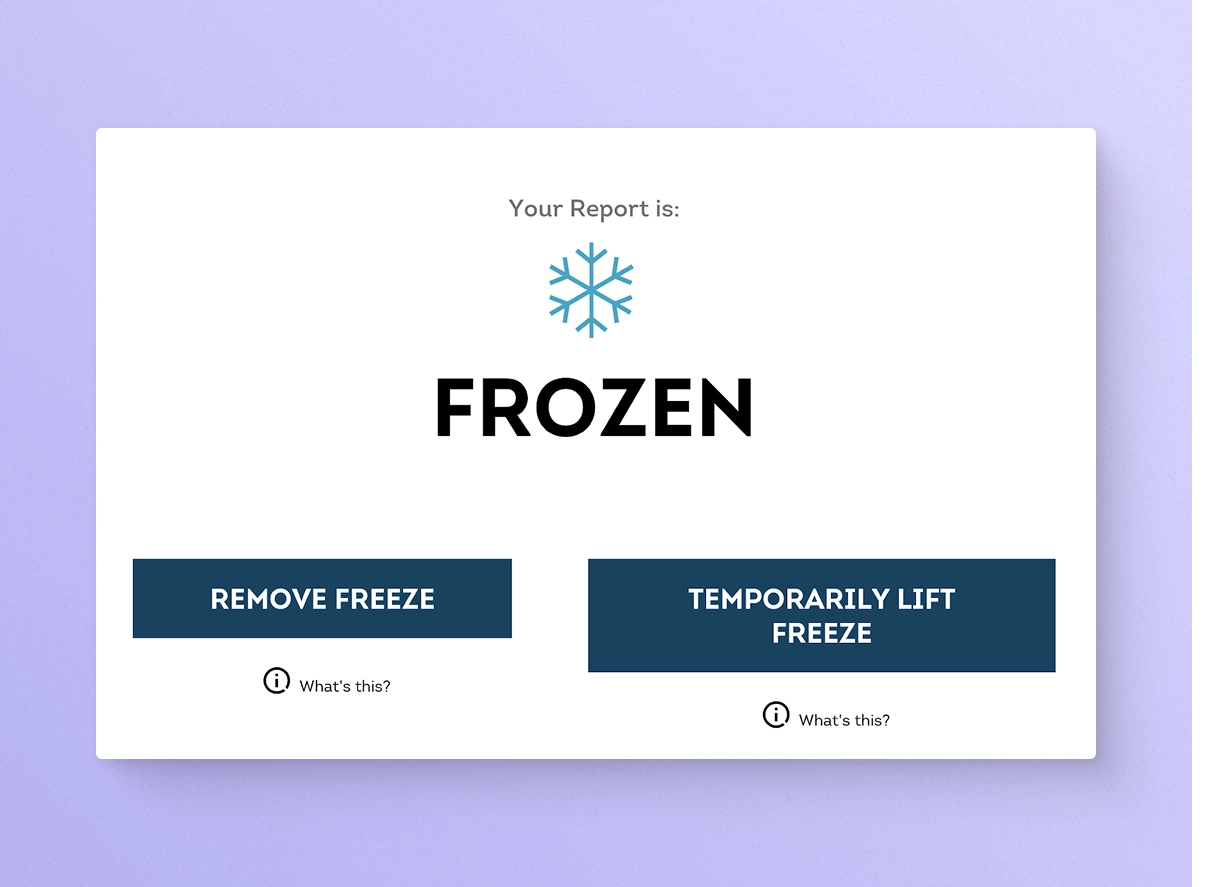

Once you freeze your credit, you’ll be able to temporarily lift or permanently remove the freeze by logging into your account.

Screenshots from TransUnion® website showing security freeze process as of October 26, 2025.

If you do not have access to a computer, call TransUnion® at 1-800-916-8800 to request your credit freeze.

Can you freeze business credit?

Currently, you cannot place a credit freeze on your business credit reports. Commercial credit reporting agencies, such as Dun & Bradstreet (D&B), Experian Business, and Equifax Business, do not offer this feature. Instead, you can place fraud alerts or monitoring services on your business profile to detect suspicious activity early.

D&B Credit Insights, for example, provides free alerts about score changes or new inquiries.

Experian allows you to place a fraud alert on your business credit file. It provides the following instructions on its website:

To put a fraud alert on your Experian business credit report, send Experian Commercial Relations a letter on your company letterhead asking that a fraud alert be placed. Include the signature and contact information of the company's business owner. We will attach a message to your business credit report asking that the business be advised prior to any lending giving credit.

Nav Prime can help you check and monitor your business credit with detailed credit reports from the major business credit bureaus, along with alerts.

Regularly reviewing your business credit reports and using monitoring tools may help identify suspicious activity so you can quickly investigate.

What happens when your credit is frozen?

When a credit freeze is active, new lenders can’t access your credit report without your permission.

You can still use existing credit cards, loans, and lines of credit normally.

However, applying for new credit, opening utility accounts, or signing up for certain services that require a credit check may be delayed until you lift the freeze.

Credit monitoring tools continue to work during a freeze. They can alert you to changes in your credit report, such as new inquiries or account updates, but they can’t override the freeze itself.

While I expected a credit freeze to be something of a hassle, it’s not that difficult to manage. I still monitor my credit, and have successfully applied for new credit cards.

One surprise: I was able to open new credit cards with my current issuers without having to lift the freeze. Because they already have access to my credit information as a card issuer, I didn’t have to take any extra steps.

Watch: Gerri explains how she bounced back from identity theft

Operating your business with a frozen credit file

Business owners may need to temporarily lift their personal credit freeze to apply for business financing or open new accounts. Some financing products, including those that require a personal guarantee, may involve personal credit checks even for business funding. If your credit is frozen, your application could be delayed or denied.

If you are applying for new financing, you may want to let the lender know you have frozen your personal credit and ask for instructions for unfreezing it.

If they can’t tell you which specific bureau they will get your credit reports from, you may need to unfreeze your credit temporarily with each bureau. You can set a time limit—one day or longer—so you don’t forget to freeze it again and leave your credit unprotected.

Again, it’s best to ask the lender for advice when you apply for new financing.

How to unfreeze your credit

Unfreezing is simple and free. You can lift your freeze temporarily or permanently using your online account or PIN.

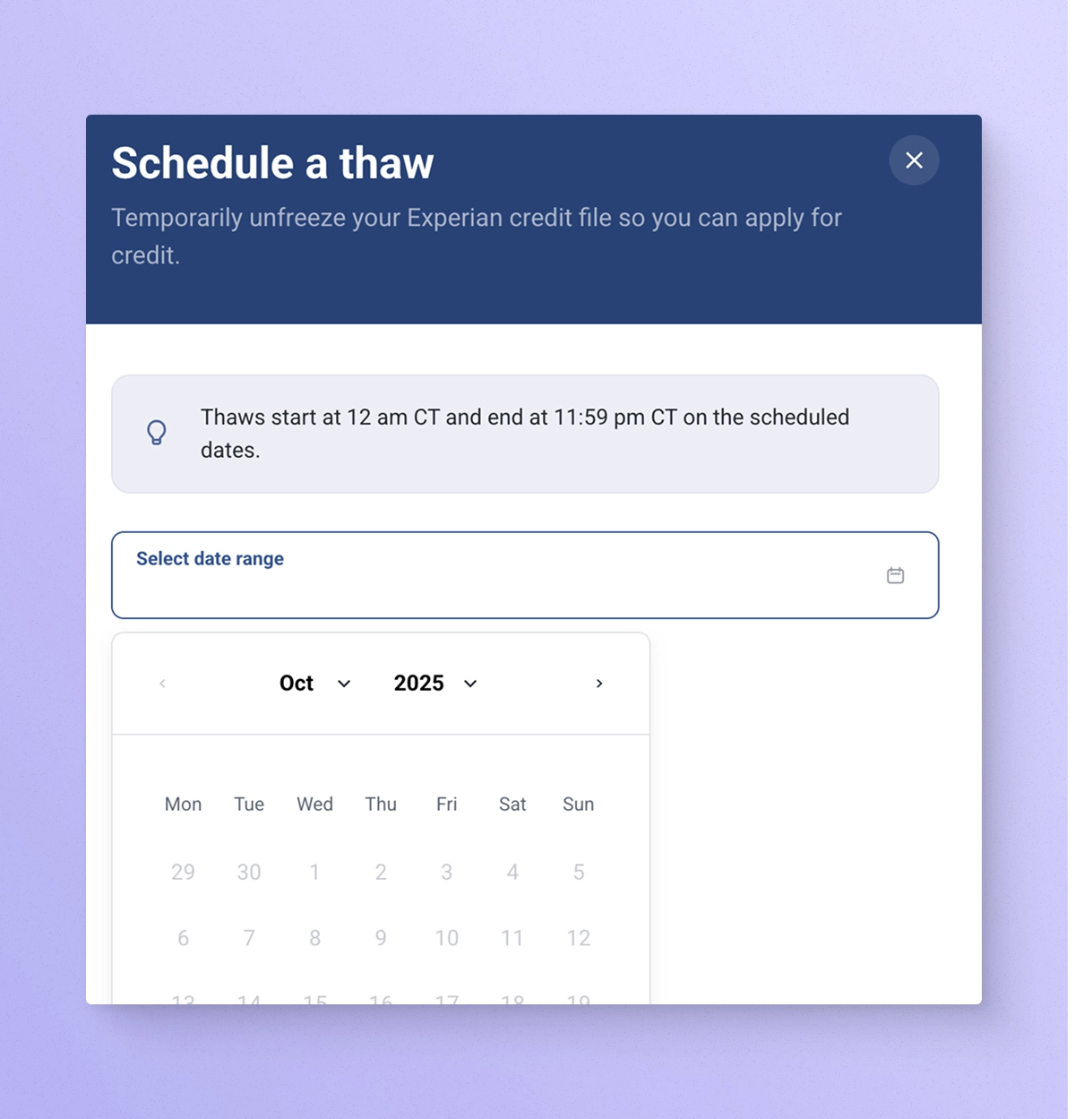

Lift an Experian credit freeze

Log in to your Experian account, select “Remove or Lift Freeze,” and choose either a temporary lift (for a specific date range) or a permanent removal.

You can schedule a thaw using the calendar:

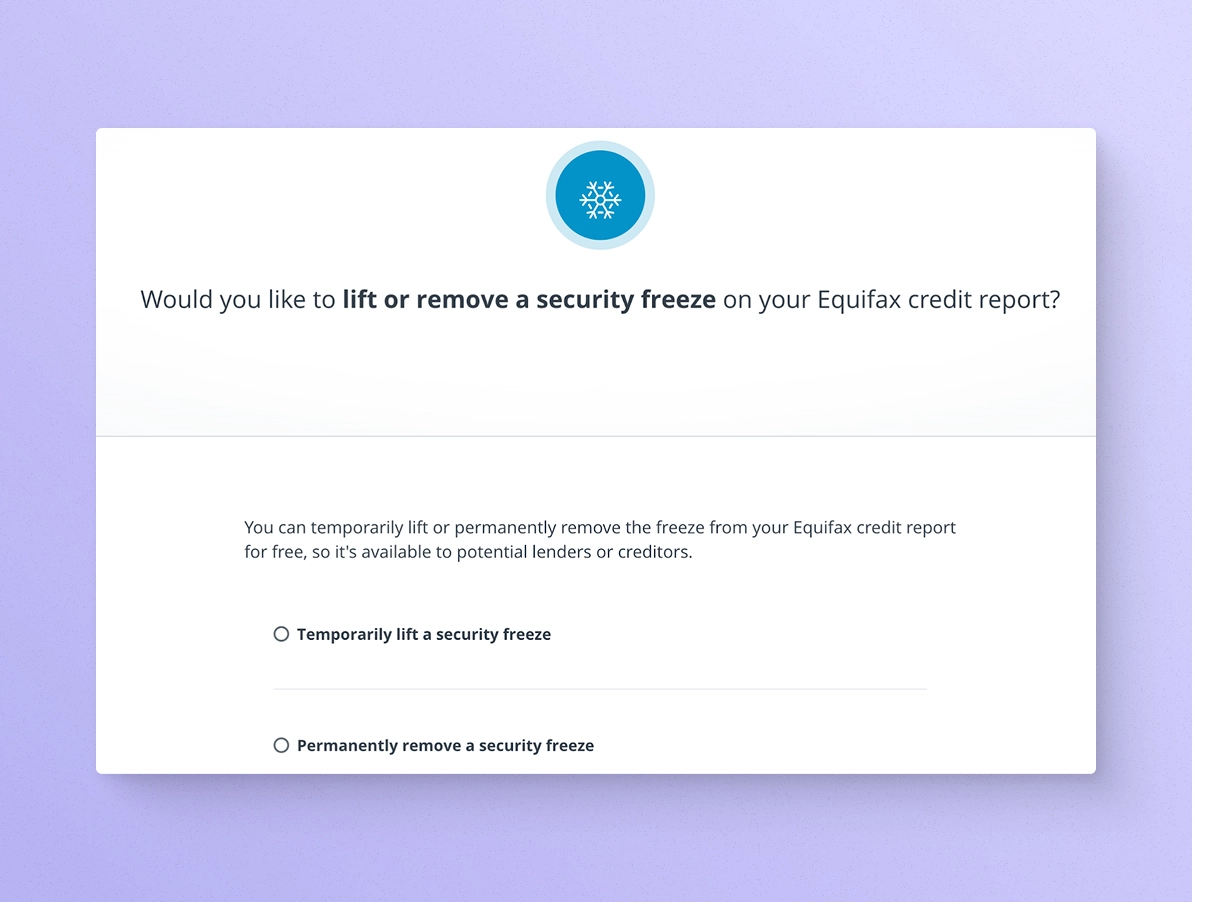

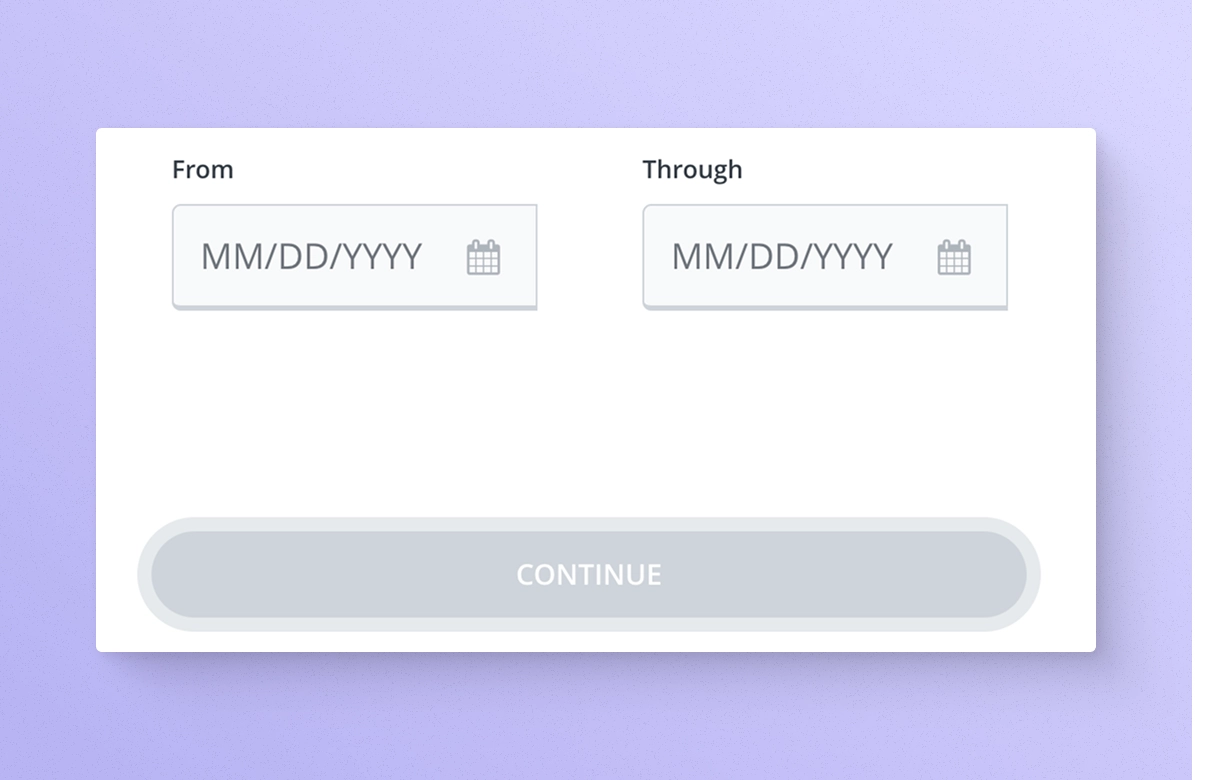

Lift an Equifax credit freeze

Sign in to your Equifax account, select “Manage a Freeze,” and follow the prompts to unfreeze temporarily or permanently. You’ll see the option to temporarily lift or remove your freeze:

If you choose temporarily lift a security freeze, you’ll see a calendar that lets you choose your dates:

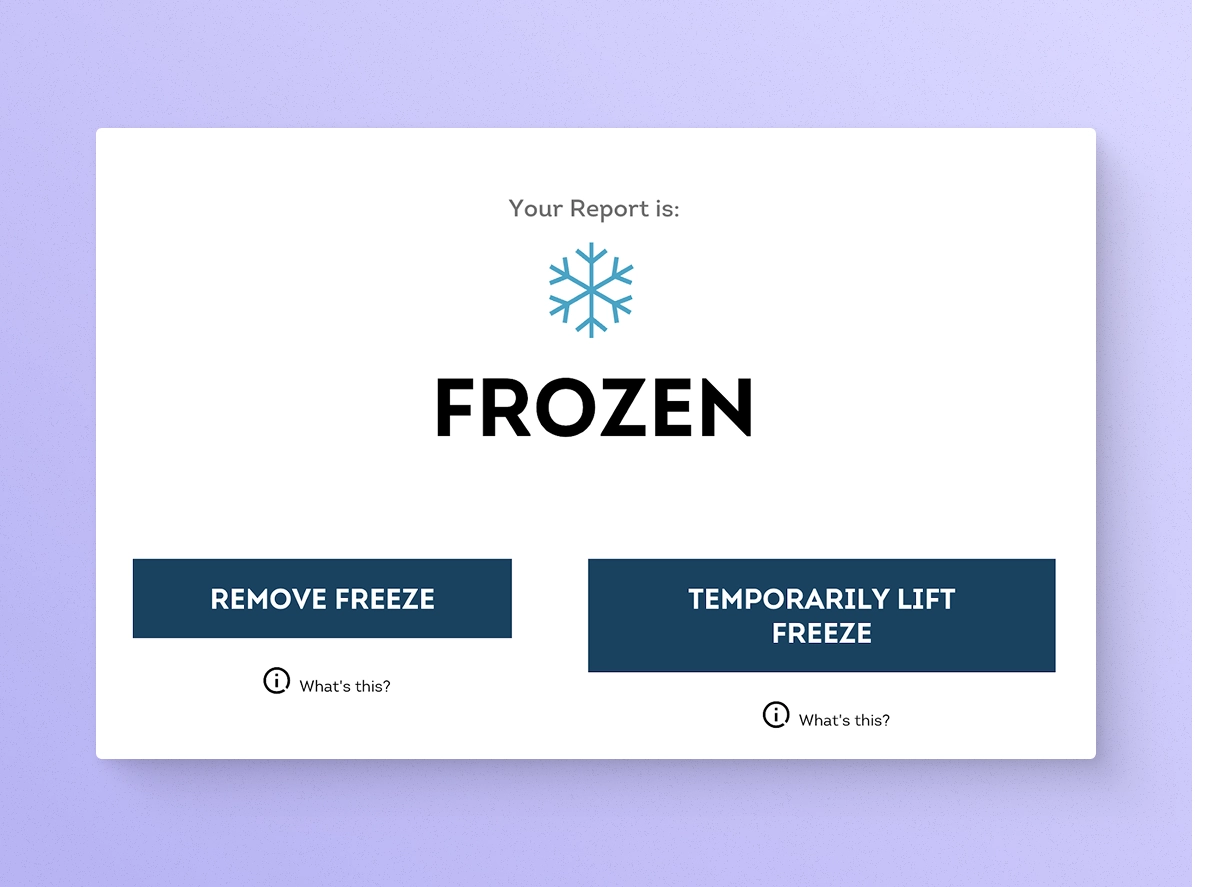

Lift a TransUnion credit freeze

Access your TransUnion account, click “Lift My Freeze,” and set a duration or permanently remove it.

How to make freezing your credit more easily and safely

There are a few things you can do upfront to make freezing your credit easier and safer:

- Create a strong unique password to log in

- Keep that password in a secure place, such as a password manager

- Don’t share your password with anyone else

- Log in only when you are on a private internet connection (like at home) or using a VPN

The biggest problem you’re likely to run into with credit freezes is forgetting your log in credentials. When you do, you’ll need to take a few extra steps to verify your identity. It shouldn’t prevent you from freezing or unfreezing your credit, but it may make it a little more frustrating.

The flip side of that is using the same password you use elsewhere, making it easy for id thieves to access your information.

Is a credit lock helpful?

A credit lock is usually part of credit service. It can be helpful but understand that it may be a

“If you pay for a credit and identity monitoring service from any of the three credit bureaus you may get by with a credit lock, but most experts agree they're not as secure as a freeze and only as good as your cyber hygiene,” Friedlander warns.

“If you're going to use a lock instead of a freeze, make sure you don't daisy-chain weak passwords. If you're not using passphrase-based, long-and-strong passwords and multi-factor authentication, a simple credential stuffing attack could open you up to a wide array of financial crimes.”

Checking for data breaches and protecting your information

The National Public Data Breach, known as the NPD data breach, was announced in August 2024.

Currently, there are two sites that help consumers check if their data has been potentially exposed in the breach. These sites may also be helpful for business owners looking for an additional level of protection for their businesses.

Using Pentester.com to check for breaches

Pentester.com allows users to see if their email addresses or personal information have been exposed in a breach. Simply enter your email address to receive results and recommendations for securing your accounts.

Atlas Service and Data Dividend Project

The Data Dividend Project (formerly npdbreach.com, now databreach.com) helps individuals track data breaches and learn how their information may have been compromised. It also connects users with tools for recovering control of their data.

Additional resources

Set up alerts from your financial institutions for unusual transactions. Use unique passwords for each account and enable two-factor authentication. Review your credit reports at least once a year through AnnualCreditReport.com.

How much does freezing credit cost?

Placing and lifting a credit freeze is completely free under federal law. Be cautious of third-party services that charge fees for credit freeze management or monitoring.

Use secure websites (look for the lock symbol and https in the website address). Start with official credit bureau websites and be careful: scammers use a lot of different methods to try to trick you into sharing sensitive information.

Can I monitor my credit with a credit freeze?

Yes. A credit freeze doesn’t prevent you from monitoring your credit reports. You’ll still receive updates from monitoring services about score changes, new accounts, or inquiries. However, these services can’t approve new credit activity or lift freezes on your behalf—you must manage that directly with the bureaus.

Nav Tip

One of the biggest risks of a credit freeze is thinking you don’t need to check your credit with a freeze in place. That’s a mistake. Monitor your credit to make sure your current lenders report accurate information, to keep track of any potential problems (like late payments on accounts you forgot about), and to monitor your credit standing.

Can I build credit when it’s frozen?

Yes. A credit freeze doesn’t stop you from opening new accounts (though you will need to lift the freeze temporarily). It also does not stop existing accounts from reporting to the bureaus if that is their normal policy.

Accounts that report can continue to report:

- Type of credit account (such as revolving or installment)

- Date opened

- Payment history

- Credit limit and/or high balance

- Current balance

Getting and using tradelines that report to credit bureaus, paying on time and keeping credit utilization low can help you keep your accounts in good standing and can contribute toward good credit even with a freeze in place.

Credit freeze vs. fraud alert vs. credit monitoring: A comparison

Feature | Credit freeze | Fraud alert | Credit monitoring |

Purpose | Blocks most new credit accounts from being opened | Alerts lenders to verify identity before issuing credit | Notifies you of activity on your credit reports |

Access | Prevents most new access to credit reports | Allows access but requires extra verification | Does not block or limit access |

Duration | Until you lift it | One year (renewable) or seven years extended alert in the case of fraud | Free from some sources; or ongoing subscription from others |

Cost | Free | Free | May be subscription-based |

How Nav can help

Nav Prime helps business owners monitor business credit along with personal credit in one dashboard. (A free account offers summary reports from multiple bureaus.)

Through Nav’s platform, you can track changes in your reports, receive alerts, and compare financing options without affecting your credit score. Nav also provides guidance on business funding strategies and tools for building your credit profile.

Make monitoring your credit easier

Know the ins and outs of what’s going on with your personal and business credit, all in one place. Unlock your detailed credit reports and scores from the major business bureaus with Nav Prime.

Frequently asked questions

Build your foundation with Nav Prime

Options for new businesses are often limited. The first years focus on building your profile and progressing.

Get the Main Street Makers newsletter

Rate this article

This article currently has 2 ratings with an average of 4 stars.

Gerri Detweiler

Education Consultant, Nav

Gerri Detweiler has spent more than 30 years helping people make sense of credit and financing, with a special focus on helping small business owners. As an Education Consultant for Nav, she guides entrepreneurs in building strong business credit and understanding how it can open doors for growth.

Gerri has answered thousands of credit questions online, written or coauthored six books — including Finance Your Own Business: Get on the Financing Fast Track — and has been interviewed in thousands of media stories as a trusted credit expert. Through her widely syndicated articles, webinars for organizations like SCORE and Small Business Development Centers, as well as educational videos, she makes complex financial topics clear and practical, empowering business owners to take control of their credit and grow healthier companies.