How to remove hard inquiries from credit reports

Michelle Lambright Black

Contributor

Summary

- Hard inquiries may drop credit scores a few points, and in some cases, removing unauthorized inquiries may help your scores recover a little faster — though results vary and changes are often small.

- There are several ways to remove hard inquiries and each can be effective in certain situations, but none are guaranteed.

- Always check your reports for inquiries you don’t recognize, as they could signal fraud or identity theft.

Editorial note: Our top priority is to give you the best financial information for your business. Nav may receive compensation from our partners, but that doesn’t affect our editors’ opinions or recommendations. Our partners cannot pay for favorable reviews. All content is accurate to the best of our knowledge when posted.

When someone accesses your credit reports or credit scores, that fact is noted as an inquiry on your credit reports. Hard inquiries, which result from shopping for credit cards or loans, can result in a few points drop in your credit score — usually in the range of 3–8 points.

While most hard inquiries have minimal impact on your scores, unauthorized inquiries could signal identity theft. Knowing how to spot and dispute these can help protect your credit scores.

Start your business credit journey

Build business credit, monitor credit health, and accelerate growth — all with Nav Prime.

Steps to remove hard inquiries

The general rule of thumb is that you can only remove inaccurate or unauthorized hard inquiries from your credit reports. Only inaccurate or unauthorized inquiries can be disputed. Legitimate inquiries generally cannot be removed.

Follow these steps:

Step 1: Get your credit reports

Check your credit reports from all three major credit bureaus. You can claim a free copy of your consumer reports from Equifax, TransUnion, and Experian at AnnualCreditReport.com.

Nav Tip

Checking your personal credit yourself does not hurt your scores.

Step 2: Identify unauthorized inquiries

Your credit report must list anyone who has checked your consumer credit reports or scores in the past two years. Review inquiries listed on your credit reports. Look for ones you didn't authorize.

If you discover inquiries you don't recognize, it could be a sign of identity theft. Make a list of any suspicious inquiries—you'll need this information for your dispute.

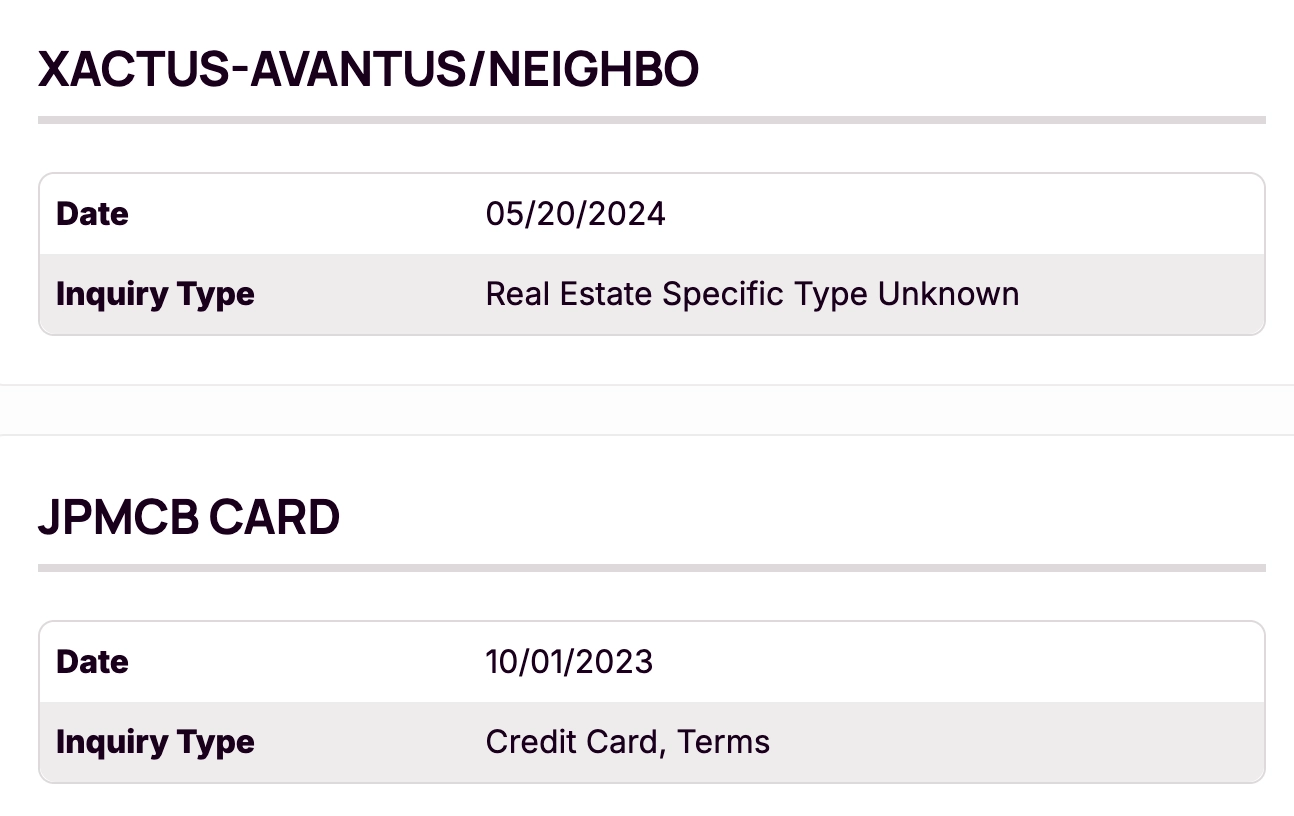

Here’s an example of what an inquiry may look like on your credit reports:

Since most creditors only check credit with a single bureau, you’ll want to compare your credit reports from all three major credit bureaus. Inquiries are likely to be different with each. Mortgage loan applications are the exception, as lenders typically must check all three credit reports when you apply for a home loan.

Step 3: File disputes with credit bureaus

The Fair Credit Reporting Act, a federal law, gives you the right to dispute information you believe is inaccurate or incomplete on your credit reports. You can do that by contacting each credit bureau that shows an unauthorized inquiry.

There are three ways to do this: call the credit bureau, dispute an inquiry online, or write a letter.

Calling can be a quick way to talk with someone at the credit bureau about your dispute, online disputes are very fast and efficient, and letters can give you a record of your dispute (if you keep a copy) in case it’s not resolved as you expected.

Dispute contact information

Bureau | Phone | Online | |

Experian | P.O. Box 4500, Allen, TX 75013 | 866-200-6020 | |

TransUnion | P.O. Box 2000, Chester, PA 19016-2000 | 800-916-8800 | |

Equifax | P.O. Box 740256, Atlanta, GA 30374-0256 | 866-349-5191 |

Writing a credit dispute letter

If you decide to write to the credit bureau, here are a few tips:

- Provide your identifying information: name, address, last four digits of Social Security number, and a credit report ID if you have one.

- Identify the specific inquiries you don't recognize (name of company, date)

- Mention if you believe you are a victim of fraud

- Be clear and direct — no specific format required

- Send by certified mail with return receipt requested or with tracking

The credit bureau will typically investigate your claim and notify you of the results within 30 days.

If you have been a victim of ID theft, include a copy of your police report and ID theft affidavit from IdentityTheft.gov with your dispute.

Step 4: Follow up if needed

If a disputed inquiry is verified but you strongly disagree, you can file additional disputes. You can also:

- Speak with an attorney specializing in the Fair Credit Reporting Act

- Add a 100-word statement to your credit report explaining why you believe the inquiry is wrong. (This won’t help your credit scores, though.)

Business credit disputes

Business credit bureaus don't have to follow the Fair Credit Reporting Act, so consumer dispute rules don't apply. However, you can still dispute incorrect information on your business credit reports. Business credit bureaus like Dun & Bradstreet offer their own dispute processes, such as the iUpdate system, for updating business data.

Business credit dispute contacts

Anyone can check your business credit. However, someone applying for accounts in your business name without authorization is still considered identity theft.

Hard vs. soft inquiries

Understanding the difference between inquiry types helps you know which ones might affect your credit scores.

What is a hard inquiry?

Hard inquiries occur when you apply for credit and a lender checks your credit report as part of their decision process. These include applications for:

- Credit cards

- Mortgages

- Auto loans

- Personal loans

- Business loans

Impact on credit scores

Hard inquiries can lower your credit score by a few points and remain on your credit report for 24 months. However, most credit scoring models only consider them for the first 12 months. And some inquiries are grouped together and counted as a single inquiry. We’ll explain in more detail in a moment.

What is a soft inquiry?

Soft inquiries happen when someone checks your credit for reasons other than a credit application. These have zero impact on your credit scores and only appear on reports you check yourself.

Examples of soft vs. hard inquiries

Soft inquiries | Hard inquiries |

Checking your own reports | New loan applications |

Employment-related credit checks | Many cell phone applications |

Pre-approved credit offers | Credit card applications |

Insurance-related credit checks | Mortgage applications |

Account reviews by existing creditors | Collection agencies |

Can you remove hard inquiries from your credit report?

If an inquiry is truly unauthorized, you can dispute it. If you did try to apply for credit and just want to remove the inquiry to raise your credit score, you are unlikely to succeed if you’re disputing an inquiry you authorized.

Some credit repair companies claim they can remove all recent hard inquiries, but the law only requires removal of inaccurate or unauthorized ones. Be cautious — you can file disputes yourself for free. By law, only incorrect or unauthorized inquiries can be removed — legitimate ones must remain.

Federal law requires hard inquiries to stay on your report for 24 months so you know who has accessed your credit file. The credit bureaus have strong incentives to correct inaccurate information when you dispute it:

- The Fair Credit Reporting Act requires them to investigate disputes and correct inaccuracies

- Accurate information makes for a better product they can sell to lenders

- Non-compliance can result in lawsuits or fines

Whether you can get legitimate inquiries removed and whether you should try to do that are two different questions.

While it may feel good to get an inquiry removed, it may not have as much of an effect on your credit scores as you hoped. There are a few reasons for this:

- The number of points lost with a single inquiry is usually small, and often becomes even smaller over time. Inquiries often have little to no effect on credit scores after 2–12 months.

- Some inquiries are grouped by type and count as one. With FICO scores, auto, mortgage, and student loan inquiries in the past 30 days are ignored. Beyond that, each of these types of inquiries within a 14- or 45-day time period typically count as one. With VantageScore, most inquiries within a 14-day rolling window count as one. Learn more here.

- Unlike information that appears on reports with all three major credit bureaus, most inquiries typically only appear on one of your reports. Even if you get some removed, that may not affect all your credit scores.

In other words, instead of spending a lot of time and energy, or even money, trying to get inquiries removed, there may be other actions you can take that could have a bigger long-term impact on your credit scores.

Reasons to dispute hard inquiries

You may want to dispute hard inquiries in these situations:

- Identity theft: Someone applied for credit using your information without permission.

- Clerical errors: A lender pulled your credit by mistake (wrong person with similar name).

- Unauthorized applications: A company checked your credit without your consent.

- Fraudulent applications: You never applied for the credit product in question.

- Duplicate inquiries: A lender pulled your credit multiple times for one application. Sometimes that’s legitimate, but not always.

Does removing hard inquiries improve your credit score?

Removing unauthorized hard inquiries may improve your credit score, but if there is an impact, it’s often small, and varies person to person. Here's what you need to know:

Personal credit scores

FICO says a single hard inquiry typically lowers scores by less than five points each. The impact diminishes over time, with most scoring models ignoring inquiries after 12 months. If an inquiry is a few months old, it may have very little impact on your credit score. If it’s more than 12 months old, it probably isn’t affecting your score at all, though VantageScore does warn that inquiries may impact scores for up to 24 months.

Business credit scores

Hard inquiries are not usually a major factor in business credit scoring. Some business credit scores — like the grade based on the Dun & Bradstreet (D&B) PAYDEX® score and Equifax business credit scores — don't consider inquiries at all.

Focus your credit improvement efforts on factors that have bigger impacts, like payment history and credit utilization. Only dispute inquiries if they're truly unauthorized.

How to prevent unauthorized credit inquiries

While you can't eliminate the risk of identity theft entirely, you can take steps to protect your credit.

Freeze your credit reports: A security freeze prevents new lenders from accessing your credit reports unless you unlock them first. This stops most fraudulent account openings.

Set up fraud alerts: These require lenders to verify your identity before opening new accounts.

Monitor your credit regularly: Check your reports monthly, rather than annually, to catch problems early.

Protect your information: Be cautious about sharing personal information and only apply for credit through reputable, secure sites.

Review statements carefully: Look for unfamiliar accounts or inquiries on your credit reports and review your account statements carefully.

Shop strategically: When you need credit, consider using services that match you to credit offers that better match your qualifications, rather than applying randomly.

Access better funding options with a solution you can’t get anywhere else

Improve your business’s financial health profile, unlock better financing options, and get funded — only at Nav.

Frequently asked questions

Build your foundation with Nav Prime

Options for new businesses are often limited. The first years focus on building your profile and progressing.

Get the Main Street Makers newsletter

Rate this article

This article currently has 19 ratings with an average of 5 stars.

Michelle Lambright Black

Contributor

Michelle Lambright Black is a credit expert and finance writer with more than 20 years of experience covering consumer credit, business credit, lending, small business financing, and money management. She specializes in translating complex credit reporting, credit scoring, and underwriting concepts into clear, practical guidance for business owners and consumers.

Michelle’s work has appeared in national publications including USA Today, Forbes Advisor, Fortune Recommends, Reader’s Digest, Experian, FICO, LendingTree, Bankrate, Yahoo Finance, Business Insider, and Buy Side from The Wall Street Journal. She is the founder of CreditWriter.com, an award-winning personal finance and credit education platform, and has served as an expert witness in credit-related legal matters. Michelle holds a B.A. in Spanish and French from Winthrop University, where she graduated summa cum laude.