Business Credit 101

Business credit basics

Simply put, business credit measures how well your business pays its bills. It’s separate from personal credit, and can be a powerful tool to give your business financial flexibility.

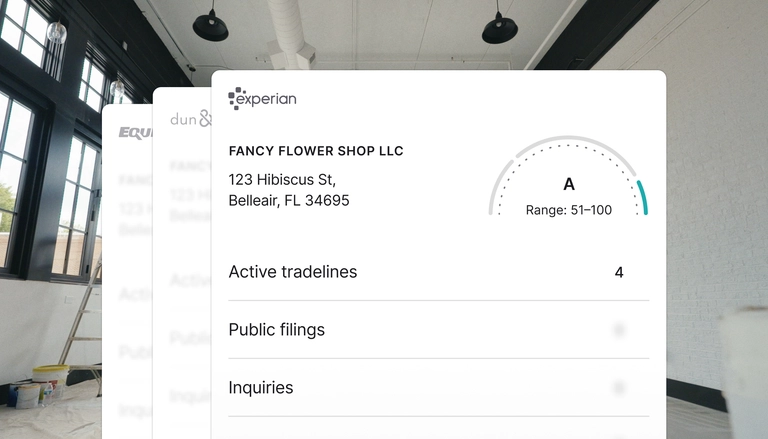

Business credit scores are calculated by business credit bureaus like Dun & Bradstreet, Experian, and Equifax. The bureaus collect data from lenders, suppliers, and public records to assess your business’s financial responsibility. Business partners can use it as a gut-check of your business’s trustworthiness when deciding to work with you.

For business owners, a strong business credit score can translate into lower interest rates, better trade credit with vendors, and access to the financial support you need to grow and maintain your business.

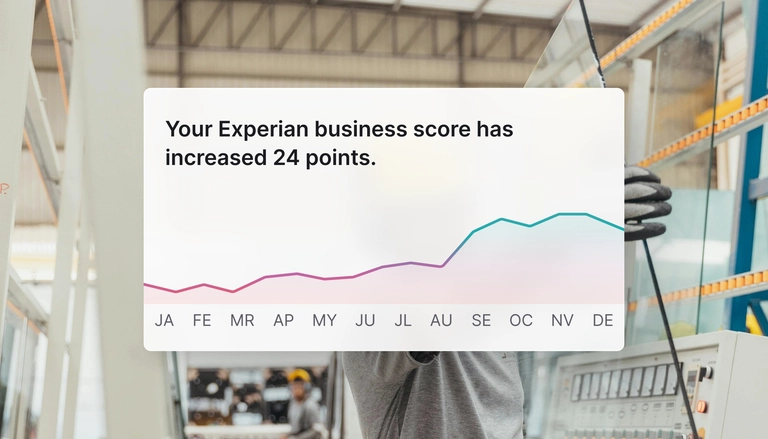

Building business credit takes time, but consistency is the key to long-term progress. To unlock the tools and guidance you need to build business credit with all three major bureaus, get started with Nav Prime.

What is business credit?

At some point in your journey as an entrepreneur, you’re sure to have heard of business credit. However, if you’re like many business owners, you may wonder what does business credit mean?

Business credit is a company’s history of buying something now and paying for it later. It’s like a rating for how consistently you pay your bills on time. A good business credit rating may make it easier to borrow money when your company needs it and to win large partnerships, such as government contracts.

Why business credit matters

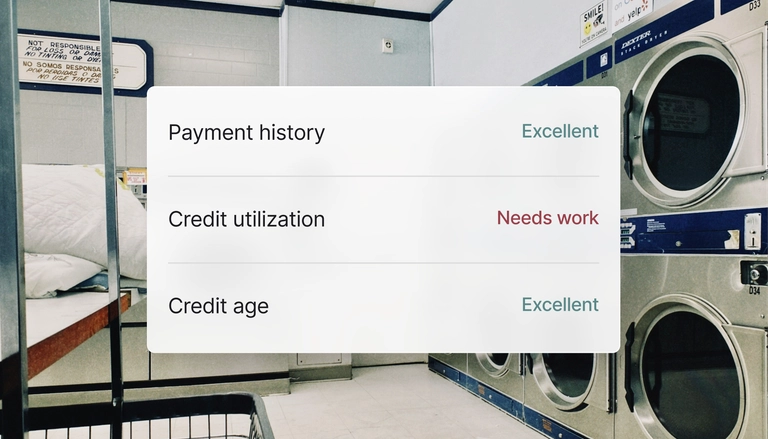

A strong business credit score can give your business more options. Lenders and other creditors check business credit to determine how likely your business is to pay bills on time — and decide whether to offer financing. Potential clients, particularly large ones, may look at your business credit history to assess how stable your business is, and therefore if you are likely to be able to fulfill an order or complete a project.

Your scores can also help you:

- Save on financing costs: A high credit score may help you qualify for loans with lower interest rates, which makes it less expensive to borrow over time.

- Get more time to pay: Vendors and suppliers can use business credit to decide what trade credit terms to give your business (net-30, net-60, etc.). More flexible terms can help you manage cash flow.

- Support your growth: Creditworthiness matters. Whether you’re looking for business financing, or in the running for a major contract, strong business credit can help your business achieve those goals.

Explore our guide

Chapter 1

Understanding business credit scores

Unlock business credit insights with Nav Prime

Frequently asked questions

Business credit glossary