Recently a representative from one of my business credit card issuers called and invited me to apply for one of their corporate credit cards. His pitch: this card wouldn’t require a personal guarantee, and it would be approved based on my business data, rather than my personal finances.

I asked lots of questions so I could share this option with other business owners. But when he got to the key minimum qualification I was a bit crestfallen. The card was only available to businesses with at least $4 million in annual revenues. I knew that’s more than many small businesses make.

Fortunately it’s not the only option available if you’re looking for a business credit card that doesn’t rely on personal credit or personal guarantees and your business isn’t making millions of dollars in revenue yet.

Here’s what you need to know when looking for EIN-only business credit cards.

Get the credit your business deserves

Join 250,000+ small business owners who built business credit history with Nav Prime — without the big bank barriers.

What’s An EIN-only Credit Card?

An EIN-only business credit card is a term used to describe a credit card that allows you to apply without providing your Social Security number (SSN), relying on your personal credit history, or agreeing to be personally liable for business debt. The idea is that you use your businesses’ EIN rather than your SSN when you apply for the card.

If you’re not familiar with an EIN, it’s short for Employer Identification Number (EIN), a nine-digit tax identification number issued by the IRS. EINs are mostly used by businesses to file taxes, and are available to most businesses, ranging from large companies to sole proprietorships.

Your business must obtain an EIN if it has employees, is a corporation or partnership, files certain types of tax returns, or if it has certain types of retirement plans. (Find out if your business needs an EIN here.) You may also request an EIN if you operate as a freelancer or independent contractor and want to use a tax id number separate from your SSN.

Getting an EIN is simple and straightforward. You can request an EIN for free from the IRS. It’s easiest and fastest to use their online request form but you can also request it by mail. If you work with a business formation company, they may include or offer this service.

For most credit card applications, an EIN is optional, but you some business lenders require them, and you may need one for certain cards or to open a business bank account.

There may be several reasons why you want a EIN-only business credit card:

- Your personal credit profile isn’t great and you want to find a credit card issuer that won’t check personal credit,

- You don’t want to use a business credit card that will report your account history to your personal credit reports and impact your personal credit scores,

- You want to build credit in the name of your business, and/or

- You’d like to avoid personal liability in the event your business does not succeed.

It’s important to understand that each of these goals may be achieved in different ways, and may not require an EIN- only credit card. Still, if you want to get one of these credit cards you need to know where to look.

100+ business credit cards in one click

Business credit cards can help you when your business needs access to cash right away. Browse your top business credit card options and apply in minutes.

How to Get a Business Credit Card With an EIN

For most small business owners, especially those with newer businesses or modest revenues, qualifying for an EIN-only business credit card presents challenges.

Major card issuers like American Express, Bank of America, Capital One, Chase, and Wells Fargo typically require the following during the application process:

- Personal credit checks

- Good to excellent personal credit scores

- Personal guarantees

You may notice these requirements are similar to personal credit cards. That’s because a small business (and especially a new business) is considered a higher credit risk, and issuers want to be reasonably sure they’ll recoup their money if the business fails.

Most EIN-only business credit cards from major issuers are corporate cards, and for those cards, most providers want to see:

- Established business history (typically 2+ years in operation)

- Substantial annual revenue (often at least $2 million or more)

- Strong business credit profile

- Positive cash flow demonstrated through business bank account statements

If that doesn’t describe your business, let’s look at other options.

Best Business Credit Card Options: No Credit Check or Soft Credit Check

Every business is different, so there’s no single best credit card option for every business. However, if you are looking for EIN-only cards, the following options either do not check credit or will only use a soft credit check, which does not impact personal credit scores.

Nav Prime Card

We realize we are putting our card first in this list, and that's because it’s a great choice for many cardholders looking to avoid using their personal credit to qualify, because Nav Prime Card* does not check personal credit.

Nav Prime Card transactions are reported as a monthly tradeline, turning everyday transactions into opportunities that can build business credit history with regular use.

The Nav Prime card is available exclusively to Nav Prime members. Nav Prime gives you cash flow insights, detailed credit reports, multiple tradelines, and tools that may improve your financial health so you can access the best financing options for your business when you need it.

Nav Prime Card

Lowest minimum requirements on the market. Available with Nav Prime.

Pros

- The Nav Prime Card is the only business credit-building charge card with no credit check, no personal guarantee, and no security deposit

- Nav will report your everyday purchases as a tradeline

- Access the Nav Prime Card as part of Nav Prime — the only solution that lets you track your credit progress while simultaneously building your business credit.

Cons

- The Nav Prime Card does not offer a traditional 30-day repayment window like many other charge cards

- The nav Prime Card has an automatic 24 hour repayment window.

Intro APR

Purchase APR

Annual Fee

Welcome Offer

BILL Divvy Corporate Card

The BILL Divvy Corporate Card uses a soft pull credit check, which will not impact your credit scores. It is available to sole proprietors as well as businesses operating under other structures such as a corporation or LLC. There are multiple paths to approval.

It also offers rewards: Up to 7% points, based on payment settings. All charges made on this charge card are due and payable when you receive your periodic statement.

BILL Divvy Corporate Card

Eligibility based more on revenue, requires full repayments monthly.

Pros

- Free and flexible expense management platform

- No annual fee.

Cons

- No early spend bonus and lower rewards than other cards

- Must pay off all balances in full each month.

Intro APR

Purchase APR

Annual Fee

Welcome Offer

Capital on Tap Business Credit Card

When you apply for the Capital on Tap Business Credit Card there will only be a soft credit check on personal credit and business credit. (You can still be turned down for credit reasons.) To qualify, you must:

- Be an active director of the company or majority shareholder of 25%+ ownership.

- Be based in the US (you and the business)

- Earn annual business revenue of at least $30,000.

*All information about the Capital On Tap Business Credit Card has been collected independently by Nav.

Business Gas Cards with EIN-Only Approval

For businesses where fuel is a major business expense, gas cards may be a good choice.

- Perks are often focused on fuel discounts within a specific network of gas stations

- Cards often offer detailed reporting and spending controls for employee cards

Many fleet fuel cards base eligibility on business revenue and data, and may use a business credit check rather than a personal credit check.

Examples include:

- Shell Card: Shell offers two cards that feature fuel rebates. There is a soft credit check and no personal guarantee+

- WEX Fleet Card: Also offers two cards featuring fuel discounts. There is a soft credit check and no personal guarantee+

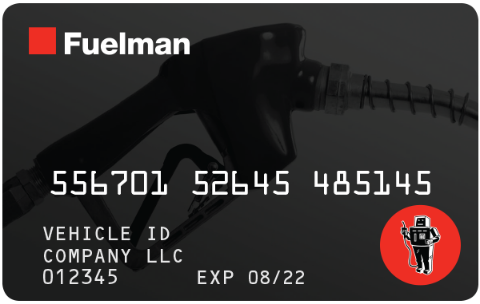

- Fuelman Mixed Fleet Card: If you operate as a business entity there will be a check using your EIN. If the business doesn’t qualify on its own, the issuer may request a PG and there will be a hard credit check at that point.

Fuelman Mixed Fleet Card

Business owners get $0.08 off every gallon at 40,000+ locations.

Pros

- gas card

Cons

- gas card

Intro APR

Purchase APR

Annual Fee

Welcome Offer

Information about the Shell Card and WEX Fleet Card been collected independently by Nav. Information for these cards was not reviewed by or provided by the issuers. These cards are not currently available through Nav. To see what credit cards are available, please visit the Nav Credit Card Marketplace.

Secured Business Credit Cards

Another popular option with business owners who have no credit history or bad credit, secured cards allow you to place a security deposit with the credit card company to help ensure repayment. There may be a soft credit check or no personal credit check.

The deposit amount often determines the credit limit, but if you pay on time, the issuer may raise the spending limit.

Options include:

- Bank of America Business Advantage Unlimited Cash Rewards Mastercard Secured credit card

- Business Edition® Secured Mastercard® Credit Card

Wells Fargo and Union Bank offered secured business credit cards in the past but are not currently open to new credit card applications.

Alternatives Business Financing Options

If the reason you want a business credit card is to get financing for your business, there are a number of business financing options that either use a soft credit check or don’t check personal credit at all.

Merchant cash advances

For businesses with strong sales volume, a business cash advance or merchant cash advance can offer fast funding in the form of a lump sum advance against future sales:

- Rarely requires strong personal credit

- Based on your business’s sales history, not personal credit

- Daily or weekly repayment from sales

Invoice factoring or financing

For B2B businesses that invoice other companies, invoice factoring offers faster payments of outstanding invoices:

- Typically no personal guarantee required

- Focus on invoice quality rather than business owner’s credit

- Qualification based on customers’ creditworthiness

Supplier credit/Vendor terms

Supplier or vendor accounts allow businesses to purchase goods and services and pay for them later, typically within 30-90 days:

Terms range from net-10 to net-180 (days to pay from invoice date)

- Many net-30 accounts don’t involve personal credit checks

- Some report payment history to business credit bureaus

- Can help establish initial business credit history

Crowdfunding

Raise money from supporters or investors interested in your business. Options may include rewards-based crowdfunding which offers tangible rewards or presells a product, investment crowdfunding which allows you to raise money from a pool of investors, and loan-based crowdfunding, which must be repaid.

- Successful campaigns can raise a lot of money

- Funding is usually based on the business, rather than creditworthiness

- Only loan-based crowdfunding typically checks credit; other types rarely do

Building Credit With an EIN

How does your EIN tie into your credit history? If a lender requests an EIN on a credit application but does not request a Social Security number, it’s possible the lender will not check your personal credit.

Using your EIN to apply for credit is one way to separate your business and personal finances. However, keep in mind that a lender may require a personal guarantee even if you don’t supply a SSN, and there is no personal credit check. Read the application and cardholder agreement carefully to understand your responsibility.

One common misconception is that an EIN is used to match business credit report data to a business, similar to the way a Social Security number is used to help match consumer credit information in personal credit reports.

Commercial credit reporting agencies typically use their own proprietary identifiers to track business credit history; Dun & Bradstreet uses the DUNS number, Experian uses the Business Identification Number and Equifax uses an Equifax ID. While lenders may request an EIN on a credit application, it’s not required to report an account to business credit bureaus.

Most small business credit cards and some of the small business financing options mentioned in this article can help you build business credit, provided you make your payments on time.

With business financing, not all companies report to all business credit bureaus. Some report only negative information. If you want to build business credit, make sure the company reports positive information to at least one of the major business credit reporting agencies, or the Small Business Financial Exchange (SBFE).

Start your business credit journey

Build business credit, monitor credit health, and accelerate growth — all with Nav Prime.

FAQs on EIN-Only Credit Cards

Is it possible to apply for a business credit card with no personal guarantee?

Yes, but most business cards without a PG available from major card issuers require substantial revenue (typically $2M+) and strong business credit. Startups and smaller businesses will have fewer options but they do exist. We’ve listed some above.

Do EIN-only business credit cards affect personal credit?

Most small business credit card issuers do not report payment history to the owner’s personal credit unless they default. However, most do check personal credit and that inquiry can lower personal credit scores by a few points. (The effect of that credit check is often short-lived.)

If the issuer does not check personal credit, or uses a soft credit check, there will not be an impact on personal credit. And if there is no personal guarantee involved, the issuer may not reserve the right to report to personal credit if the cardholder defaults.

How can I apply for a business credit card with bad personal credit?

Look at options like secured business cards, or the Nav Prime Card which does not require a personal credit check. Improving your business’s financial profile by paying on time and establishing a positive payment history will expand your options over time.

Is it easier to qualify for a business credit card than a personal card?

Most small business credit cards from major issuers evaluate applications based on factors similar to personal cards: personal credit scores and income. This makes business credit cards an attractive option for startups that don’t yet have strong business revenues or business credit scores.

Do you need business income to get a business credit card?

While you need income to qualify, many issuers allow you to include household income from all sources on your application, not just business revenue.

How long do you have to be in business to get an EIN-only business card?

It’s usually easiest to qualify for credit cards without personal credit checks if your business is well-established, though there are exceptions as we’ve described above.

Can startups get an EIN-only business credit card?

Startups can consider charge cards with alternative approval criteria or secured credit cards to get started.

Can I build business credit with just an EIN?

Yes, using vendor accounts, business credit builder products, and EIN-only financing options that report to business credit bureaus such as Dun & Bradstreet, Equifax, or Experian.

Why does my EIN not have a credit score?

An EIN is just a taxpayer identification number. It doesn’t have a credit score—it’s your business that establishes its own credit history. The EIN is simply an identifier, similar to how your SSN identifies you but doesn’t itself have a credit score.

*Nav Technologies, Inc. is a financial technology company and not a bank. Banking services provided by Thread Bank, Member FDIC. The Nav Visa® Business Debit Card and the Nav Prime Charge Card are issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa cards are accepted. See Cardholder Terms for additional details. FDIC insurance is available for funds on deposit through Thread Bank, Member FDIC. All other features of the Nav Prime membership are not associated with Thread Bank.

Build your foundation with Nav Prime

Options for new businesses are often limited. The first years focus on building your profile and progressing.

Gerri Detweiler

Education Consultant, Nav

Gerri Detweiler, a financing and credit expert, has been featured in 4,500+ news stories and answered 10,000+ credit and lending questions online. In addition to Nav, her articles have appeared on Forbes, MarketWatch, and Startup Nation. She is the author or co-author of six books, including Finance Your Own Business, and she has also testified before Congress on consumer credit legislation.