How many points does a hard inquiry affect my credit score?

Gerri Detweiler

Education Consultant, Nav

Summary

- A single hard inquiry usually lowers your score by less than five points, though some people may see a slightly larger or smaller change depending on their credit profile.

- Hard inquiries are created when you apply for new credit, and remain on your credit report for two years, but typically only affect credit scores for 2–12 months.

- Soft inquiries, can be created when you check your own credit or apply for a job or insurance, do not affect credit scores.

- Grouping certain types of loan applications within a short time frame may limit the impact of multiple inquiries.

Editorial note: Our top priority is to give you the best financial information for your business. Nav may receive compensation from our partners, but that doesn’t affect our editors’ opinions or recommendations. Our partners cannot pay for favorable reviews. All content is accurate to the best of our knowledge when posted.

Shopping for credit can be smart, but it may also affect your credit scores. If you're someone who is trying to improve your credit, losing even a few points to hard inquiries can feel stressful.

It doesn’t have to be. Inquiries are an often misunderstood factor in credit scores.

Understanding how hard inquiries work can help you shop for credit more confidently without unnecessarily damaging your score.

How much does a hard inquiry lower your credit score?

A hard inquiry is an inquiry that results from applying for credit. FICO says that one new inquiry typically results in a less than five-point drop in your personal credit score.

The exact impact depends on the personal credit scoring model used, and all the information in your credit report. If you have a long history of good credit, the impact will likely be lower than someone who is in the process of establishing credit for the first time.

For example: If you have a credit score of 740 and apply for three credit cards within a few weeks, you might see your score drop to 735 or lower. This could potentially move you from a "very good" to a “good” credit range with some lenders. However, the exact impact depends on the scoring model and your credit history.

Keep in mind that most lenders and companies only check credit with a single credit bureau. An inquiry that appears on your personal Equifax credit report won’t affect credit scores calculated from your personal TransUnion credit report, for example. (Mortgage applications are different: They typically check all three credit reports.)

While the five or fewer points FICO mentions isn’t a large amount, it could drop you into a lower rate tier. Generate a few hard inquiries in a short period of time, and the points can add up to a more significant drop in your scores.

Hard inquiry vs. soft inquiry: What's the difference?

When you apply for a mortgage, auto or student loan, credit card, or any other form of credit, the lender has the legal right to check your personal credit. By law, credit reporting agencies must tell you every time someone checks your credit.

That credit check is listed under the "inquiries" section of your credit report.

Hard inquiry | Soft inquiry |

Impacts your credit score | No impact on credit score |

Shown to other lenders | Only visible to you |

Examples: Credit cards, loans, mortgages | Examples: Pre-approved offers, employer checks, your own credit check |

Any inquiry that may impact your credit scores is known as a "hard" inquiry. These inquiries are shown to others who order your credit reports.

Other inquiries are only shown to you when you order your own credit reports. They are not used when credit scores are calculated. They are called "soft inquiries." Soft inquiries include credit checks by:

- Employers

- Insurance companies

- Yourself

- Pre-approved credit offers

How long does a hard inquiry affect your credit score?

Inquiries remain on your credit report for two years. The Fair Credit Reporting Act requires credit bureaus to disclose to you all credit inquiries on your personal credit report for the past two years.

But the real impact may be shorter than that. When it comes to FICO scores, models typically only count inquiries that have occurred in the past 6–12 months. And for most people, inquiries won't matter after a few months. The impact will "level off" in as little as two months, especially if the credit history overall is strong.

With VantageScore it’s possible inquiries may affect your credit for up to 24 months, especially if you don’t have a strong established credit history.

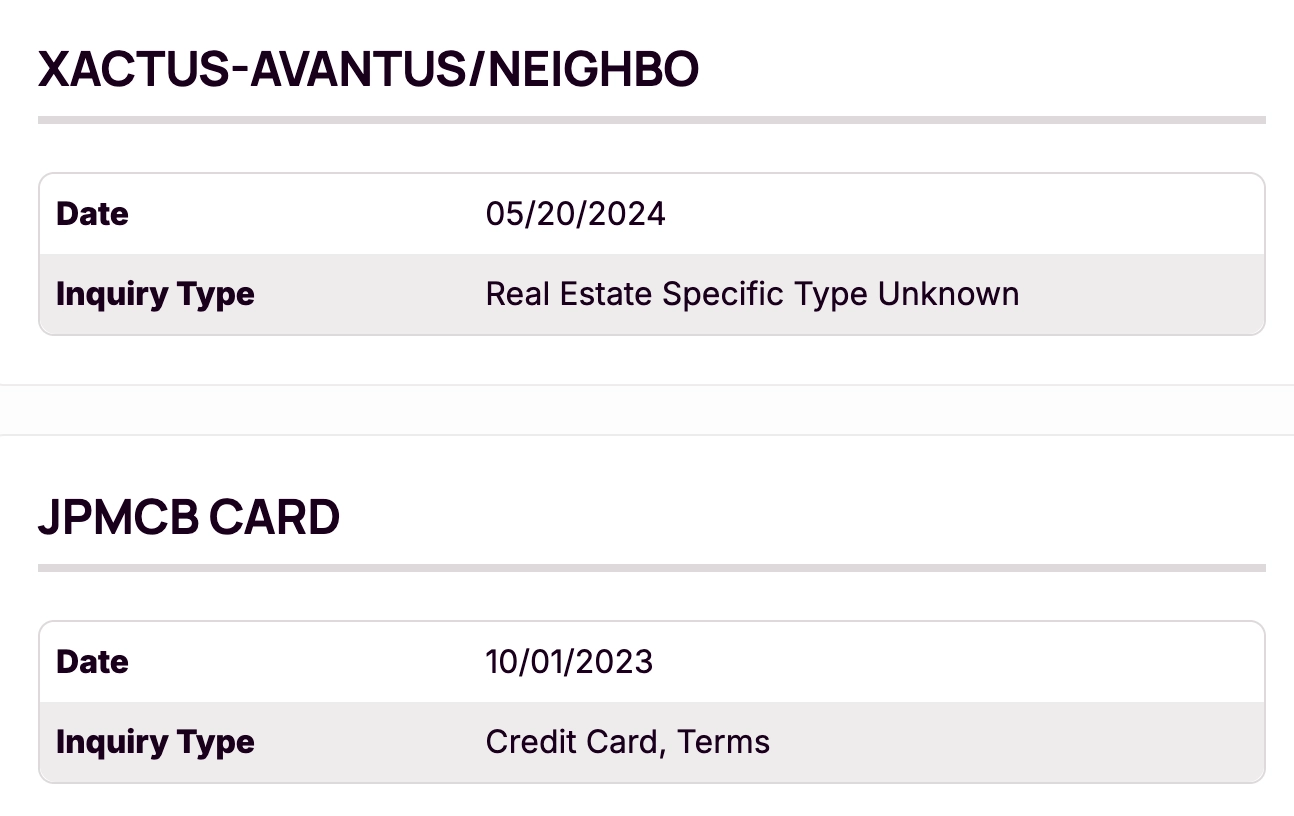

Examples of inquiries on a personal credit report:

Credit score impact of multiple hard inquiries

There are times when hard inquiries won't drop your score as much as you think. These exceptions occur in some situations when you rate or price shop competitors for the same type of purchase.

For example, if you visit several dealerships to shop for a car, each dealership may want to run your credit and they often share your application with multiple financing sources, resulting in multiple inquiries. However, your scores won't always take a hit for each one of those inquiries.

Many scoring models group multiple inquiries in a short period of time and count them as one.

Personal credit shopping windows

- FICO: Auto, mortgage, and student loan inquiries in the past 30 days are ignored. Beyond that, auto, mortgage, and student loan inquiries within a 45-day time period typically count as one. (This grouping occurs within each type of inquiry. For example, all auto inquiries within a 45-day period.) However, that time period can vary, depending on which version of a FICO score is used. Older credit scoring models still used in the mortgage industry, for example, may use a 15-day buffer instead of 45 days.

- VantageScore: All inquiries within a 14-day rolling window count as one. The exceptions are collection and retail inquiries; each inquiry of this type counts individually.

Note that with FICO scores, shopping for credit cards or personal loans will generate multiple inquiries that don't get grouped together and counted as one.

To help reduce the impact of inquiries, you may want to limit loan shopping within a two week period. This does not guarantee you won’t see a large drop from multiple inquiries, though.

Be especially cautious if you are trying to get a larger loan, such as a mortgage, where lower interest rates are closely tied to your credit scores.

Inquiries and business credit

The impact of inquiries on business credit can be somewhat different from personal credit. Many business credit bureaus do not distinguish between hard and soft inquiries the way personal credit bureaus do. However, each bureau’s practices and scoring models may vary.

In addition, there’s no requirement for credit bureaus to stop reporting inquiries after two years like there is with personal credit.

That said, inquiries don’t typically carry as much weight in many business credit scores as they may with consumer credit scores.Some business credit scores don't take inquiries on business credit reports into account at all.

But even if those inquiries do not affect credit scores, credit managers who review business credit reports may look closely at inquiries and may hesitate to extend credit or financing to businesses with a lot of recent inquiries.

Also keep in mind that if you apply for a small business loan or business credit card, the lender may check your personal credit, and that may affect your personal scores.

Many personal credit checks for small business loans create soft inquiries, but not always. And most small business credit cards require a personal credit check which creates a hard inquiry.

Finally, some business credit scores, such as Experian Intelliscore Plussm, FICO® SBSSsm, and Equifax Business Delinquency Score™ offer a blended score that can evaluate both personal and business credit. This means that inquiries that impact your personal credit could impact these business credit scores as well.

How to minimize the effect of hard inquiries

Here are practical steps to help protect your credit scores when applying for new credit:

- Use rate shopping windows: When shopping for mortgages, auto loans, or student loans, consider applying within a two week window to increase the chances that these inquiries will be grouped as one.

- Monitor your credit reports regularly: Check for unauthorized inquiries that could signal identity theft. If you find any, dispute them.

- Maintain strong overall credit: A few hard inquiries won't likely affect your credit significantly if you have an on-time payment history, a solid mix of credit, and low balances.

- Consider pre-qualification tools: Some lenders offer soft-pull pre-qualification that won't affect your score.

Find the right financing for your business

Don’t waste hours of work finding and applying for loans you have no chance of getting — get matched based on your business & credit profile today.

How to remove hard inquiries from your credit report

In most cases, legitimate hard inquiries will remain on your credit report for the full two years. But, you can dispute inquiries that are:

- Unauthorized or fraudulent: If you didn't apply for credit but see an inquiry, dispute it immediately with the credit bureau.

- Older than two years: Credit bureaus should automatically remove these, but errors can occur.

- Duplicates from the same lender: Sometimes the same application generates multiple inquiries. Duplicate inquiries can be disputed.

To dispute an inquiry, contact the credit bureau directly and let them know you didn’t apply for credit. The bureau must typically investigate within 30 days and remove invalid inquiries.

Learn: How to remove hard inquiries from credit reports

The bottom line: inquiries

There are real benefits to maintaining high credit scores. You'll often get approved for credit faster and easier, and you can qualify for the best interest rates, including 0% intro APR credit card offers. That means you can borrow money cheaply, or even free. You may also be in a better position to negotiate prices if you have a high credit score.

Hard inquiries are a normal part of applying for credit, and their impact is often short-lived and manageable.Still, apply for credit strategically, and focus on maintaining good payment history and low balances to help build a strong credit history.

Frequently asked questions

Build your foundation with Nav Prime

Options for new businesses are often limited. The first years focus on building your profile and progressing.

Get the Main Street Makers newsletter

Rate this article

This article currently has 73 ratings with an average of 5 stars.

Gerri Detweiler

Education Consultant, Nav

Gerri Detweiler has spent more than 30 years helping people make sense of credit and financing, with a special focus on helping small business owners. As an Education Consultant for Nav, she guides entrepreneurs in building strong business credit and understanding how it can open doors for growth.

Gerri has answered thousands of credit questions online, written or coauthored six books — including Finance Your Own Business: Get on the Financing Fast Track — and has been interviewed in thousands of media stories as a trusted credit expert. Through her widely syndicated articles, webinars for organizations like SCORE and Small Business Development Centers, as well as educational videos, she makes complex financial topics clear and practical, empowering business owners to take control of their credit and grow healthier companies.