Why are my credit scores different? Personal and business factors explained

Gerri Detweiler

Education Consultant, Nav

Summary

- Personal credit scores vary due to different scoring models (FICO vs. VantageScore), differences in data each bureau collects, and the timing of updates across major credit bureaus Experian, Equifax, and TransUnion.

- Business credit scores show even more variation because of very different data sources, score ranges, payment experience weighting systems, and how each bureau handles public records.

- There's no single "real" score that matters for all situations: The most accurate credit score depends on which specific model your lender uses.

Editorial note: Our top priority is to give you the best financial information for your business. Nav may receive compensation from our partners, but that doesn’t affect our editors’ opinions or recommendations. Our partners cannot pay for favorable reviews. All content is accurate to the best of our knowledge when posted.

You check your credit score on one website and see 720. Then you apply for a loan and the lender says your score is 680. Sound familiar?

Score discrepancies occur because there's no single credit score. Multiple companies create credit scoring models, each credit bureau collects the data that’s used to create scores, and updates to credit reports happen frequently throughout the year.

Understanding these differences helps you focus on what actually impacts your ability to get approved for loans, better vendor terms, or favorable interest rates.

Access better funding options with a solution you can’t get anywhere else

Reduce the pain in financing with streamlined applications, instant offers and approval rates that are 3.5X higher than industry averages.

Why your personal credit scores are different

There are several reasons why your credit scores may be different when you check them.

1. Different scoring models (FICO vs. VantageScore)

FICO® and VantageScore use different formulas to calculate your creditworthiness, even when looking at identical credit report data.

FICO scores have been around since the 1950s and come in multiple versions. Mortgage lenders typically use older models like FICO Score 4 from TransUnion, FICO Score 2 from Experian, and FICO Score 5 from Equifax. Credit card companies often use FICO Bankcard scores.

VantageScore® was created in 2006 by the three major bureaus working together. Most free credit monitoring services show VantageScore 3.0, while the newer 4.0 version offers improved accuracy.

The same person might have a FICO score of 720 and a VantageScore of 690 because each model weighs factors differently. As one example, FICO gives payment history about 35% weight, while VantageScore 4.0 calls total credit usage "extremely influential" but uses ranges rather than percentages.

Likely impact: high

2. Update timing and reporting lags

Credit reports are updated frequently, but not simultaneously. Pay off a high credit card balance and your score can jump 50+ points once that new lower balance hits your credit report. But there may be a lag depending on when the credit card company reports that new balance when you check your credit.

Different versions of credit scoring models can also affect how timing impacts scores. Some models incorporate "trended data" that looks at payment patterns over time, while older models take more of a snapshot approach to analyze credit data.

Likely impact: medium

3. Data differences across bureaus (Experian, Equifax, TransUnion)

Each credit bureau maintains its own database, and most creditors who report to consumer credit report to all three major bureaus.

But they don’t have to.

Sometimes companies only report to one or two bureaus to save costs. For example, a collection account might appear on one of your credit reports but not another.

Additionally, most hard inquiries appear on one credit report since most lenders only check credit with one bureau, unless you are applying for a mortgage.

Likely impact: low

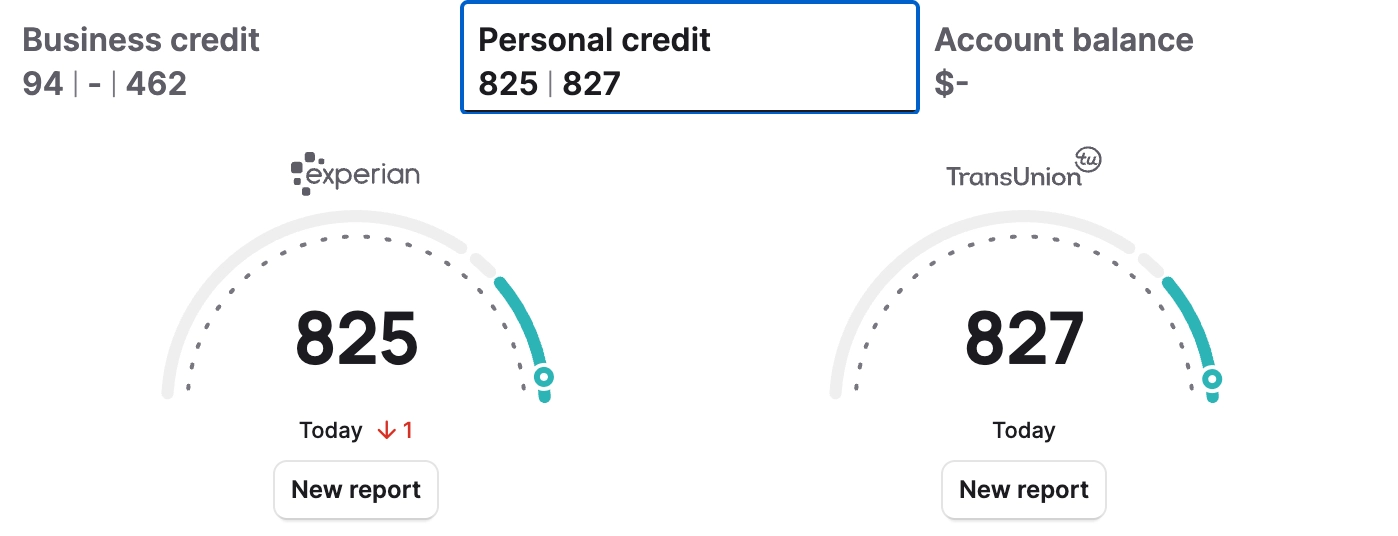

Here’s an example of two personal credit scores accessed the same day. Both are using VantageScore 3.0:

Source: Nav.com (September 2025)

Notice how close these two scores are. They both used the same scoring model and the credit data each bureau has is very similar, resulting in similar scores.

Why your business credit scores are different

Business credit score variations are often even more dramatic than personal scores because the data sources, weighting systems, and reporting requirements differ significantly.

1. Bureau data sources (Dun & Bradstreet, Experian, Equifax)

While there are three major business credit bureaus, Dun & Bradstreet (D&B), Equifax, and Experian, it is less common in business credit for lenders, vendors and other companies to report to all three.

Some lenders report to the SBFE, a data exchange that works with commercial bureaus. However, SBFE data is not used in traditional Dun & Bradstreet credit products such as PAYDEX® Scores.

The Small Business Financial Exchange (SBFE) adds another layer of complexity. This member-owned network collects payment data from over 200 financial institutions including major business credit card issuers and SBA lenders, then partners with all the major commercial credit bureaus. An SBFE member can purchase a credit report from one of these bureaus with or without SBFE data, and scores created as a result may be different.

Likely impact: high

2. Business credit scoring models

Each of these credit bureaus creates and sells their own credit scoring models. Similar to the different FICO scores, there are over a dozen credit scoring models, each with its own score range and score factors.

Here are a few examples:

Business scoring models | Score range | Highest possible score |

D&B PAYDEX® Score | 0–100 | 100 |

D&B Failure Score® | 1,001–1,875 | 1875 |

Experian Intelliscore PlusSM | 1–100 | 100 |

Experian Intelliscore PlusSM V3 | 300–850 | 850 |

Equifax Business Delinquency ScoreTM | 101–662 | 662 |

Equifax OneScore for Commercial | 300–660 | 660 |

FICO® Small Business Scoring Service℠ (SBSS℠) | 0–300 | 300 |

For a full list, see Nav's article, What is the highest possible business credit score?

Of all the score factors, payment history is usually the most important. Scoring models weight payment experiences using different formulas, which can create significant score discrepancies. Here are a few differences:

D&B PAYDEX® Scores typically reward early payments with the highest credit scores. Trade payment data is the most common type used for these scores.

Intelliscore Plus allows lenders to purchase a blended score that takes into account both consumer and business credit data — or just consumer data when the business hasn’t established business credit.

Equifax doesn’t accept collection accounts reported by third parties (such as collection agencies).

Likely impact: high

3. Public record and UCC filing impact

How each bureau handles public records can create another source of variation.

Tax liens, judgments, and bankruptcies appear differently across bureaus based on the data they gather and include in reports and/or scores.

UCC liens may appear on business credit reports but typically don’t affect business credit scores, though lenders often factor them into loan decisions.

Not all businesses will have public record data on their credit reports, however. If they don’t, this factor is a non-issue.

Likely impact: medium-low

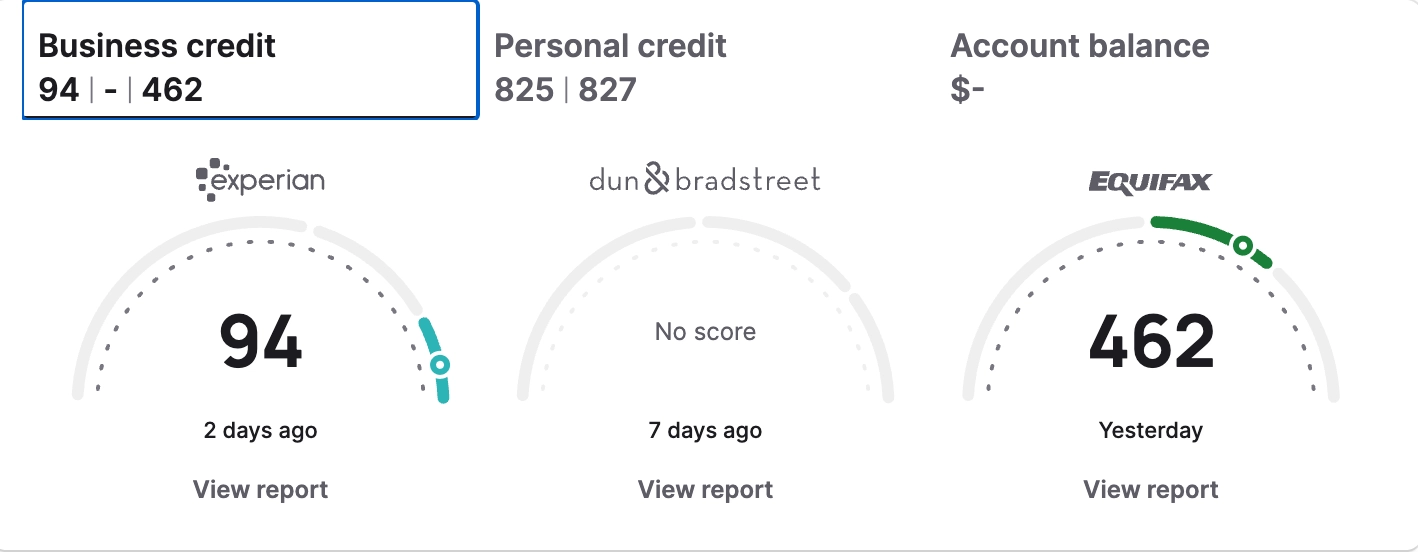

Here’s an example of three business credit scores accessed the same day via Nav:

Source: Nav.com (September 2025)

Notice how this business has strong credit scores with Experian and Equifax, but no report with Dun & Bradstreet, which may be due to too few active accounts reporting.

Start your business credit journey

Build business credit, monitor credit health, and accelerate growth — all with Nav Prime.

Which credit score matters most for lending?

The score that truly matters is the one a lender or other company uses to make decisions.

And lenders have lots of choices, whether they are checking business credit, personal credit, or both.

Personal lending scores by loan type

Here are the most popular FICO scores used by lenders, according to MyFICO.com

Experian | Equifax | TransUnion |

Widely used versions | ||

FICO® Score 9 FICO® Score 8 | FICO® Score 9 FICO® Score 8 | FICO® Score 9 FICO® Score 8 |

Versions used in credit card decisioning | ||

FICO® Bankcard Score 9 FICO® Bankcard Score 8 FICO® Score 3 FICO® Bankcard Score 2 | FICO® Bankcard Score 9 FICO® Bankcard Score 8 FICO® Bankcard Score 5 | FICO® Bankcard Score 9 FICO® Bankcard Score 8 FICO® Bankcard Score 4 |

Versions used in mortgage lending | ||

FICO® Score 2 | FICO® Score 5 | FICO® Score 4 |

Source: MyFICO.com (July 2025)

Business lending and vendor terms

SBA lenders use a score called FICO SBSS. This score can evaluate the owner's personal credit data, business credit data and even financial information to produce a single score. This score ranges from 0–300 and a higher score is better.

Equipment financing companies may use FICO SBSS or they may focus more on industry-specific risk ratings and UCC filing history, than general business credit scores.

Net-30 vendors often check D&B PAYDEX® scores since they specifically measure trade payment performance.

Again, it’s up to the lender to decide which bureau to purchase reports from, and which credit score to buy (if any).

Steps to fix and monitor your scores

Personal credit steps

- Get all three personal bureau reports from Experian, Equifax, and TransUnion to find out what each report says. (Free consumer reports are available at AnnualCreditReport.com.)

- Compare account information across reports — look for missing tradelines, incorrect balances, or accounts that should be closed.

- Dispute errors with the correct bureau online or by mail, providing documentation to support your claim if you have it.

- Check your personal credit scores to find out which factors are affecting your scores with each bureau. You can check both personal and business credit with Nav Prime.

- Pay down high balances to help improve credit utilization ratios across all bureaus, if that’s what’s bringing down your scores.

- Set up credit monitoring to track changes and get alerts when new accounts appear.

Find more details on how to build strong credit in Nav’s guide to the five main credit scoring factors.

Business credit monitoring steps

- Use Nav Prime to check business credit scores from all 3 major bureaus in one place.

- Verify business information accuracy including legal name, address, industry codes, and years in business across all three bureaus

- Identify missing tradelines by comparing which vendor accounts report to D&B, Experian, or Equifax.

- Establish net-30 accounts with suppliers that report to business credit bureaus to build payment history

- Monitor monthly for changes and to track your progress establishing business credit.

Frequently asked questions

Start your business credit journey

Build business credit, monitor credit health, and accelerate growth — all with Nav Prime.

Build your foundation with Nav Prime

Options for new businesses are often limited. The first years focus on building your profile and progressing.

Get the Main Street Makers newsletter

Rate this article

This article currently has 264 ratings with an average of 4 stars.

Gerri Detweiler

Education Consultant, Nav

Gerri Detweiler has spent more than 30 years helping people make sense of credit and financing, with a special focus on helping small business owners. As an Education Consultant for Nav, she guides entrepreneurs in building strong business credit and understanding how it can open doors for growth.

Gerri has answered thousands of credit questions online, written or coauthored six books — including Finance Your Own Business: Get on the Financing Fast Track — and has been interviewed in thousands of media stories as a trusted credit expert. Through her widely syndicated articles, webinars for organizations like SCORE and Small Business Development Centers, as well as educational videos, she makes complex financial topics clear and practical, empowering business owners to take control of their credit and grow healthier companies.