What affects your FICO credit score & how is your score calculated?

Gerri Detweiler

Education Consultant, Nav

Summary

- FICO® and VantageScore® create the main credit credit scoring formulas used by consumer lenders, insurance companies, and other businesses.

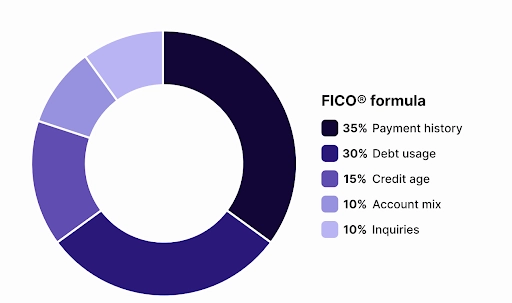

- FICO uses five main personal credit scoring factors: payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%), and account mix (10%).

- Of the main credit scoring factors, payment history, and amounts owed (debt) typically carry the most weight.

- Learn how each individual factor can affect your credit scores, and actions to consider if you are trying to build or rebuild good credit.

Editorial note: Our top priority is to give you the best financial information for your business. Nav may receive compensation from our partners, but that doesn’t affect our editors’ opinions or recommendations. Our partners cannot pay for favorable reviews. All content is accurate to the best of our knowledge when posted.

It takes more than on-time payments to build a good credit score. If your goal is to build or rebuild your credit, understanding the main credit scoring factors can help you decide where to focus your efforts.

Credit scoring models are complex and each one evaluates information in your credit report somewhat differently. There is no guarantee that a specific type of account(s) will improve your individual credit scores, or that any of the actions suggested here may improve your credit scores. Your results may vary.

What are the five main credit score factors?

FICO lists five main factors that affect credit scores:

- Payment history – 35%

- Amounts owed (debt/utilization) – 30%

- Length of credit history (credit age) – 15%

- Account mix (types of credit) – 10%

- New credit (inquiries) – 10%

Of the five factors, payment history carries the most weight. Paying on time is crucially important.

Amounts owed (or amount of debt) is close behind as the second most important factor, but there are nuances you’ll want to understand. The length or age of your credit history is third on the list in terms of importance, followed by account mix and new credit/inquiries.

Let’s look at each of the five factors in detail.

Start your business credit journey

Build business credit, monitor credit health, and accelerate growth — all with Nav Prime.

1. Payment history

Whether you pay bills on time is the single most important factor that makes up your personal credit scores. Again, there are some nuances to this factor you’ll want to understand.

Timing

With personal credit, payment activity typically falls into 30-day buckets; payments are categorized as on time/current, or 30, 60, 90, or 120 days late. Most lenders will not report a late payment on an account unless it is late by a full billing cycle.

For example, if your credit card bill is due on the 2nd of January, you probably won’t be reported late on your personal credit reports as long as your payment is received and credited to your account by the 1st of February.

Warning

A late payment can remain on your credit reports for up to seven years. But not all missed payments carry the same weight. Credit scoring models evaluate late payments in several ways:

- How many times were you late? The score often looks at the frequency of your missed payments. The more times you’ve paid late, the more your scores may suffer.

- How recently were you late? Recent information carries more weight. Late payments in the last two years typically have the greatest impact on your scores. Ironically, the better your score to begin with, the more it’s likely to drop due to a reported delinquency. In fact, a single late payment can drop a high score by 50–100 points or more!

- How late were you? Scoring models take into account the severity of late payments; 90 days late is worse than 30 days late, for example.

2. Amounts owed (including utilization)

The factor amount owed isn’t just about how much you owe on your loans and credit cards. While that may be part of the calculation, credit scores also look carefully at how you use the credit available to you.

Revolving credit utilization

Revolving utilization, or debt usage, compares balances to credit limits on revolving accounts — mainly credit cards but also lines of credit.

Let's say you have a credit card with a $1,000 limit, and your card issuer reports your balance as $500. Your debt usage ratio is 50%. If your limit is still $1,000 but your reported balance is $200, your debt usage ratio is 20%.

Nav Tip

To calculate utilization, divide the balance on your credit report by the credit limit, then multiply by 100 or move the decimal two places right.

Generally, lower utilization is better. Utilization above 20–25% may start to hurt your scores, but it also depends on other factors in your credit reports.

Debt usage is calculated on each individual account and in the aggregate (in other words, total limits across all revolving accounts vs. total balances).

Other debt-related factors

There are other ways your debt can affect your credit scores:

- Number of accounts with balances: Balances on many accounts may affect your credit scores, even if each individual balance is low.

- Installment loan paydown: Here the score can take into account how much you've paid down on installment loans (car loans, mortgages, student loans) compared to what you originally borrowed. Paying these down may help your scores.

- Amount owed by account type: Your total debt across different types of accounts (credit cards vs. loans) can factor into your scores. This also ties into the types of credit factor we’ll cover in a moment.

3. Length of credit history, or credit age

The "age of credit" or "length of credit history" factor looks at when you opened your first account, the average age of all your accounts, and when you opened your most recent one. Any type of account on your credit reports contributes to this factor — whether it's a mortgage, credit card, or car loan.

This factor makes up roughly 15% of consumer FICO scores.

FICO reports that consumers with the highest credit scores opened their first account, on average, twenty-five years ago, and the average age of all their accounts is eleven years.

However, you can still achieve a high FICO score with a shorter credit history if the rest of your credit report is strong. A longer history helps, but it's not the only factor that helps build good credit.

New and closed accounts

Opening new accounts lowers the average age of all your accounts. That doesn’t mean you shouldn’t open new accounts, but be thoughtful about which ones you really want, since this can affect your scores. (This overlaps with the next factor, new accounts.)

Closing an account doesn't immediately remove it from your credit reports, at least not right away. Most closed accounts remain on your reports for about ten years after closing and can continue to contribute to your credit history length during that time.

Start your business credit journey

Build business credit, monitor credit health, and accelerate growth — all with Nav Prime.

4. New credit (including inquiries)

The "new credit" factor makes up 10% of your FICO score. It focuses on recent credit checks and how many new accounts you've opened.

Credit inquiries

Credit inquiries are simply a record of when a lender, creditor, or other company reviews one of your credit reports or requests a credit score based on that information.

Hard inquiries: A hard inquiry (or "hard pull") occurs when you apply for new credit — a mortgage, car loan, credit card, or personal loan. Note that some business lenders check personal credit when evaluating business loan applications, which can create a hard inquiry on the business owner's personal credit file.

Hard inquiries can impact your credit scores, though different scoring models treat them differently. Typically, a hard inquiry may lower your score by three to seven points. The drop is usually small and temporary, but multiple inquiries in a short period can add up.

Soft inquiries: A soft inquiry occurs when your credit is reviewed, but not necessarily for a new credit decision. Common examples include checking your own credit score, pre-approved credit offers, employer background checks, or when your existing lenders review your account.

Soft inquiries don't affect your credit score, no matter how many occur. They're visible only to you when you review your report.

Inquiry groupings

Both FICO and VantageScore group certain types of hard inquiries so multiple checks for the same purpose count as one.

FICO consumer score models may group mortgage, auto, and student loan inquiries within a 15-, 30-, or 45-day window depending on the version used. Very old FICO models, including the version traditionally used for many mortgage loans, don't offer these groupings.

VantageScore uses a 14-day rolling window where all similar inquiries are treated as a single event.

Hard inquiries remain on your credit report for two years but typically only affect FICO scores for the first twelve months. After one year, many scoring models stop considering them in calculations, though VantageScore warns that inquiries may affect scores for up to two years.

An inquiry only appears on the credit report that was checked. If a lender checked your TransUnion report, that inquiry won't appear on your Equifax or Experian reports, for example.

New accounts opened

Beyond inquiries, this factor also considers how many new accounts you've opened recently and what types they are. Opening several new credit accounts in a short time represents greater risk — especially for people without a long credit history.

Opening a new account can impact your credit profile in a few ways:

- Average age: New accounts can lower the average age of all your accounts, which may impact your length of credit history.

- Credit utilization: Using a new credit card or line of credit increases your total balances, which can raise your utilization ratio and affect the "amounts owed" factor. But a new credit line can also raise your available credit, which may lower overall utilization.

- Credit mix: A new account may diversify your types of credit; for example, adding an installment loan when you only have credit cards. That may positively impact your credit mix.

- Payment history: Over time, consistently paying a new account on time can add to a positive payment history.

5. Account mix, or types of credit

Credit mix is one of the five main FICO score factors and accounts for about 10% of your consumer FICO score. It refers to the variety of credit accounts listed on your credit reports.

Consumers with the strongest credit scores tend to have a credit history with on-time payments for both revolving credit accounts (like credit cards) and installment accounts (like mortgages, student loans, or car loans).

Types of personal credit accounts

Credit accounts on consumer credit reports generally fall into two broad categories — revolving credit and installment credit. Having both types may help strengthen your credit profile.

Revolving credit

Revolving accounts provide credit with flexible monthly payment amounts, subject to minimum payments and due dates. Your available credit replenishes as you pay down balances.

Common revolving accounts include:

- Credit cards

- Retail store cards

- Gas cards

- Home equity lines of credit (HELOC)

Installment credit

Installment credit means you borrow a fixed amount and repay it in regular payments over a set time period. Once you pay off the loan, the account will be closed.

Common installment loans include:

- Mortgages

- Auto loans

- Student loans

- Personal loans

- Home equity loans

While having a good credit mix can help your score, it's only 10% of the calculation. It most likely won't determine whether you get approved for credit, but it can play a part if you're aiming for the highest possible score.

Start your business credit journey

Build business credit, monitor credit health, and accelerate growth — all with Nav Prime.

What you may find confusing about the five factors

The five factors sound simple enough, but there are two main reasons why people often find them difficult to understand — how they’re calculated and the different types of scores.

1. How credit scores are calculated

The reality is credit scores use sophisticated calculations.

Companies like FICO and VantageScore carefully analyze data in credit reports and track patterns over time to see which factors are linked to credit risk. Each factor can interact with others, making it harder to predict how much a particular action (a single late payment or inquiry, for example) will affect your individual credit scores.

2. Different kinds of scores

Another source of confusion is this: There are many different versions of credit scores, called credit scoring models.

Take FICO® scores, for example. Over the years, FICO has created more than 50fifty versions of FICO scores, including ones that lenders may customize for their own customer base. There is also a version called FICO® Small Business Scoring Service℠ (SBSS℠), or FICO SBSS scores, used specifically for small business loans.

Each credit scoring model may use the data that make up these categories a little differently.

Here’s an example. You can check your FICO score through your credit card company and on the same day visit an auto lender that also checks your FICO score. Those two numbers can be different for a couple of reasons:

- You viewed your credit score based on data from one credit bureau (Experian, for example), while the auto dealer used a credit report from a different credit bureau (Equifax, for example).

- The auto lender checked an auto score such as FICO® Auto Score 9, while you viewed a bankcard score like FICO® Bankcard Score 9.

The good news

If that all sounds puzzling, here’s the good news:

The basics apply no matter which scoring model is being used. By understanding what the five main factors are, and how they generally work, you can create a plan to build and maintain strong credit.

How long do credit score changes take to show up?

Credit bureaus generate scores using the data available when someone requests them, and that means your credit scores can change any time new information is reported.

Most creditors report to credit bureaus monthly, and that means most updates appear on your credit reports within 30–45 days.

Credit card payments and new balances typically show up within a week of your statement closing date.

Brand new accounts may sometimes take a couple of billing cycles to appear, and public records like bankruptcies can take 60–90 days to be reported.

The key takeaway: Any action you take to improve your credit — paying down debt, correcting mistakes — may impact your score after the updated information reaches the credit bureaus. But once the credit bureau has the information, any credit scores purchased will be based on the current data available.

Learn more in Nav’s guide: How often does my credit score change?

What moves each factor up or down

We will go into each of these factors in a moment, but here’s an overview of what may help and what may hurt your credit scores. Remember, this is highly individual.

Factor | Weight | What may help | What may hurt |

Payment history | 35% |

|

|

Amounts owed | 30% |

|

|

Length of credit history | 15% |

|

|

New credit | 10% |

|

|

Account mix | 10% |

|

|

Start your business credit journey

Build business credit, monitor credit health, and accelerate growth — all with Nav Prime.

How to help improve your credit scores quickly

Understanding the five main factors helps you focus your credit-building efforts where they'll have the most impact. Here are some practical steps you can take for each factor.

For full details, get Nav’s free guide, Smart credit strategies for small business owners.

1. Payment history (35%)

Your goal here is to have a credit report that includes a history of on-time payments and minimize negative payment information on your credit reports. Since this is the most important factor, even small improvements can make a difference in your scores.

- Set up autopay or payment reminders to avoid paying late.

- If you have late payments on your report, make sure they're accurate and dispute any errors.

- If you have multiple collection accounts for the same debt, dispute the older one(s).

- If you have fewer than two open, active credit accounts, consider opening additional accounts to build a payment history.

- A secured credit card or credit builder account can help if you're having trouble qualifying for other credit accounts.

2. Amounts owed/utilization (30%)

The overall goal here is credit utilization that doesn’t hurt your scores. Again, there’s no perfect ratio, but most consumers will find that utilization below 20–25% is a good goal to start.

- Pay off balances: Pay your credit card balances to below 25% of your credit limit and see how that impacts your scores; lower may be better.

- Pay earlier: If you charge a lot but pay in full each month, make your payment before your statement closing date to help lower reported balances.

- Try for an increase: Request a credit limit increase from your card issuer. It may not always work but it’s typically worth a shot.

- Consolidate: Consider consolidating credit card debt with a personal loan that doesn't count toward credit utilization.

- Consider switching cards: If you use personal credit cards for business purchases, consider using a business credit card that doesn't report regular activity to personal credit reports instead to separate your business and personal credit.

3. Length of credit history/credit age (15%)

This factor rewards older accounts and a longer average age across all your accounts. Since time is the main ingredient here, your focus should be on adding age where possible and avoiding actions that significantly lower your average account age.

- Become an authorized user: Ask a trusted family member to add you as an authorized user on one of their older credit card accounts with an on-time payment history and low balances, as the full account history typically appears on your report.

- Limit the number of inquiries: Avoid opening multiple new accounts at once, as this can lower your average account age.

4. New credit (10%)

The goal here is not necessarily to avoid shopping for credit all together, but to carefully minimize the number of recent hard inquiries on your credit reports and avoid opening too many new accounts in a short time frame.

- Limit your inquiries: Count the number of hard inquiries on each of your credit reports in the past year. Try to stay below 3—6 in the most recent year.

- Apply for multiple loans at once: When shopping for auto loans, mortgages, or student loans, you may want to apply to multiple lenders. If so, submit all applications within a 14-day window to help increase the chances they count as a single inquiry.

- Track your inquiries: Dispute any unauthorized hard inquiries that appear on your credit reports.

5. Account mix/types of credit (10%)

A mix of revolving credit (credit cards) and installment loans (mortgages, auto loans) paid on time can help strengthen your credit profile. If you're missing one type of credit entirely, adding it may help, but only take that on if it also makes financial sense.

- Consider adding a credit card: If you don't have at least two open revolving accounts (credit cards), consider getting one to build your credit history. (A secured card is an option if you're having trouble qualifying.) This may not be a good idea if you already have a lot of inquiries.

- Consider adding a loan: If you don't have an installment account, consider a credit builder loan or a personal loan to diversify your credit mix. Consider carefully if you already have a large number of inquiries on your reports.

The bottom line

Building strong credit isn’t about chasing quick fixes — it’s about understanding how the main credit scoring factors work together and making consistent, informed decisions over time.

While payment history and amounts owed tend to have the biggest impact, every factor plays a role in shaping your credit profile. By focusing on on-time payments, keeping debt manageable, being thoughtful about new credit, and letting your credit history age, you can put yourself in a better position to build or rebuild good credit.

Remember, credit scoring models may differ, but the fundamentals stay the same — and small, steady improvements can add up to meaningful results over time.

Start your business credit journey

Build business credit, monitor credit health, and accelerate growth — all with Nav Prime.

Frequently asked questions

Build your foundation with Nav Prime

Options for new businesses are often limited. The first years focus on building your profile and progressing.

Get the Main Street Makers newsletter

Rate this article

This article currently has 31 ratings with an average of 5 stars.

Gerri Detweiler

Education Consultant, Nav

Gerri Detweiler has spent more than 30 years helping people make sense of credit and financing, with a special focus on helping small business owners. As an Education Consultant for Nav, she guides entrepreneurs in building strong business credit and understanding how it can open doors for growth.

Gerri has answered thousands of credit questions online, written or coauthored six books — including Finance Your Own Business: Get on the Financing Fast Track — and has been interviewed in thousands of media stories as a trusted credit expert. Through her widely syndicated articles, webinars for organizations like SCORE and Small Business Development Centers, as well as educational videos, she makes complex financial topics clear and practical, empowering business owners to take control of their credit and grow healthier companies.