Equifax business credit reports: What’s included and how to use yours

Gerri Detweiler

Education Consultant, Nav

Summary

- The information in your Equifax® business credit report may affect your eligibility for small business loans and financing.

- Equifax creates several different business credit scores based on the information in your report.

- Learn what’s included in an Equifax business credit report, understand score ranges, and how to get and interpret your report.

Editorial note: Our top priority is to give you the best financial information for your business. Nav may receive compensation from our partners, but that doesn’t affect our editors’ opinions or recommendations. Our partners cannot pay for favorable reviews. All content is accurate to the best of our knowledge when posted.

You may have heard of Equifax from the personal credit space. But did you know they also offer small business credit reports and scores? Let's explore what those look like, what they offer small business owners, and how to read them.

What is an Equifax business credit report?

Think of it as one of your business’s financial resumes. An Equifax business credit report shows your company's credit history and financial track record, similar to how personal credit reports work for individuals. Lenders, suppliers, and even other companies can review it when deciding whether to do business with your company.

Equifax is one of the three major business credit bureaus, along with Experian and Dun & Bradstreet. Their reports help companies assess the risk of extending credit or services to your business.

An Equifax business credit report includes:

- Company information

- Credit accounts reported to Equifax

- Public records

- Inquiries

- Business credit score

There are three major commercial credit bureaus in the U.S. In addition to Equifax, your business may have business credit reports with Dun & Bradstreet and Experian.

What’s included in my Equifax business credit report?

Most Equifax business credit reports are purchased by companies that want to reduce risk when doing business with another business. Here are the main parts that are included when they buy your report:

What’s included in an Equifax business credit reports | |

Data | Description |

Company profile and background information | Business name, address, phone, tax ID, industry codes, principals, years in business, and employee count |

Credit accounts and payment history | Details on business loans, credit cards, lines of credit, and trade accounts with payment patterns |

Public records | Bankruptcies, liens, judgments, UCC filings, and business registration details |

Credit inquiries | Who has requested your credit report and when |

Credit scores and risk ratings | Numerical scores that predict your likelihood of paying on time or experiencing financial difficulty |

Company information

This section includes details such as business name and DBAs (doing business as), addresses, tax ID/EIN, business structure (corporation or LLC) and when it was established, number of employees, and industry codes (SIC and/or NAICS codes).

An Equifax identification number (EFX ID) will also be listed. This is a 9-digit number created by Equifax and used to track the business.

Nav Tip

When you start building business credit, it is helpful to build your business foundation to make sure these details best represent your business. Read Nav’s checklist to make your business legit to learn how.

Alerts and inquiries

Different sections of your report will list how many inquiries are on file, and when those inquiries occurred. Important: It won’t list the names of companies that inquired, so it can be hard to know who’s looking at your business report

While inquiries (aka “credit pulls”) will be listed, Equifax does not take inquiries into account when calculating risk scores.

Public records

A public record is information that is recorded by a public agency. On your business credit report, that typically means information filed with the courts such as lawsuits, liens (UCC filings and/or tax liens), judgments, and bankruptcy.

In addition to bankruptcy, liens, or judgments, this section will also include business registration information received from the Secretary of State or other sources. This can include:

- Registered name of the business

- Incorporation date

- State where incorporated

- Incorporation status

- Contact name and title

- Business address

Days beyond terms

This section summarizes payment history, the single most important factor that influences business credit scores. Business credit reports often use days beyond terms (DBT) to describe how many days after the due date a payment was made. For example, if your terms with a vendor is “net-30,” and you pay on day 34, the account will be reported as 4 DBT.

When you look at your Equifax business credit report, you’ll see a section that shows how quickly — or slowly — you’ve been paying your bills over the past 12 months. Specifically, it tracks the average number of days past due on your non-financial accounts (like vendors, suppliers, or service providers). Equifax also shows how your payment habits compare to other businesses in your same industry, as well as to all businesses nationwide. This makes it easier to see where you stand and how potential lenders or partners might view your payment reliability.

Payment index

Equifax also includes its Payment IndexTM, which shows how well your business has paid its bills. It’s based on the most recent non-financial payments, or payments not made to financial institutions like loans or credit cards, reported to Equifax. It gives more weight to larger payments.

Here’s how they suggest this be interpreted:

Payment index | Days past due |

90+ | Pays as agreed |

80–89 | 1–30 days past due |

60–79 | 31–60 days past due |

40–59 | 61–90 days past due |

20–39 | 91–120 |

1–19 | 121+ days past due |

Source: Equifax® Business Training Guide

Scores

You can also see your Equifax business credit scores on your report. We’ll talk about those in more detail in a moment.

Financial data

When available, the report may include general information about bank balances and returned checks, assets, real estate owned, inventory, and sales.

Report highlights

Equifax will summarize and feature information about your business’s credit history in this section. It may include:

- How long your company has actively had business credit accounts

- How many accounts have been opened/closed/updated

- Delinquencies (new delinquencies, non-charge offs and charge offs, including amount)

- Most severe status

- Single highest credit extended

- Total current credit exposure and highest credit exposure

- Number of inquiries

It will also summarize and analyze open accounts, with:

- Total/median/average balance

- Current portion of balance due

- Delinquent accounts that haven’t been written off as a loss

- Total past due and at-risk balance

Tradelines

If your business has credit accounts like net-30 tradelines listed on your Equifax business credit reports, the report will go into detail about these tradelines. It might include the balance, amount past due, payment due, and other relevant details.

Because Equifax also operates a consumer credit reporting agency, it can produce blended credit scores that include information about the owner’s personal credit along with commercial credit data about the business.

(This is optional and available with some credit scores. Consumer data is governed by the Fair Credit Reporting Act, which limits access to only those allowed, like when someone applies for a personal loan and approves a credit check.)

Equifax business credit scores and risk ranges

When it comes to business credit scores, there’s a twist — unlike Equifax consumer credit scores that range from 300–850, Equifax produces several credit scores for use in business, each with its own credit score range:

Scoring model | Description | Score range |

Business Delinquency Financial ScoreTM | Predicts the likelihood of severe delinquency (91+ days late), charge-off (a lender writes off the debt as lost), or bankruptcy on financial services accounts, like loans. | 101–715 |

Business Delinquency ScoreTM | Predicts the likelihood of severe delinquency, charge-off, or bankruptcy within the next 12 months. | 101–662 |

The Business Failure Risk Score™ | Predicts the likelihood of business failure through either formal or informal bankruptcy within the next 12 months. | 1000–1604 |

Equifax® OneScore for Commercial | Predicts the likelihood of a financial account becoming severely delinquent, including major derogatory events and bankruptcies, within 24 months after opening a financial account. | 300–660 |

Business Failure Risk Class™ | A high-level representation of the Equifax® Business Failure Risk Scoring System. Businesses are grouped into 5 risk classes based on the Business Failure Risk Score. | 1–5 |

Unless otherwise noted, a higher score equals lower risk. With several of these scores, a “0” indicates you have a bankruptcy on file.

Nav Tip

Both the Business Delinquency Score and Business Delinquency Financial Score offer the option to blend consumer credit information with business credit data. In other words, information about your personal credit can be reviewed along with your business credit to create a single blended score. This matters because lenders often look at both when deciding whether to approve you for a loan, credit card, or even vendor terms, meaning your personal credit can directly impact your business’s ability to access funding.

Equifax also offers scoring solutions that can help lenders determine credit limits. These include suggested credit limits for suppliers, credit card issuers, or those offering loans. Equifax does not set credit limits, though; these tools are designed to be used as guidelines by lenders who will decide themselves the credit limit to set.

How are Equifax business credit scores calculated?

It helps to know what impacts your score so you know what to focus on. Equifax uses several factors to calculate your business credit scores — with payment history being the most significant. Understanding these factors helps you focus your efforts on what matters most for improving your scores.

Top factor: payment history

Your track record of paying bills on time carries the heaviest weight in Equifax scoring models. Depending on the scoring model and data available, this can include:

- Days beyond terms on trade accounts with suppliers and vendors

- Payment patterns on business credit cards and loans

- Whether you pay within agreed terms (like net-30)

- Consistency of on-time payments over the past 12–24 months

Collection accounts

It’s worth noting that Equifax does not report collection data from third parties, like collection agencies. However, a creditor can note the status of an account as in “in collection” and it would be considered negative.

Credit utilization

How much of your available credit you're using may affect your scores. High balances relative to credit limits can signal financial stress, while keeping balances low demonstrates good credit management.

There’s a twist here though: Many lenders that report to business credit don’t report credit limits. In that case, the scoring model may substitute a recent high balance for this information.

Public records

Public records include information available from the courts. Negative public filings can significantly damage your scores:

- Tax liens and judgments

- Bankruptcies and legal actions

- Unpaid obligations to government agencies

- UCC filings (depending on how many, exposure)

Industry risk classification

Equifax can consider your business type/industry when calculating scores. Some industries are viewed as higher risk due to economic volatility, seasonal fluctuations, or regulatory challenges.

Nav Tip

Make sure you choose the right industry codes (SIC or NAICS codes) to help avoid your business being miscategorized.

Length of credit history

Businesses with longer credit histories and established relationships with creditors typically receive higher scores. New businesses often start with lower scores until they build a payment track record.

Account mix

Having a variety of credit types (trade accounts, business credit cards, and financial accounts like term loans) can positively impact scores.

The specific weight given to each factor varies by scoring model, but you can safely assume that payment history is the top factor no matter which credit scoring model a lender purchases.

How do I get my Equifax business credit report?

There are a couple of ways you can access your Equifax business credit reports.

With Equifax

You can go directly to Equifax and request a credit report on your own business (you can also request credit reports on other businesses) for a fee. A single business credit report currently costs $49.95.

With Nav Prime

With Nav Prime, you can get detailed credit reports and scores* from multiple business credit bureaus, including business and personal credit reports from Equifax, for less than if you purchased the reports individually from all the credit bureaus.

Using Nav can help you understand what information companies are reporting about your business, as well as view both business and personal credit in one spot.

In your Nav Credit Health dashboard, you can see trends in your credit, key factors having the most impact on your scores, and what to focus on next.

You’ll also get details on public records, including UCC filings, that can directly and indirectly impact financing or other opportunities.

Start your business credit journey

Build business credit, monitor credit health, and accelerate growth — all with Nav Prime.

Read: How to check business credit scores and reports

How to read and interpret your report

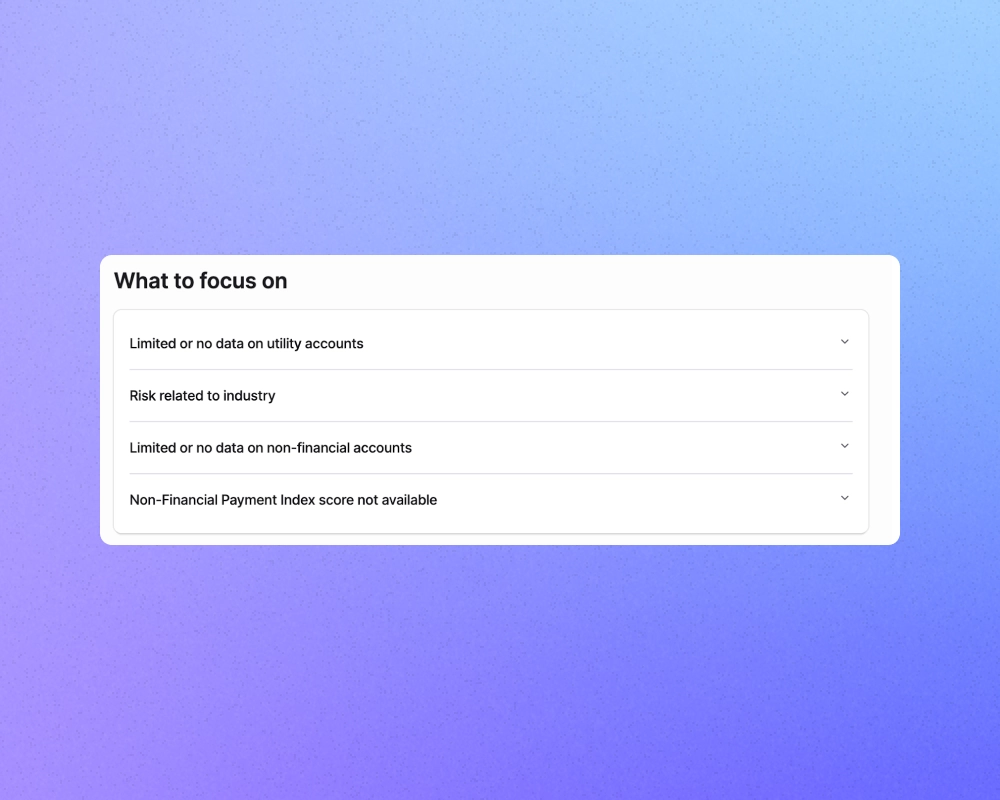

If you check your Equifax business credit report through Nav Prime, the first thing you’ll notice is the section titled What to focus on. It will give you a list of the top factors impacting your credit score.

Here’s an example:

Carefully evaluate each factor in more detail, and decide which you may be able to improve. In the example above, one of the reasons given is:

Limited or no data on utility accounts

There's a lack of data about your utility accounts (e.g., electricity or internet). A lack of this data creates gaps in your credit profile, potentially lowering your score. Confirm that utility providers report your payment history to credit bureaus.

If you work from a home office, you may not be able to get a utility bill in the name of your business. In that case, you may want to look at another factor.

Another reason listed is:

Limited or no data on non-financial accounts

Equifax has limited or no data about your non-financial accounts (e.g., vendors or suppliers). Without sufficient data, your creditworthiness is harder to assess, which often results in a lower score. Establish tradelines with vendors that report to business credit bureaus.

This business owner could get tradelines through vendors that report to Equifax business credit and pay on time to help build a credit history.

Your Equifax business credit report obtained with a Nav Prime account will also list information about the following key factors:

1. Active tradelines

An active tradeline is a business credit account (like a vendor account, line of credit, or loan) you’re currently using.

Equifax reports accounts (tradelines) for up to 24 months, whether negative or not.

Here you’ll see:

- Type of account (category)

- Current balance

- DBT

- Balance owed

2. Public filings

Public filings are any business records available to the public, including bankruptcies, liens, or collections. Review this section carefully to make sure any information reported is correct and belongs to your business. Equifax does not report UCC filings.

If you don’t see any information in this category, it means Equifax doesn’t have information about public filings for your business.

3. Balances with terms

Balances within terms are outstanding amounts you owe that are within the payment schedule or due date (meaning not overdue). Accounts paid on time can be helpful for establishing a strong credit history.

4. Business profile

You’ll also see company information including:

- Industry codes (NAICS and SIC codes)

- Number of employees

- Legal business name

- Equifax ID

- Business type

- Business address

- Phone numbers

- Website URL

- Years in business

- State of incorporation

- Key personnel

Review this information to see if it is accurate and up to date. If there is a strong mismatch with the information on your credit application and this company data, it may cause problems.

How to improve your Equifax business credit score

Whether you're starting from scratch or looking to boost an existing score, these strategies can help you build stronger business credit with Equifax.

1. Pay all bills on time

This is the single most effective action you can take. Late payments hurt your scores more than any other factor, so prioritize:

- Trade accounts and supplier payments

- Business credit card balances

- Loan and line of credit payments

- Even small vendor accounts matter

2. Keep credit balances low

High credit utilization signals financial stress to lenders. Aim to use less than 30% of your available credit limits across all accounts.

3. Establish reporting trade accounts

Many businesses have "thin files" because they don't have enough accounts reporting to credit bureaus. Build your credit profile by adding:

- Net-30 supplier accounts that report to Equifax

- Vendor credit arrangements

- Business relationships with reporting creditors

4. Get business credit cards that report

Business credit cards often report to major business credit bureaus, though some report through the Small Business Financial Exchange (SBFE) rather than directly to Equifax. Still, that data may be used by lenders who purchase those reports from Equifax.

5. Consider business financing

Small business loans and lines of credit can strengthen your credit mix when they report to Equifax or the SBFE network.

6. Resolve public record issues

Resolve liens, judgments, or tax obligations as quickly as possible. These negative items can severely damage your scores.

7. Monitor and dispute errors

Check your Equifax business credit report regularly and dispute any inaccurate information that could be dragging down your scores.

8. Be patient with new accounts

Be strategic about applying for new credit. Consider spacing out applications and focus on maintaining good payment history on existing accounts.

Building strong business credit takes time, but consistent on-time payments and smart credit management can steadily improve your Equifax scores.

Finding and correcting errors on Equifax business credit reports

Here are three steps to finding and correcting errors on your business credit reports:

1. Get your report

Whether you get your report from Nav Prime each month or go directly to Equifax, get a copy of your business credit report so you can see what information they have about your business. Because some of the information about your business comes from the public record, it’s not uncommon for there to be errors, omissions, or other incorrect information.

2. Dispute inaccurate or incomplete information

If you find any information that needs to be corrected, you can file a dispute with Equifax. Equifax will investigate and will typically return with the results of the investigation within 30 days. If there is a verifiable error, Equifax will update your business credit report.

3. Regularly monitor your business credit

It’s human nature to positively impact the metrics we pay the most attention to — that includes your business credit profile. Regularly monitoring what is included in your business credit report will help you build a strong business profile that can help you access small business loans and financing when you need it.

Start your business credit journey

Build business credit, monitor credit health, and accelerate growth — all with Nav Prime.

Business credit is one of the most misunderstood aspects of running a small business, but is an important part of building a healthy and thriving company.

Nav Technologies, Inc is a financial technology company and is not an FDIC-insured bank. Banking services provided by Thread Bank, Member FDIC. The Nav Prime charge card is issued by Thread Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa cards are accepted. See Cardholder Terms for additional details. All other features of the Nav Prime membership are not associated with Thread Bank.

Nav provides access to Experian™ Intelliscore PlusSM V2, Equifax® Business Delinquency Score®, TransUnion®VantageScore® 3.0, D&B PAYDEX®, and Experian™ VantageScore® 3.0. VantageScore is a registered trademark of VantageScore, LLC.

Build your foundation with Nav Prime

Options for new businesses are often limited. The first years focus on building your profile and progressing.

Get the Main Street Makers newsletter

Rate this article

This article has not yet been rated

Gerri Detweiler

Education Consultant, Nav

Gerri Detweiler has spent more than 30 years helping people make sense of credit and financing, with a special focus on helping small business owners. As an Education Consultant for Nav, she guides entrepreneurs in building strong business credit and understanding how it can open doors for growth.

Gerri has answered thousands of credit questions online, written or coauthored six books — including Finance Your Own Business: Get on the Financing Fast Track — and has been interviewed in thousands of media stories as a trusted credit expert. Through her widely syndicated articles, webinars for organizations like SCORE and Small Business Development Centers, as well as educational videos, she makes complex financial topics clear and practical, empowering business owners to take control of their credit and grow healthier companies.