Decoding a Loan Offer from BondStreet

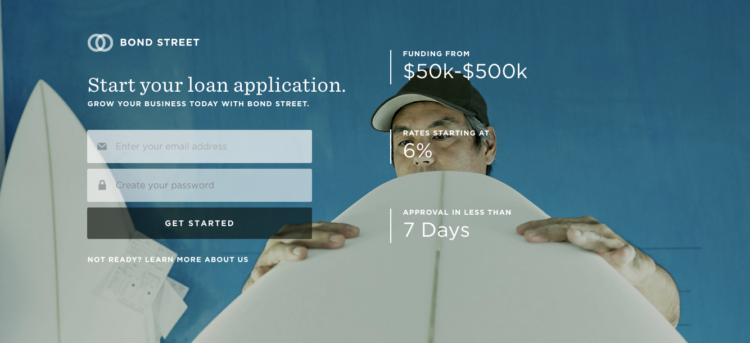

Bond Street, a business lender which made its first loan a year ago recently closed $110M of financing from Spark Capital and Jefferies. From the first look, they are an online term loan lender just like FundingCircle or Dealstruck. We decided to do a deep dive on their application. Here is what we found. Rates & Fees & Requirements Their APRs are between 8-25% for loans that will be repaid in 1-3 years. The basic requirements are 2 years in… Read More

![How Much Money Do You Need to Start a Business? [Infographic]](https://www.nav.com/wp-content/uploads/2015/06/start_biz_cover-750x343.jpg)