2018 Business Credit Snapshot by State

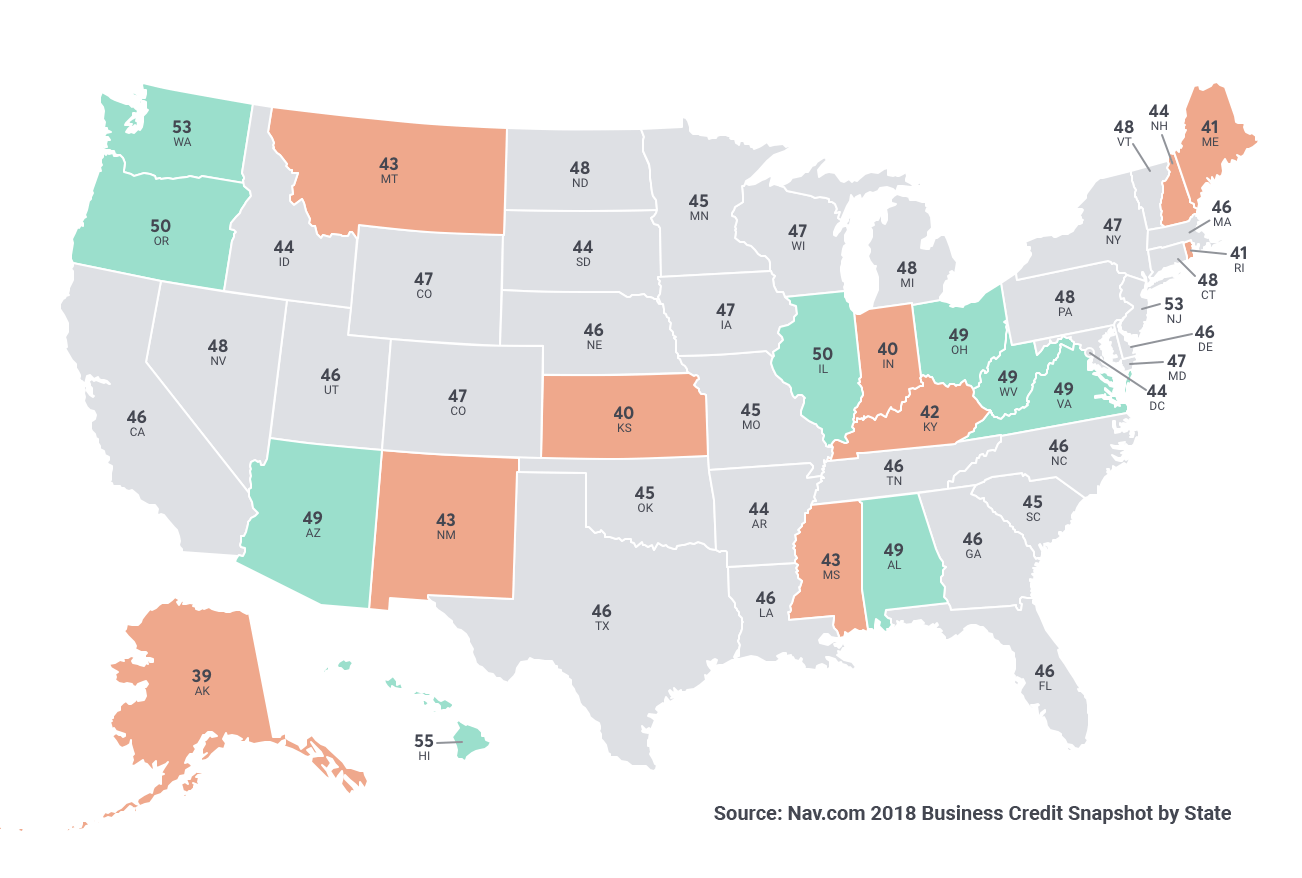

SAN MATEO, Calif., March 28, 2018 — Nav, a free site that helps small business owners manage and leverage their financial data, released its second annual Business Credit Snapshot by State. In the report, Nav ranks each U.S. state by taking the business credit scores of 15,478 of its small business customers and calculating the average score for each state.

- Hawaii ranked best, averaging a business credit score of 54.6 on the Experian Intelliscore Plus℠ scale of 0 to 100.

- Alaska ranked last, averaging a business credit score of 38.7

A number of surveys look at consumer credit scores, but there’s much less information available on the credit health of America’s small businesses. Both personal and business credit scores can impact a business owner’s ability to get approved for business credit cards, loans and trade credit. The higher a state’s business credit score, the easier it is for business owners to get money to expand, hire employees or get through cash flow crunches.

Nav’s 2018 Business Credit Snapshot by State shines a light on where business owners have healthier credit scores, as well as some surprising regional and year-over-year trends.

2018 Average Business Credit Score By State

The Experian Intelliscore Plus℠

Experian’s Intelliscore Plus℠ business credit score is a numerical score that ranges from 1 to 100, and can provide insight on how much of a risk a business may be.

BAD SCORE

1-10

HIGH RISK

POOR SCORE

11-25

MEDIUM-HIGH RISK

FAIR SCORE

26-50

MEDIUM RISK

GOOD SCORE

51-75

MEDIUM-LOW RISK

GREAT SCORE

76-100

LOW RISK

Rankings & Trends

The top 5 states

Hawaii ranked best with an average business credit score of 54.6, followed by Washington (52.6), Illinois (50.0), Oregon (49.7), and West Virginia (49.4).

The bottom 5 states

Alaska ranked last with an average business credit score of 38.7, followed by Kansas (39.7), Indiana (40.0), Maine (40.7), and Rhode Island (41.3).

2017 comparisons

Business credit scores have a narrow range (from 0 to 100), which means a small change in score can mean a big difference in rank. First-placed Hawaii and last-placed Alaska were only separated by 16 points.

Oregon, Alabama and Michigan were the only states to repeat from last year’s top ten list. While New Hampshire and Maine, who both ranked near the top of the list in 2017, fell near the bottom of the pack this year, ranking 46th and 48th respectively.

A tale of two rust belts

West Virginia, Ohio and Illinois all ranked in the top 10, while Kentucky and Indiana each ranked in the bottom 10.

Consumer credit correlation?

Hawaii is the only state that placed in the top 10 of both consumer and business credit scores. Alabama and West Virginia are among the states with lowest consumer scores, but made the top ten of business credit scores.

Methodology

To generate average business credit scores by state, Nav examined Experian’s Intelliscore Plus℠ business credit score from 15,478 of its small business customers. Each credit score was grouped together by state and Nav averaged together each business’s’ credit in each state. Consumer credit data was sourced from Experian’s 2017 State of Credit report.