Updated July 28, 2021 to include the new SBA PPP Direct Forgiveness Portal.

This 3508EZ PPP Forgiveness Application form may be used by businesses with PPP loans of more than $150,000 who qualify based on SBA requirements we’ll discuss in a moment. It’s designed to be more streamlined than the full forgiveness application form 3508. The SBA updated the PPP Loan Forgiveness Application Form 3508EZ on January 16, 2021. Make sure you are using the latest version.

The material contained in this article is for informational purposes only, is general in nature, and should not be relied upon or construed as a legal opinion or legal advice. Please keep in mind this information is changing rapidly and is based on our current understanding of the programs. It can and likely will change. Although we will be monitoring and updating this as new information becomes available, please do not rely solely on this for your financial decisions. We encourage you to consult with your lawyers, CPAs and Financial Advisors.

While applying for forgiveness may still seem daunting—- even with this simper form— the 3508EZ form requires fewer calculations and less documentation for eligible borrowers than the full forgiveness application.

Here we’ll walk through the application. If you have questions that aren’t answered on the application itself you may find answers in the SBA guidance.

Who can use the 3508EZ form?

The 3508EZ form is designed for businesses that borrowed more than $150,000 for their first or second draw PPP loan and who meet at least one of the following criteria:

Filling out Form 3508EZ

If you plan to use this form to qualify for forgiveness, we recommend you print out the PPP Forgiveness Application Form 3508EZ and follow along here. Your lender may use an electronic version of this form but if you have it handy, it won’t hurt to have this information already filled out.

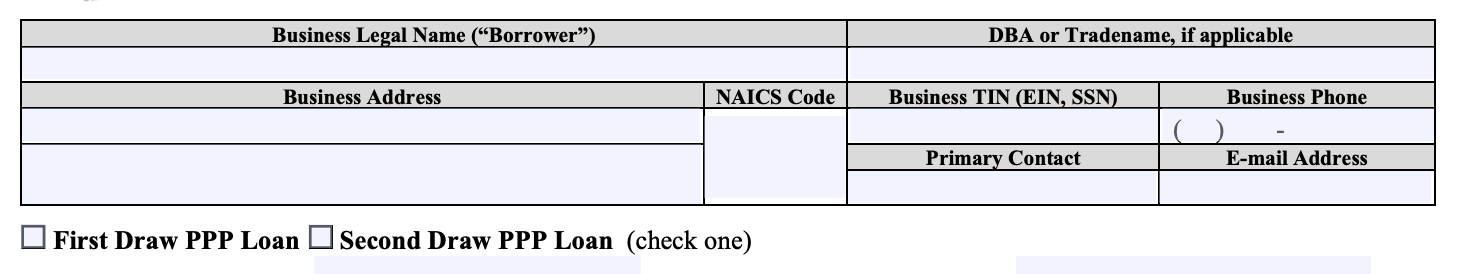

First fill out basic information about your business. Unless your business address has changed, this should be the same as the information you used when you applied for PPP:

If this is your first PPP loan, check the box that says First Draw PPP Loan. If it’s your second PPP loan, check the box that says Second Draw PPP Loan.

Note: You must submit a forgiveness application for your first PPP loan before, or at the same time, as the second draw forgiveness application is submitted.

SBA PPP Loan Number: ________________________

This is the number assigned by the SBA to your loan. If you don’t have it, ask your lender.

Lender PPP Loan Number: __________________________

Enter the loan number assigned to the PPP loan by the Lender. Again, if you don’t know, ask your lender.

PPP Loan Amount: _____________________________

This is the amount you received.

PPP Loan Disbursement Date: _______________________

Again, this is when the funds were deposited in your bank account. If you received more than one disbursement, use the date of the first one.

Employees at Time of Loan Application: ___________

Enter the total number of employees at the time of the Borrower’s PPP Loan Application.

Employees at Time of Forgiveness Application: ___________

Enter the total number of employees at the time the borrower is applying for loan forgiveness.

Check the box if the Borrower, together with its affiliates (to the extent required under SBA’s interim final rule on affiliates (85 FR 20817 (April 15, 2020)) and not waived under 15 U.S.C. 636(a)(36)(D)(iv)), received PPP loans with an original principal amount in excess of $2 million. If you received more than $2 million (with affiliates) make sure you review this with your advisors.

Forgiveness Amount Calculations

Payroll and Nonpayroll Costs

Line 1: Payroll Costs

Employee Benefits: The total amount paid by the Borrower for:

- Employer contributions for employee group health, life, disability, vision, or dental insurance, including employer contributions to a self-insured, employer-sponsored group health plan, but excluding any pre-tax or after-tax contributions by employees. Do not add employer health insurance contributions made on behalf of a self-employed individual, general partners, or owner-employees of an S-corporation, because such payments are already included in their compensation.

- Employer contributions to employee retirement plans, excluding any pre-tax or after-tax contributions by employees. Do not add employer retirement contributions made on behalf of a self-employed individual or general partners, because such payments are already included in their compensation.

- Employer state and local taxes paid by the borrower and assessed on employee compensation (e.g., state unemployment insurance tax), excluding any taxes withheld from employee earnings.

Owner Compensation: Any amounts paid to owners (owner-employees (with an ownership stake of 5% or more), a self employed individual, or general partners). For each individual owner in total across all businesses, this amount is capped at

(a) $20,833 (the 2.5-month equivalent of $100,000 per year), or

(b) the 2.5-month equivalent of the individual’s applicable compensation in the year that was used to calculate the loan amount (2019 or 2020), whichever is lower.

Nonpayroll Costs

Next, you’ll fill out information about nonpayroll costs. You only need to include these if you want to apply for forgiveness for these amounts. If you qualify for full forgiveness based on payroll costs and/or you don’t want to apply for forgiveness based on nonpayroll costs, you can put 0 in Lines 2-8.

Eligible nonpayroll costs cannot exceed 40% of the total forgiveness amount. Count nonpayroll costs that were both paid and incurred only once.

Line 2. Business Mortgage Interest Payments:_______

Enter the amount of business mortgage interest payments (not including any prepayment or payment of principal) paid or incurred during the covered period for any business mortgage obligation on real or personal property incurred before February 15, 2020. Do not include prepayments.

Line 3. Business Rent or Lease Payments: ______

Enter the amount of business rent or lease payments paid or incurred for real or personal property during the covered period, pursuant to lease agreements in force before February 15, 2020.

Line 4. Business Utility Payments:______

Enter the amount of business utility payments (business payments for a service for the distribution of electricity, gas, water, telephone, transportation, or internet access) paid or incurred during the covered period, for business utilities for which service began before February 15, 2020.

Line 5. Covered Operations Expenditures: _____________________

Enter the amount of covered operations expenditures paid or incurred during the covered period. The application defines these as “payments for any business software or cloud computing service that facilitates business operations, product or service delivery, the processing, payment, or tracking of payroll expenses, human resources, sales and billing functions, or accounting of tracking of supplies, inventory, records, and expenses.”

Line 6. Covered Property Damage Costs: _____________________

Enter the amount of covered property damage costs paid or incurred during the covered period. The application defines these as “costs related to property damage and vandalism or looting due to public disturbances that occurred during 2020 that were not covered by insurance or other compensation.”

Line 7. Covered Supplier Costs: _____________________

Enter the amount of covered supplier costs paid or incurred during the covered period. These are defined in the application as “expenditures made to a supplier of goods for the supply of goods that are essential to the operations of the borrower at the time at which the expenditure is made, and made pursuant to a contract, order, or purchase order in effect prior to the beginning of the covered period (for perishable goods, the contract, order, or purchase order may have been in effect before or at any time during the covered period).”

Line 8. Covered Worker Protection Expenditures:________________

Enter the amount of covered worker protection expenditures paid or incurred during the covered period. These are defined in the application as “operating or capital expenditures that facilitate the adaptation of the business activities of an entity to comply with the requirements established or guidance issued by the Department of Health and Human Services, the Centers for Disease Control, or the Occupational Safety and Health Administration, or any equivalent requirements established or guidance issued by a State or local government, during the period starting March 1, 2020 and ending on the date on which the national emergency declared by the President with respect to the Coronavirus Disease 2019 (COVID-19) expires related to maintenance standards for sanitation, social distancing, or any other worker or customer safety requirement related to COVID-19, but does not include residential real property or intangible property.”

Potential Forgiveness Amounts

Now comes the fun part. You get to find out whether you qualify for full forgiveness. Hopefully you will!

Line 9. Sum the amounts on lines 1-8: ________

Line 10. PPP Loan Amount: _______

Line 11. Payroll Cost 60% Requirement (divide Line 1 by 0.60): _____

Divide (don’t multiply!) the amount on line 1 by 0.60, and enter the amount. This determines whether at least 60% of the potential forgiveness amount was used for payroll costs.

Forgiveness Amount

Line 12. Forgiveness Amount (enter the smallest of Lines 9, 10, and 11): _______

That’s the end of the calculation. Congratulations!

Unfortunately, we’re not done yet. There are three more parts to the application:

- Representations and Certifications

- Documentation

- Borrower Demographic Information (optional)

Representations and Certifications

There is a full list of certifications on page two of the application that the borrower will need to initial. We won’t repeat them all here but you should read them carefully and if you have any questions about whether you can answer them affirmatively, talk to your attorney or tax professional.

Documentation

Certain documentation will have to be included with your forgiveness application. You can find the documentation requirements starting on page 4 of the application form.

You must retain required documents for six years after the date the loan is forgiven or repaid in full, and permit authorized representatives of SBA, including representatives of its Office of Inspector General, to access such files upon request. Keep good records!

This article was originally written on June 17, 2020 and updated on December 14, 2021.

Just wanted to know where to submit 3508EZ form for my foregiveness loan I received in July for 15,000.00

To your lender or to the SBA forgiveness portal if they participate.

on the sba.gov site:

https://www.sba.gov/document/sba-form-3508ez-ppp-ez-loan-forgiveness-application-instructions

there are versions 1-7 of the 3508EZ application.

The earlier versions allow “Alternative Payroll Covered Period”. The later don’t. Why? Can I still use Version 1 and use Alternative Payroll Covered Period? This is for my PPP loan disbursed on May1st 2020.

The alternative covered period was essentially made moot by the Economic Aid Act which provides borrowers with the flexibility to choose the end of their Covered Period using 8 to 24 weeks from loan disbursement.

Can you explain what the relevance is of “the number of employees at the time of the forgiveness application”? If the forgiveness is based on number of FTE’s during the “Covered Period”, what is the relevance of the number of employees at the time we submit the application? Thank you

It may be statistical information for the SBA.

But where do you send the form?

Doesn’t form 3508EZ also apply for loans of UNDER $150,000?

After filling out the form — WHERE does it go??

The SBA now wants anyone with a loan of $150,000 or less to use 3508S but you still have to do the math and that’s not on the 3508s form. That’s why I recommend you fill out the 3508EZ to verify your forgiveness amount. Just hold on to it. You’ll only need to share it with the SBA if your loan is audited. You’ll apply for forgiveness with your PPP lender and presumably there you will use 3508S – or more likely an electronic version of it.

You always apply for forgiveness through your lender, or the company servicing your loan if your lender has assigned it to someone else. They will likely use an online version of the form. If you file 3508S we recommend you fill one of the other forms out (3508EZ or 3508 depending on your situation) and just keep a copy in case you are audited by the SBA.

Do I fill out the 3508EZ I am a independent contractor that receive a PPP loan as a independent contractor

If you borrowed less than $50,000 on your PPP loan look at this article about form 3508S.

what if you are seasonal worker with only being paid in cash

Unfortunately I don’t think you will be eligible to apply.

What if your an independent contractor and you simply used 100% of the PPP loan towards payroll/commissions? If I had a $18,000 PPP loan that is, couldn’t i simply apply the full $18,000 to lost wages? Do I have to fill out the mortgage interest and utility information? It clear that mortgage interest and utility expenses would be far less than lost wages.

Yes it is entirely possible for independent contractors to qualify based solely on payroll. Did you see the newer forgiveness form that they came out with? 3508S may be even easier for you. Just follow the instructions on the application. Keep in mind you’ll want to check with your lender as they may put forms into an online portal.

I am completing the simplified loan forgiveness application for my church. We had 4.5 employees through the period covered by our PPP loan. One of our full time employees had since requested and was approved to go to part time status. We now have 4.0 full time equivalent employees. The loan forgiveness application asks for the number of employees at the time we complete the application. Was it 4.5 because that was the number at the end of the period covered by our loan, or Is it 4.0, the number we have today? If it is 4.0, can I include an explanation that the original number, 4.5, was constant throughout the time cover by the loan?

The application instructions state:

Employees at Time of Loan Application: Enter the total number of employees at the time of the PPP Loan Application.

Employees at Time of Forgiveness Application: Enter the total number of employees at the time the Borrower is applying for

loan forgiveness.

That part is before the calculation for forgiveness section which starts at line 1. My guess it is partly for government statistical purposes – perhaps to track the impact of this program.

When in doubt just follow what the instructions say for each line even if it doesn’t make logical sense. And don’t hesitate to reach out to an accounting professional familiar with this application if you need more help. Any loan amount that is forgiven is free money to the business (in your case, church) – it can be well worth it to get advice to make sure you are filling it out correctly.

Does the lender turn in anything with the EZ form or do they solely submit that for forgiveness?

Lenders have their own instructions and from what we’re seeing different lenders are handling it differently. There’s still some lack of clarity on certain issues unfortunately.

This article was very helpful~ thank you!

Regarding the covered period (and listing FTE numbers during the covered period), if we have fully used up our loan funding within 12 or so weeks, would our covered period information (including the number of employees or FTEs during the covered period) be for the full 24 weeks, or just the period that we are submitting expenses for forgiveness for (so the 12 weeks it took to use up our CARES act loan amount?

Karen – I’d suggest you just follow the application instructions as carefully as you can. If you go step by step through the instructions it tells you to use the 24 week covered period (or the alternative covered period) if that’s the period you are using. Most borrowers will be eligible for full forgiveness even though the loan amount they received and the new covered period are a different period of time. (Confusing but the changes are a net benefit in general.)

We received a $10,000 EIDL which is labeled EIDLADV on our bank statement. We were later offered an EIDL loan which we did not accept. I assume the ADV after the EIDL means “advance” and that we must repay it on our PPP Foregiveness EZ form. Am I correct?

If you did not accept the loan then that should be the advance. (I’ve seen it as EIDLG not EIDLADV but I have seen other comments that seem to indicate that’s another way it is classified on the ACH deposit.) You can always contact the SBA to confirm.

I have started my 3508EZ form and I am trying to figure out what is the proper documentation for owners compensation. I don’t use a payroll company, I simply tranfers funds from my business to personal account for my compensation. Do I simply submit my schedule C or show the transactions during the allowable period that we’re for owners compensation?

It’s my understanding that Schedule C will be sufficient in this scenario but it is possible additional guidance will come from the SBA. Ultimately you’ll want to check with your lender as they will process your forgiveness application.

I made an error on the easy form and submitted the wrong documents, now i’m not able to change or submit thge correct form. is there a way to delete and upload the correct documents?

Theresa – I assume you filled it out with your lender so you’ll need to reach out to them.

We were told that the EIDL was a grant and did not have to be repaid. It looks like that may not be true. The lost payroll cost for the 24 week period would be 12,000 for us and the rent $6,453 during that period ( of which only 4,000 could be claimed?. It seems like our costs would be enough to qualify for forgiveness of the $10,000 until you enter the smallest of lines 5, 6 and 7. The smallest is 7200 which is 60% of the payroll lost during the 24 weeks. This makes it look like we have to repay $2800. What are we not understanding?

For EIDL, the portion that is a grant should be deposited into your account with the notation EIDL-G. The grant does not have to be repaid. The loan, if you accept one, does.

Unfortunately I am having a had time following your example on PPP. The biggest mistake I see people make is that on line 7 they multiply by .60 not divide. Make sure you are dividing by .60.

If I am on the 24 week loan forgiveness period, can I divide the PPP loan by 24 and claim 1/24 of the loan amount as owner compensation replacement each week? I am self employed, schedule C, no employees. Also, I received an EID grant, but did not apply for an EIDL loan. Should I still include my EIDL application number, even though the application is now closed? Thank you!

Alli – Most self employed borrowers will be eligible for full forgiveness as long as they applied for the correct amount. I have not seen any guidance from Treasury or SBA that requires PPP applicants to pay themselves on a specific schedule (once a week, once a month or even on a lump sum for example.)

As for the EIDL question, your lender may ask about that when you apply for forgiveness as the grant reduces PPP forgiveness. I’d recommend checking with your lender.

If I am a corporation with 10 employees and I had them full time and did not reduce their hours can I use the EZ application. I think there was some confusion with my bank saying I had to be a Self employed/self contractor.

You don’t have to be self-employed to use the EZ application as long as you meet the criteria spelled out on the application and instructions– also listed in this article.

I am filling out the ppp loan forgiveness form.

I cannot find sba loan number. It says to get it from the Lender. Who is my Lender the? Bank of America?

I also do not know where to send paperwork to. Do I give it to BOA?

All of my employees are considered full time and are paid by the hour. However, there are times that they do not work the full 40 hours in a week (for reasons of their own) and are paid accordingly. Would this be considered a reduction in the average paid hours?

Stacia – I don’t feel comfortable giving advice on specific questions about FTE reductions due to the complexity of the guidance. I’d suggest you read the application instructions carefully and seek advice from an accounting or financial professional if you still have questions.

Line 7 on the Form 3508EZ has me confused as well. Our payroll costs – Line 1 = $183,649.00. Divide that by 0.060 = 306081.66. My question is – do I move the decimal point 2 to the left? If that is correct, then the forgiveness amount is – $3,060.82. Subtract that from our loan amount ($197,100.00 – 3.060.82 = $194,039.18). So basically we are forgiven $3,060.82 and have to pay the $194,039.18 back???? Sorry . . . . I just want to make sure I get this right!!!!!

Did you divide by .60 or multiply? That seems to be the biggest source of confusion.

I just received PPP loan $15,000 on July 3. Can I wait and star distribution of payroll to myself end of July? I am self employed with no income at this time, I am collecting Unemployment + the extra$600. If I start paying myself now, I will loss the unemployment and the extra $600. I Don’t wand to get in trouble, but I did not see anywhere that I must start distribution payroll immediately upon receiving the PPP loan. The only requirement is to make payroll within 24 weeks.

Simon – I have not found good clear guidance on how PPP intersects with unemployment insurance. Unfortunately you’ll have to try to contact your state unemployment agency.

i apply ppp loan by myself online no lender . where do i send the forgiveness aplication EZ form to .any address? thanks

Tom – you had to have received PPP through someone even if you did it online. The SBA does not make PPP loans directly. Are you confusing this with EIDL? If not you have to figure out which lender or agent gave you the PPP loan.

great nav thru this only question is what is the web site do I send it to?

You apply for forgiveness through the lender that gave you your PPP loan.

I’m self employed and my business wasn’t directly affected by social distancing, but the industry I work for was (hospitality). This means I’m unable to initial that line on page two, correct? Will not initialing every line mean my loan won’t be forgiven?

Amy – you mentioned you are self employed. Did you borrow $50,000 or less? If so there is a brand new forgiveness application form you may want to use instead: New Paycheck Protection Program (PPP) Loan Forgiveness Application 3508S: Will It Help You?

Hi, 2 days ago I filed my PPP EZ application with PDF download application but I don’t know how to send back to them please help me.

You’ll need to ask your lender how to apply for forgiveness.

Contact the lender that gave you the PPP loan. They may have an electronic version they want you to use but the information you filled out in the form will help.

Once finished with the 3508EZ form is there a mailing address you know of to send it too? Can we fill out online, submit online, and what is that website address?

Hi Sean – You’ll file for forgiveness with your lender. They may provide an online form but if you’ve filled the paper one out it should be easy!

Sean you apply for forgiveness with the lender who gave you the PPP loan. They may use an electronic application but if you’ve filled out the form that should make it easy!

Hello! Can I use the EZ form if an employee was terminated for cause during the covered period? If so, how do I explain the difference in FTE at the beginning and end of the covered period in a way that will allow full forgiveness?

Yes there may be an exception for employees terminated for cause that you could not replace. The instructions include information about FTE reductions. Make sure you look at the full forgiveness application instructions and not the EZ form.

The EZ Application does not address whether an employee who is fired for cause or who voluntarily terminates employment can be excluded from the headcount for determining eligibility to use the EZ Application. Can you please clarify?

The instructions for that form refer you to this Interim Final Rule for specific situations. (Just search for the word “cause” in that doc.) That would seem to suggest it falls under the second half of that second box in the checklist on the instructions. However, I don’t feel comfortable giving individual advice so I’d recommend you consult with your own advisors or consider using the full 3508 form.

Once we fill the form for SBA-PPP loan forgiveness, who/which address should we send the forms to.

Ahmad – You will submit it to the lender who gave you your PPP loan.

There is a problem with the math here. Say I borrow $20,000 in the ppp program. I have $4,000 in rent and payroll of $16,000 in an 8 week period. This should all qualify for forgiveness according to the program. If I enter $16,000 on line 1 and then on line 7 divide that by .60 I will get $9,600. That will be the smallest amount of lines 5, 6, and 7 so I will enter $9600 as my forgiveness amount when the entire $20,000 should be entitled for forgiveness.

I read further in the replies and you answered my question in other responses asking the same thing. If I DIVIDE $16,000 by .60 we get $26,666 which would not be the smallest of the the 3 lines. I bet many people fill that in incorrectly. Thanks so much for setting me straight!

I am an independent contractor and I moved in March. So does that mean that I cannot apply for foregiveness of rent and utilities at my house? Also, can a portion of my rent and utilities (if I was eligible based on dates) be used to qualify or must they be based on commercial contracts only?

I think you will find the Interim Final Rule on Owner Compensation & Certain Non Payroll Expenses helpful.

I’ve never received a response from my application with sba.gov. Have I been overlooked or denied. Thank you and God Bless you.

We aren’t affiliated with the SBA. If you haven’t heard from them I suggest you call the SBA Disaster Assistance hotline or reach out to your local Small Business Development Center.

Where do I send my completed PPP Loan Forgiveness Application Form 3508EZ ?

Dana – you apply for forgiveness through your lender. You’ll want to contact them.

Hello, on the form 3508EZ, I am not understanding the forgiveness amount calculation.

Line 8 says “Forgiveness Amount (enter the smallest of Lines 5, 6, and 7):”

If my PPP loan was $20,000, and $12,000 was paid to payroll (60%), and the remaining $8K to other eligible expenses, then according to the application instructions, my forgivable amount would only be 60% of the $12,000 used for payroll, or $7,200 (assuming that is the smallest amount of lines 5, 6, and 7). So is that correct? On a $20,000 PPP loan where ALL of the funds were used for eligible expenses, only $7,200 is forgivable?

That doesn’t seem to make any sense. Can you explain please? Or if I am mistaken in my understanding, please explain where I am in error please?

Thank you,

Ted

Based on what you’re saying, Line 1 is $12000. On lines 2-4 you have $8000. Line 5 totals lines 1-4 so it’s $20000. Line 6 is $20000. Line 7 is also $20000 ($12000 divided by .60 – not multiplied). You enter the smaller of lines 5-7 on line 8 and since they are all the same you enter $20,000. That’s 100% forgiveness. Don’t ask me how the math works (the line 7 calculation threw me too) but that’s how the instructions work and the end result seems to make sense!

I’m not an accounting professional so please don’t rely on my calculations for forgiveness.

Ah ok, I see. I was multiplying and not dividing. Makes sense now. Thank you!

Ted. I have run into this same problem. Something is wrong. It doesn’t make sense. The answer proposed to you makes no sense either. I have looked on the internet for a revised form or reasonable answers to this dilemna but there seem to be none. I intend to contact my lender, even though, their cover letter with the links to instructions and application states they take no responsibility for the accuracy of the forms. Seems they know something is wrong.

Karen – it’s confusing but the numbers should work if you divide by .60 on line 7 (not multiply). If not, you can always get help from. an accounting professional familiar with these forms.

Thanks for your web page.

I worked as Real Estate Agent as contractor what possibilities I have to qualify for PPP forgiveness?

Thanks.

John

It doesn’t matter what type of work you do. What matter is how and when you spend the PPP funds.

Line 7 is confusing. Payroll cost of 60% is not the same as payroll cost divided by 0.6

For example. if payroll cost is $10,000, 60% is $6000, but $10,000 divided by 0.6 is $16,666.

which one is correct, $6000, or 16,666?

Thanks

It is confusing! Make sure you follow the instructions and divide by .60 – don’t multiply.

I had a similar question. So we’re not calculating 60% of the payroll costs? For example, my line 5 = $13,099.91 so line 7 would be 21,833.18? Is that right?

PS – this article was super helpful!

Divide by .60 not multiply one line 7. It’s confusing I know.

Thanks for this page!

I’m a rideshare driver, listed as “self/Uber/Lyft “ on the loan paperwork. I have been approved, but am unsure if I officially qualify, and haven’t yet signed. The amounted awarded just about covers what I make in twelve weeks. Can I take the loan amount as 100% towards payroll (i.e. let it deposit in my personal bank account) and be done? If so, what will I need to submit when I apply for forgiveness? I haven’t been working since March, and don’t anticipate doing so after I receive the loan.

My lender cannot or will not return my emails or phone calls.

Thx!

Jonathan,

You will have to fill out the forgiveness application as described in this article. The application doesn’t fully explain documentation requirements for a self-employed person who files schedule C but in other guidance it appears that the 2019 Schedule C will suffice. We covered that in more detail in this article: Self Employed: How to Fill Out the PPP Loan Forgiveness Application

I heard if one has two self-employed sole proprietor businesses (i.e. 2 Schedule C’s) filed under the same SSN, same 1040, one can apply for two PPP’s. Or….can they be combined into one PPP? Can you please confirm? Thanks!

You can only get one PPP loan and since you use the same SSN to apply it makes sense you will need to apply for one loan based on both. But you’ll have to talk to the lender – ultimately they process the application.

Thank you, so much, Gerri!

You’re so welcome!

we have 30 full time employees and we did not reduce any wages or head count or any individual’s weekly 40 hours, but did reduce overtime for most employees. Does that mean we cannot use Form 3508-EZ ?

We have no rent and minimal utilities. I assume we should use the 24 week period no matter what? our PPP loan was 507,000 and after 8 weeks our forgivable amount is only about 310000 (assuming no forced reduction) so we can just keep going until we hit the 507000 in a 6 weeks or so from now ?

Regarding your questions, Treasury and SBA have not issued any further guidance beyond what’s in the application and the instructions so there are still many unanswered questions.

First, I don’t see any mention of overtime in either so I can only assume it is not treated differently for purposes of which form you use, however I don’t know for certain.

Second, if you received your loan on or before June 5th 2020 you can use either the 8-week or 24-week period. If you received your loan after that date the instructions state to use the 24-week period.

24 weeks doesn’t match the loan amount (which was based on 2.5 times monthly payroll – roughly 10 weeks) so the amount of PPP funding isn’t going to last the full 24 weeks without reducing salary and/or headcount: However, Tony Nitti, a CPA who has written about this for Forbes states: “Here’s where the advantage of the PPP Flexibility Act becomes obvious: PPP loans were made based on 2.5 months of the borrower’s average monthly payroll costs for 2019. Now, borrowers will get 24 weeks —or nearly six months — to incur forgivable payroll costs. Thus, for many borrowers, the total “forgivable” costs will far exceed the loan proceeds; as a result, even if the borrower finds itself subject to a reduction in the forgivable amount because of reduced salary or headcount, the math is such that even AFTER the reduction, the forgivable costs will exceed the principal balance of the loan.”

I’m sorry I can’t be more specific. I do think it’s important to consult an accounting professional, especially given the complexity involved with 30 employees and overtime pay.

You did not get it correct. The form reads as follows as compared to during the covered period.

The Borrower was unable to operate between February 15, 2020, and the end of the Covered Period at the same level of

business activity as before February 15, 2020 due to compliance with requirements established or guidance issued between

March 1, 2020 and December 31, 2020, by the Secretary of Health and Human Services, the Director of the Centers for

Disease Control and Prevention, or the Occupational Safety and Health Administration, related to the maintenance of

standards of sanitation, social distancing, or any other work or customer safety requirement related to COVID-19.

The Borrower’s eligibility for loan forgiveness will be evaluated in accordance with the PPP regulations and guidance issued by

Rich – I’m always happy to make corrections but I can’t ascertain what you are talking about. I’ll send you an email.

Hello Ms. Detweiler,

your article & explanation is super helpful.

But I do not understand 1 point.

In my situation, I will run out of the PPP amount in my 15th payroll…as I understand I can either choose 8 weeks or 24 weeks.

I picked 24 weeks, the total payroll amount is over the loan amount and when I do the calculation on it, the amount dont make sense.

For example:

Loan amount 2MM

Line 1: 24 weeks’ payroll cost $2.8MM

Line 7: 60% requirement: (divide line 1 by 0.60) $2.8MM divided by 0.60 =$4,666,6666?

Please advise…I am confused.

Thank you for your time.

Lydia,

I strongly encourage anyone who is having trouble filling this out to work with an accounting professional.

Generally speaking, though, the 24-week payroll and the loan amount won’t match up. (The loan amount was based on roughly 10 weeks of payroll not 24).

If I understand your question, you’re trying to figure out if you qualify for maximum forgiveness. I don’t know whether you have employees so I don’t know what you’d put in Line 8 of the Forgiveness Calculation Form but remember you’re looking for the smaller number of Lines 8, 9 and 10. If the smaller number is the loan amount (line 9) then you qualify for full forgiveness.

I found this explanation in a Forbes article by Tony Nitti helpful:

Here’s where the advantage of the PPP Flexibility Act becomes obvious: PPP loans were made based on 2.5 months of the borrower’s average monthly payroll costs for 2019. Now, borrowers will get 24 weeks —or nearly six months — to incur forgivable payroll costs. Thus, for many borrowers, the total “forgivable” costs will far exceed the loan proceeds; as a result, even if the borrower finds itself subject to a reduction in the forgivable amount because of reduced salary or headcount, the math is such that even AFTER the reduction, the forgivable costs will exceed the principal balance of the loan.

Great article! If we qualify for the EZ form, can we still use the full form anyway? I’m more comfortable that way.

It appears to be optional not mandatory. However, ultimately you’ll apply through your lender so I’d recommend you check with them.

Serious question here, your blog’s description after Line 7 is:

“Divide the amount on line 1 by 0.60, and enter the amount. This determines whether at least 60% of the potential forgiveness amount was used for payroll costs.”

But line 1 was payroll costs for the covered period, not the loan or proceeds amount. So this would make the forgiveness only 60% of the reported payroll, it seems like there is a serious error by SBA here? Any thoughts, am I following this right?

It’s divide by .60 not multiply. I struggled with that too but the numbers seem to work.

I should add that’s the language from the application and instructions.

That’s exactly what I thought, too. It was supposed to be Line 6 , not Line 1, to be divided by 0.60 in order to determine if 60% of the loan proceeds where used for payroll, not vice versa. Now it looks like SBA is backtracking on the original promise and wants to forgive just 60% of the payroll cost. Good that they changed the covered period to 24 weeks, so for most of the borrowers it will work just fine. Otherwise, the whole advertising of EDIL would’ve been very misleading.

Where do you send the new PPP loan to can you submit it through the SBA or can you submit it through a different website

Do you mean the forgiveness application? If so, you submit it to your lender. Some lenders are just starting to accept PPP loan applications. They may have an electronic portal for you to use.