State Business Credit Snapshot 2017

Like personal credit, business owners have a separate business credit score based on their company’s risk profile. Both scores matter when it comes time to getting a business loan, credit card or insurance. The higher a state’s average business credit score, the easier it is for its entrepreneurs to get money to buy equipment and hire more people.

Numerous studies look at personal credit scores, but very little information exists on the state of business credit in America. Nav’s State Business Credit Snapshot used business credit data from 15,500 of its small business customers to shine a light on which regions of the country are enjoying the benefits of strong business credit scores, as well as some surprising trends.

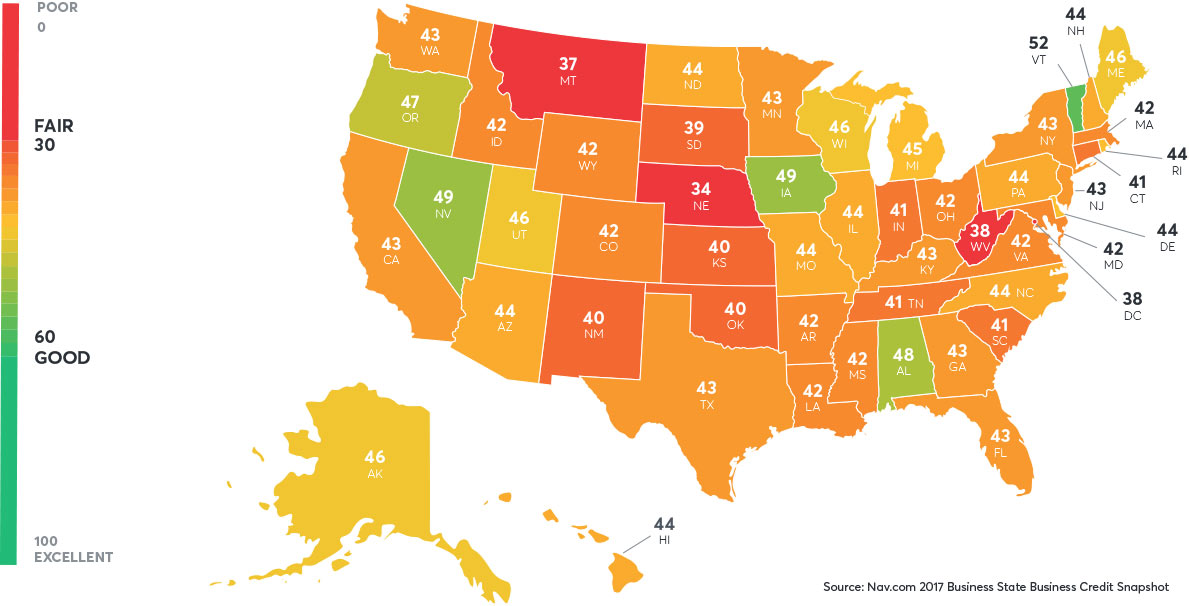

Average Business Credit Score By State

The Experian Intelliscore Plus℠

Experian’s Intelliscore Plus℠ business credit score is a numerical score that ranges from 1 to 100, and can provide insight on how much of a risk a business may be.

BAD SCORE

1-10

HIGH RISK

POOR SCORE

11-25

MEDIUM-HIGH RISK

FAIR SCORE

26-50

MEDIUM RISK

GOOD SCORE

51-75

MEDIUM-LOW RISK

GREAT SCORE

76-100

LOW RISK

10 States with the Highest Business Credit Score

10 States with the Lowest Business Credit Score

Alaska 46

Arizona 44

Arkansas 42

California 43

Colorado 42

Connecticut 41

Delaware 44

Florida 43

Georgia 43

Hawaii 44

Idaho 42

Illinois 44

Indiana 41

Iowa 49

Kansas 40

Kentucky 43

Maine 46

Maryland 42

Massachusetts 42

Michigan 45

Minnesota 43

Mississippi 42

Missouri 44

Montana 37

Nebraska 34

Nevada 49

New Hampshire 44

New Jersey 43

New Mexico 40

New York 43

North Carolina 44

North Dakota 44

Oklahoma 40

Oregon 47

Pennsylvania 44

Rhode Island 44

South Carolina 41

South Dakota 39

Tennessee 41

Texas 43

Utah 46

Vermont 52

Virginia 42

Washington 43

West Virginia 38

Wisconsin 46

Wyoming 42

Washington DC 38

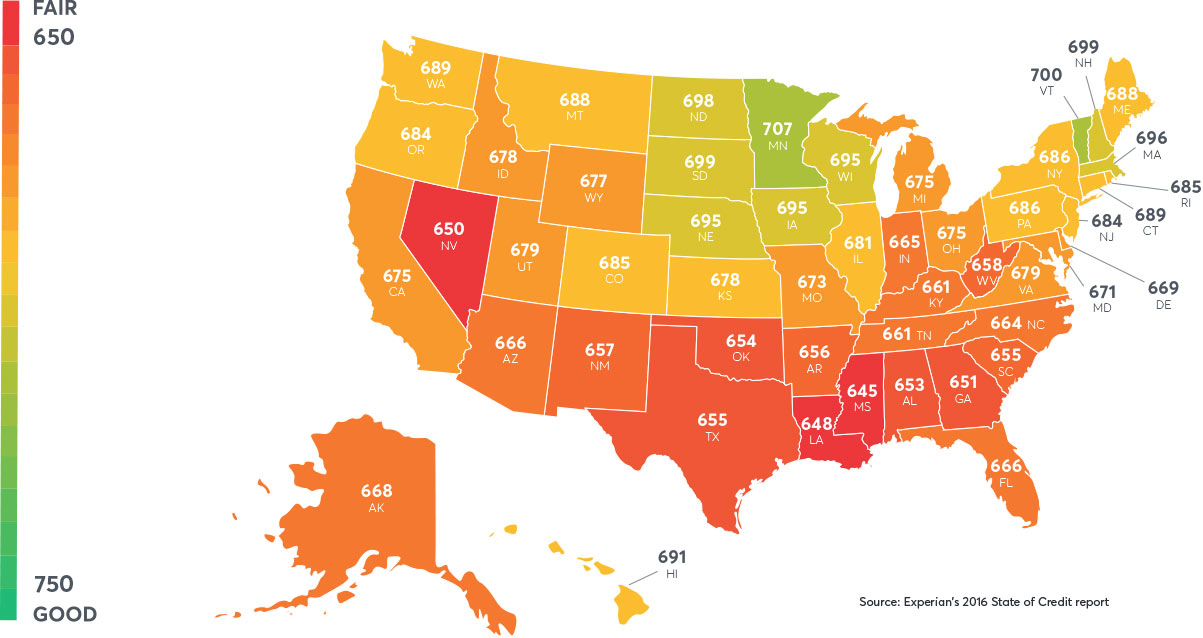

Average Personal Credit by State

Additional Business Credit Trends

A tale of two New Englands

While VT, ME, RI and NH enjoy stronger scores, their Yankee counterparts of MA and CT are behind the pack.

Sweet home Alabama

Small businesses in the southeast have some work ahead of them on their scores with the strong exception of Alabama which is in the top 10.

Midwest

The Midwest has some challenges in their scores. However, Iowa absolutely shines and North Dakota holds its own.

Swing states

The swing voting red states of Pennsylvania, Wisconsin and Michigan are in the top 20 for their stronger scores.

Rust belt

Indiana and West Virginia are states in this region that could use help in building small business credit scores.

Methodology

To generate average business credit scores by state, Nav examined Experian’s Intelliscore Plus℠ business credit score from 15,500 of its small business customers. Each credit score was grouped together by state and Nav averaged together each business’s’ credit in each state. Personal credit report data was reported by Experian’s 2016 State of Credit report.