Recently I spoke with an entrepreneur who is running into a common hurdle while trying to grow his business: his business is killing his personal credit scores. There are no delinquencies on his credit reports, but he has a lot of revolving credit and total limits much higher than average. That’s not the problem, though. High credit limits in and of themselves generally don’t damage credit scores.

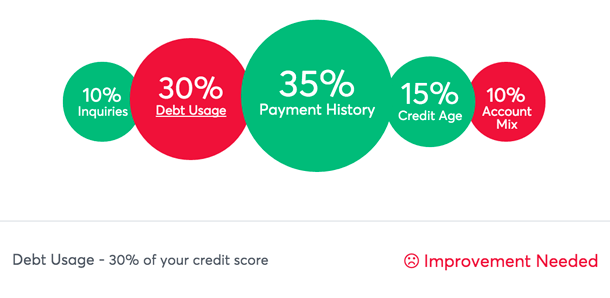

Instead, it’s his balances that are bringing down his scores. He’s maxed out on most of his credit cards and credit lines, and most of that debt is related to his business. Since “debt usage” or “utilization” is the second most important factor in most personal credit scoring models, his credit scores are quite literally being pulled down by all that debt.

Most credit scoring models compare the limits on revolving accounts, such as credit cards, to balances to calculate a debt usage ratio. It is typically calculated for each individual account as well as in the aggregate. Higher ratios can have a detrimental effect on credit scores. FICO says that consumers with the highest scores tend to use, on average, less than 10% of their available credit.

High utilization is not an uncommon problem for small business owners who often rely on personal credit to help finance their business, or use personal credit cards for business purchases. Why this happens is understandable. If you had good credit before you launched your business, it was probably easy to load up on lots of plastic. When cash flow is tight, those cards can literally be a lifesaver for your business. Plus, when your business is young, you may feel like you don’t have much choice: it can be hard to find a small business loan for a start up.

But relying too heavily on personal credit can set up a vicious cycle where your scores suffer, and that in turn limits your options when you need to borrow again.

But I Pay In Full!

You may be thinking that because you pay your credit cards off in full each month, you’re fine, even if you do use them heavily for your business. Not so fast. In most cases, by the time you pay off your business credit card bill, your balance has already been reported to the major credit reporting agencies. And that means you could appear to be “maxed out” even if you aren’t. Next time you check your credit reports or credit scores, see how you score for the debt or credit usage factor. If the answer is “not so good,” then consider another approach.

Try This Instead

There are two ways to protect your personal credit from your businesses’ purchases:

One is to get a business credit card and use it exclusively for business purchases. Most business credit cards do not report balances to the cardholder’s personal credit reports unless they default. That means those balances shouldn’t affect personal credit.

But those accounts will typically be reported to commercial credit reporting agencies, so you’ll want to keep an eye on how those balances affect your business credit scores. (Yes, these exist too!)

What if you can’t qualify for a business credit card? Perhaps you don’t make enough income in your business yet, or your low personal scores are causing your applications to be rejected. Pay off your credit cards earlier if you can, so that your payments are received and processed before the billing cycle closes. If you do, you’ll likely see the balances reported are lower, and by extension, you shouldn’t be penalized as heavily for this factor.

Ultimately your goal should be to separate your business and personal credit by using business financing when you borrow for business purposes. By doing so you’ll move from a vicious cycle to a more virtuous one: your business loans and credit cards will help you establish and build business credit, which in turn helps you borrow in the name of your business and protect your personal credit.

This article was originally written on April 13, 2016 and updated on October 21, 2020.

Have at it! We'd love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers.

Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.