We’re here to help

Find the answers to your business funding questions in our Resource Center. You’ll learn more about what it takes to qualify, repayment terms, how to choose the right loan for your business, and more.

Small-Business Loans: Compare Financing Options

Updated August 1, 2023

Looking for a small business loan? When it comes to small business loans available today, one size does not fit all. Find the best option to meet your business needs at Nav.

Compare Types of Small Business Loans Financing Options

| Type of Small Business Loan | Good For | Estimated APR | Required Credit Score |

|---|---|---|---|

| SBA Loans | Low-interest working capital; refinancing debt, equipment | 1-15% | 155 FICO SBSS *some lenders may require higher |

| Traditional Bank Loans | Versatile loans for a variety of purposes | 4-15% | 680+ FICO |

| Merchant Cash Advance | Quick access to capital if you don’t have great credit | 10-350% | 550 FICO *sometimes no score is required |

| Business Lines of Credit | Access to funds when you need them | 10-90% | 500 – 680+ FICO |

| Microloans | Businesses with thin credit profiles looking for small loan amounts | 12-18% | Varies |

| Cash Flow Loans | Quick access to cash without great credit | 11.0-90% | 600 FICO |

| Alternative Online Loans | Quick access to cash without great credit | 11.0-90% | 600+ FICO |

| Business Credit Cards | Fast turnaround time with less required documentation | 7-30% | 650+ FICO |

| Equity Crowdfunding | Capital without having to repay; experienced investors can act as mentors | Fees often total 5% of amount raised | n/a |

| Reward Crowdfunding | Testing out your idea; capital you don’t have to repay | Crowdfunding platform: 0-5% Payment processing: 3%+$.30 per transaction | n/a |

| Equipment Financing | Capital to buy equipment that doesn’t require asset (other then equipment) | 15-35% | 620+ FICO |

| Invoice Financing | Leveraging future accounts receivable | 15-25% | n/a |

| Trade Credit | Building credit | 5-25% | May or may not be applicable |

What is a small business loan?

A small business loan provides much-needed working capital that business owners can use for a variety of functions, including expanding the business, hiring staff, purchasing equipment, or keeping cash flowing. They’re useful if you prefer to avoid lending money to your own LLC. Sometimes lenders require collateral to guarantee small business loans. Typically, the borrower pays back the loan in installments over a designated period of time. Learn more about how small business loans work here.

How to Apply for a Small Business Loan

The application process for each lender may be somewhat different but it will generally involve the following:

You’ll share details about your business. You’ll typically be asked about:

- The start date of your business. If your business is incorporated, you can use that date but if not, you may use the date you received your Employer Identification Number from the IRS or the date you got your business license. If you have none of that information, you should use the date you officially started your business.

- Your business address and phone number. (Home based businesses may use a home address but you may want to consider getting an official address for your business as well as a separate business phone number).

- Your Employer Identification Number (EIN) if you have one. If you are an unincorporated business (sole proprietorship) you may use your Social Security number or Taxpayer Identification Number (TIN) but it’s a good idea to request a free EIN from the IRS.

- Identification. If you don’t have a prior relationship with the lender you will likely need to supply a driver’s license or passport to verify your identity.

You’ll agree to a credit check. Not all financing offers will involve a personal credit check but many will. Oftentimes a personal credit check is a “soft” credit check that doesn’t impact your personal credit scores, but if you’re concerned about this be sure to ask. Some lenders will also check business credit scores.

You will verify business revenues. Some lenders will allow you to provide copies of recent bank statements (3-6 months is typical) or business tax returns plus up-to-date financial statements. Increasingly though, lenders will ask you to link your business bank account so they can analyze your business revenues to determine if you meet their requirements.

Some types of financing may have other requirements. For example, for invoice factoring you may need to supply an accounts receivables (A/R) aging report that shows your outstanding invoices. For loans with collateral, such as equipment or real estate, you may need an appraisal.

Once you have submitted the required documentation, the financing company or lender will make its decision. Online lenders can typically offer a preliminary decision very quickly. They will then request any additional documentation so they can underwrite the loan and make an offer.

Banks tend to take longer to approve loan applications, and a lot more documentation may be required. Expect more back and forth, greater scrutiny, and a longer wait before you get a decision.

Once you are offered financing you’ll want to read the loan documents carefully to make sure you understand the terms of the financing, including daily or monthly payments, the cost of the financing and whether a personal guarantee is required. Some financing sources may require you to use some of the proceeds to refinance other debt.

Once you accept you can expect funds in your account within hours, or up to a couple of days depending on the lender.

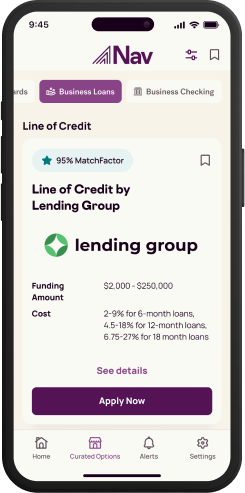

Curated funding options, smarter decisions

The world’s first financial health suite that streamlines access to the best financing options. Compare your top small business financing options, from over 160 financial products – with Nav.

How to Qualify for a Small Business Loan

The loan application approval process can be daunting, but eligibility for different types of small business financing will vary. With a bank, you may be asked to provide financial statements with your small business loan application. For a merchant cash advance, you’ll likely need to provide proof of your monthly and/or annual revenue. (Read our comprehensive Revenued Flex Line, Credibly review, and Giggle Finance review for more on merchant cash advances).

Qualifying for a small business loan often means you need good credit, especially if your business is young or does not have a lot of employees. Pay attention to any required credit score. Even one business credit card to the next may have different requirements, so read through that lender’s site to see if a minimum credit score is required. If you don’t know your personal or business credit score, find out how to check them for free here.

Some lenders will also require a down payment or collateral, so know whether you have assets valuable enough to qualify for those loans. And some lenders want you to have been in business for a certain amount of time, so make sure you meet those requirements. Learn how to boost eligibility here and make sure you know about working capital management.

How to Choose the Right Business Loan for Your Small Business

There are several factors that will guide you to choosing the best small business loans:

- Your qualifications (credit score, time in business, revenues, etc.)

- How fast you need the money

- How much you need the money

- The amount of interest you are willing to pay

The further out you plan for your financing needs, the better the deal you can get because you won’t be desperate to get the funds immediately. If you can wait a few months, you may qualify for an SBA loan at a great rate. On the other hand, if you need cash today, you may have to pay for the privilege of getting an alternative online loan with a higher interest rate.

There are many different loan options, so it may make sense to weigh your financing options with different lending products from various lenders before making a decision. It’s also important to compare lending platforms.

Short-Term vs. Long-Term Financing

The type of business need you’re trying to meet should determine the type of financing you seek. For example, the type of financing you need to purchase quick-turnaround inventory is decidedly different from the type of financing you might need to expand to an additional location across town. Fortunately, there is financing designed to meet those short-term needs as well as longer-term needs.

Generally, a loan with a term of 3-36 months is considered a short-term loan and can be a good choice to meet shorter-term business needs. A business loan with a term of five years or more is typically considered a longer-term loan. When shopping for a loan, depending on your loan purpose, consider the term that best suits your business needs.

How to Get a Business Loan From a Bank

By following the steps above, you’ve already learned how to apply for a business loan from a bank. Banks have some of the strictest application requirements, but you will likely pay lower interest rates and fees than other financing options—provided you qualify. Banks are usually not willing to lend to companies in risky industries, so if you’re looking for loans for a cannabis shop, for example, you will likely have to look at alternative lenders.

How to Get a Business Loan to Start a Business

One of the most common questions people ask when launching a startup business is “how can I pay for it?” When looking for a loan to start a business, without a track record or revenue, it will be difficult. You can demonstrate your business acumen with a well-written business plan, and secure your loan with collateral — which will improve the odds, but it will still be challenging. Since you don’t have a business yet, your personal credit score will be the only thing a lender has to evaluate your creditworthiness. Restaurant equipment loans can help start a food business. Food truck financing for large events and food truck loan options are two more useful guides.

How to Get a Loan to Buy a Business

It’s not always necessary to start a company from scratch these days. If you see a promising business for sale, it may be a good investment to buy it. You’ll likely need a business acquisition loan to finance the endeavor, however. A down payment may be required. Use the steps above for this type of loan, as well. Instead of providing all the documentation for your own business, however, you’ll need to include the same type of information for the company you’ll be buying. Note that some SBA loans may be used to buy a business.

Small Business Loan Amounts

The amount you can borrow will depend on the loan type, as well as qualifications such as your credit scores and/or business revenues. Here are some general guidelines for maximum loan amounts for a typical small business. Medium to large businesses with more employees and revenues may qualify for larger amounts. And, of course, every lender is different in terms of how much they will lend.

- Business Credit Cards: $75,000

- Equipment Loans & Leases: $5 million

- Invoice & receivables financing: $5 million

- Line of credit: $1 million

- Microloan: $50,000

- SBA loan: $5 million

- Term loan: $1 million

- Vendor terms: $50,000

How to Determine the Right Loan Amount for Your Business

Knowing how much to borrow is just as important as knowing when to borrow. Ask for too much and your application may be declined, but ask for too little and your business may find itself in a cash flow crunch in the future.

If you aren’t sure how much to borrow, your accounting professional may be able to help. SBA Resource partners such as SCORE and Small Business Development Centers can also offer free mentoring to help you determine how much to borrow to grow your business.

Types of Financing Options for Small Businesses

Small Business Administration (SBA) Loan

SBA loans are available in amounts from less than $50,000 to as high as $5 million, you’ll get lower rates and favorable repayment terms. Most SBA loan programs primarily offer business term loans, though there are some business lines of credit available. Some SBA loans may be used for refinancing debt. The loan process can take weeks or months, depending on the type of SBA loan you are trying to obtain. Only SBA Disaster Loans are made by the U.S. Small Business Administration. All others are made by participating lenders.

Traditional bank loan

Get a term loan or business line of credit from a financial institution you already do business with (or a new one) and you’ll likely pay some of the lowest interest rates of all the options—if you meet the often high eligibility requirements. (Many credit unions are also involved in business lending.)Loan amounts vary, and repayment terms range from one to twenty years. Get an answer in a few weeks to as long as four months with acceptable personal and/or business credit. Learn about business loan options for real estate companies here, as well as medical practice loans and medical supply business loans here.

Microloan

These lenders don’t consider your credit to be as crucial as others, but your credit profile still matters. These lenders are also more inclined to work with younger businesses with loan amounts much smaller (up to $50,000), hence the “micro” name. Get an answer within three months for these loans with rates that are comparable to the better credit cards. See this article for more on 5k to 10k loans.

Non-bank online loan

Because of the quick response to a loan application and the speed with which they can make funds available, online lenders are the first choice for many small businesses today. If you’re willing to pay up a higher APR and pay your debt in less than five years, you could possibly get a loan for between $25,000 – $500,000. Credit may still count, but revenues are often more important. Many lenders can approve your loan the same day and have funds available in your account within a day or two. Transportation financing is often an online loan. Read our Credibility Capital installment loan review here. Learn how to choose the right online lender for your business here.

Business/merchant cash advance

Post-PPP, a business cash advance will likely be one of the only available financing options for many businesses for the next several months. Available amounts are based upon revenues and can range from $5000 – $250,000 or more. Even those with less-than-perfect credit can get approval, provided they have the transactions to justify the advance, and the turnaround time is often within 24 hours. Learn about a working capital loan vs. a small business cash advance here.

Cash flow loan

As the name implies, cash flow loans are very focused on your cash flow. Although your credit profile will be part of the equation, these lenders want to confirm you have the cash flow you’ll need to service debt. Get approval within minutes from some lenders for amounts of up to $100,000. Be prepared to pay a minimum of 25% APR and up to 90% APR or more.

Business credit cards

Business credit cards are one of the best ways for a younger business to access borrower capital (and are a great tool for mature businesses as well). Pay industry-standard rates of up to 25% for business credit cards that offer between $1000 – $25,000. These make good short-term funding solutions, and although your credit profile is a major approval factor, it is often easier to qualify for a business credit card than a term loan or line of credit. Find out if you qualify within hours or up to a couple of weeks after applying.

Vendor financing

One of the most under-rated and often-overlooked options, you can get between $1,000 and $100,000 from a vendor you already work with. (Find new vendor accounts at Nav.com/vendors.) Some charge no interest, but the repayment time is short (as soon as ten days.) Those with a good business credit history might get an approval within hours.

It might not be a small business loan, but 30- to 6-day terms are a great way to build or strengthen your business credit profile.

Lines of credit

One final option for an existing business is a line of credit, which can generally be borrowed against again and again. This is traditionally a popular source of short-term capital for many business owners. You only pay interest on the amount you borrow. Credit profile and revenues are often major factors for these loans, which range from $1,000 – $100,000 for qualified borrowers. Get approved in hours online, or within several weeks to a month or more from a bank.Credit profile and revenues are often major factors for these loans, which range from $1,000 – $1,000,000 for qualified borrowers. Get approved in hours online, or within several weeks to a month or more from a bank. Check out Nav’s review of Credibility Capital line of credit for more.

Nav’s Verdict: Small Business Loans

The further out you plan for your financing needs, the better the deal you can get because you won’t be desperate to get the funds immediately. If you can wait a few months, you may qualify for an SBA loan at a great rate. On the other hand, if you need cash today, you may have to pay for the privilege of getting an alternative online loan with a higher interest rate.

Don’t just look at one type of loan; weigh your financing options with different lending products from different lenders before making a decision.

Nav can help by connecting you to financing options based on your business data and qualifications. Get started with a free Nav account.

Frequently Asked Questions (FAQs)

What is a good credit score for a small business?

There’s a small business financing tool for every credit score, so the answer really varies. In general, you’ll qualify for more options and better rates for more options with better rates if your credit scores are at least 650.

Can I get a small business loan with bad credit?

The short answer is, yes. Because there’s such a wide variety of business financing products, there’s one for every business and personal credit score, even if you’ve got poor credit or no credit history. Start by pulling your credit report to know where you stand. If you have time to build your credit, it may be worth it to wait to apply for financing. Otherwise, look at merchant cash advances and cash flow loans.

Are small business loans hard to get?

It really depends on your business qualifications, including revenues, time in business and personal or business credit scores. Qualified borrowers may find it very easy to get business funding, but newer businesses, those with low or declining revenues, or those with poor credit may find it more difficult. The key is to find the right financing based on your qualifications.

How do you get a small business loan?

Start by knowing what you want to use it for and then looking at what you qualify for. Spend time analyzing your cash flow and annual revenues, as well as your credit scores to understand the kinds of rates and repayment terms you might qualify for. Then go through this article to match with the right option.

What’s the easiest small business loan to get?

Again it goes back to qualifications. If you have a brand new business you may need to consider a personal loan or business credit cards while you build your business. As your business matures, you may be eligible for some of the various types of financing discussed in this article, including working capital loans and lines of credit.

How can a business get a loan with no money?

If your business is not yet making money and you do not have good personal credit, crowdfunding may be an option to consider. Crowdfunding requires good marketing, though, so get help from your local SBA resource partner, such as your Small Business Development Center (SBDC) or SCORE. Find free help for your small business at SBA.gov/local-assistance

Are small business loans a good idea?

Any kind of financing can be a risk. You need to be sure you will be able to repay the funds you receive in a timely manner. Falling behind on your payment can negatively impact your credit, which may make it more difficult to secure financing in the future. However, small business loans can free up cash flow and help you build your credit if used responsibly.

Are SBA Loans Still Available?

Paycheck Protection Program (PPP) loans and COVID-19 Economic Injury Disaster Loan (EIDL) are no longer available. However, many other SBA loans are available for businesses that qualify.

How Do SBA Loans Work?

With most SBA loans (except Disaster loans, including EIDL) you’ll apply with an SBA lender approved to make certain types of loans, such as 7(a) loans or 504 loans. The lender must make sure your business qualifies as a small business under SBA size guidelines, and must follow SBA guidelines in order to collect the guarantee from the government if your business doesn’t pay back the loan. Overall, though, getting an SBA loan is similar to getting a business bank loan.

Related Resources

- SBA Loans

- Bank loans

- Merchant Cash Advance

- Microloans

- Cash Flow Loans

- Online Business Loans

- Construction Business Loans

- Retail Business Loans

- Restaurant Loans & Financing Options

- SBA 7(a) Loans

- SBA Express Loans

- Business Credit Cards

- Equity Crowdfunding

- Reward-Based Crowdfunding

- Equipment Financing

- Invoice Financing

- How Trade Credit Can Help Your Business

- Medical Practice Loans

- Manufacturing Business Loans

- Commercial Real Estate Loans

- SBA Microloans

- SBA 504 Loans

- SBA Disaster Loans